Get the free GIFT OR TRANSFER OF SHARES

Show details

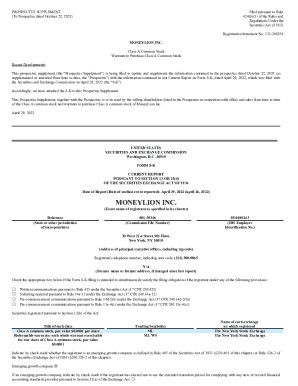

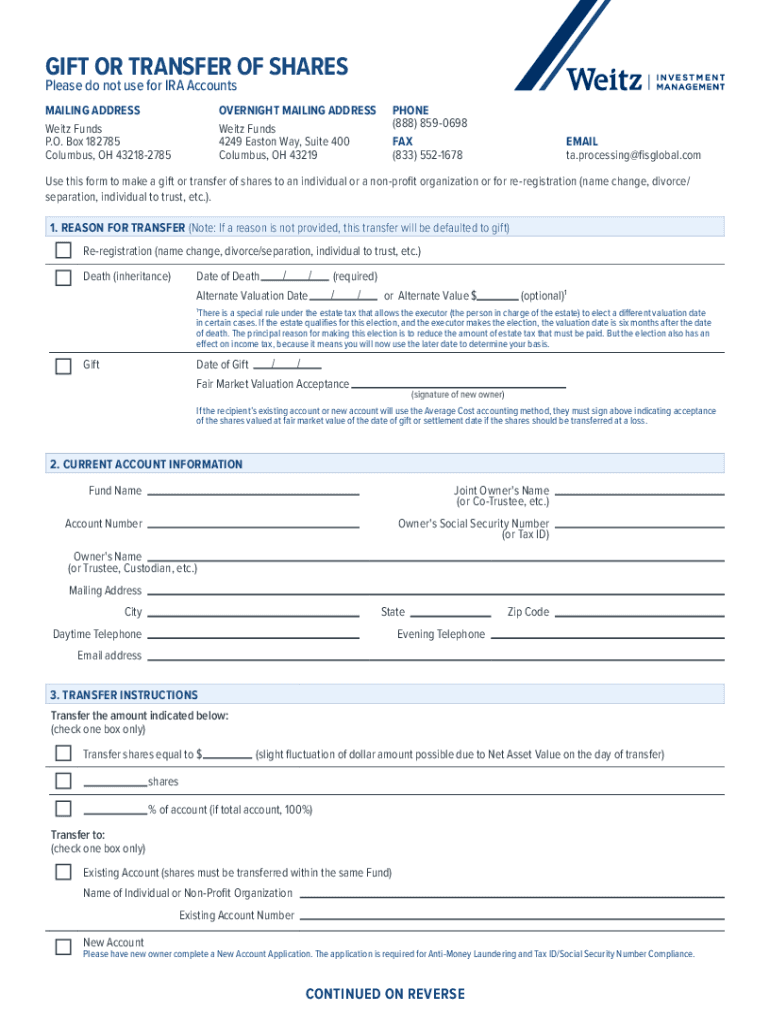

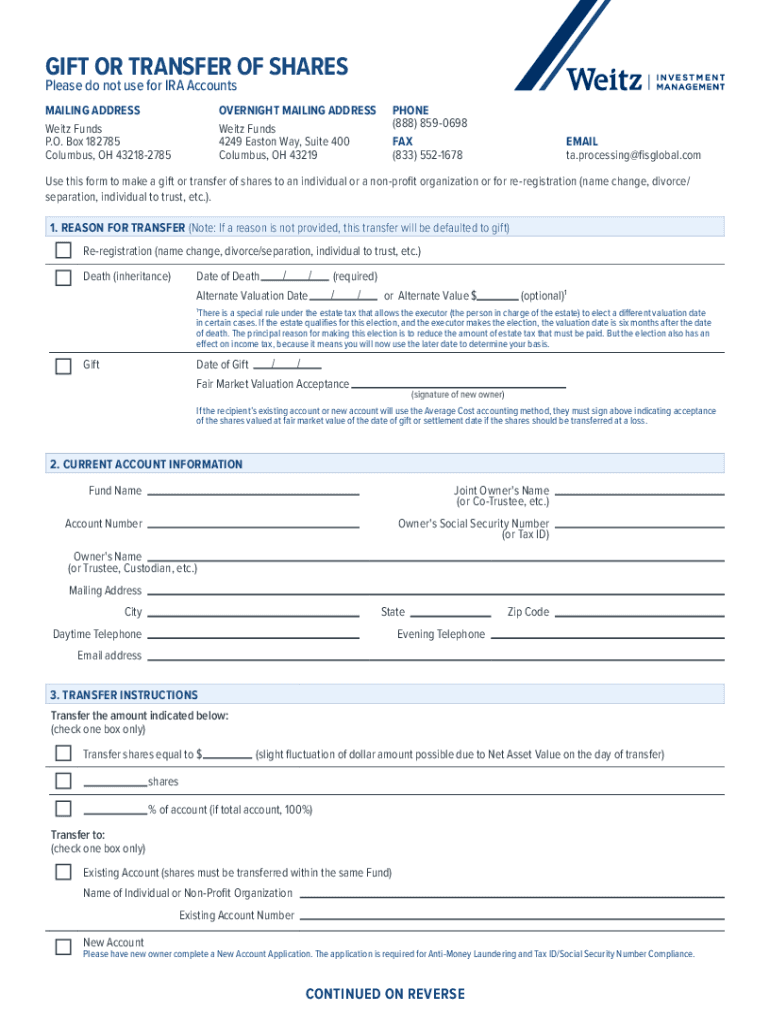

GIFT OR TRANSFER OF SHARES

Please do not use for IRA Accounts

MAILING ADDRESS

Watt Funds

P.O. Box 182785

Columbus, OH 432182785OVERNIGHT MAILING ADDRESS

Watt Funds

4249 Easton Way, Suite 400

Columbus,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift or transfer of

Edit your gift or transfer of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift or transfer of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift or transfer of online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gift or transfer of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift or transfer of

How to fill out gift or transfer of

01

Obtain the necessary paperwork from the relevant authorities or institutions. This may include forms or applications for the gift or transfer.

02

Fill out the paperwork accurately and completely. Provide all required information, such as the details of the gift or transfer, the parties involved, and any supporting documentation.

03

Double-check the filled-out paperwork for any errors or omissions. Make sure all information provided is correct and up-to-date.

04

Submit the completed paperwork to the appropriate authorities or institutions. Follow any specified submission process, such as mailing it or submitting it online.

05

Pay any applicable fees or taxes associated with the gift or transfer, if required. Keep the receipt or proof of payment for future reference.

06

Wait for the authorities or institutions to process the paperwork. This may take some time, so be patient and follow up if necessary.

07

Once the gift or transfer is approved, ensure that all legal requirements are fulfilled. This may include signing additional documents, transferring ownership, or adhering to any restrictions or conditions.

08

Keep copies of all relevant documents and records for your records. These may be useful for future reference or proof of the gift or transfer.

09

Seek professional advice or consult with legal experts if you have any doubts or concerns throughout the process.

Who needs gift or transfer of?

01

Individuals or organizations who want to legally transfer ownership of a property, asset, or financial instrument.

02

Families or individuals who want to gift assets or properties to their loved ones.

03

Businesses or individuals who want to transfer ownership of shares or stocks.

04

People who want to transfer or gift funds or other monetary assets to someone else.

05

Organizations or individuals engaged in estate planning or wealth management.

06

Anyone who wants to ensure a legal and transparent transfer or gift of any asset or property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift or transfer of in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your gift or transfer of along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit gift or transfer of straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit gift or transfer of.

How do I complete gift or transfer of on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your gift or transfer of. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is gift or transfer of?

A gift or transfer refers to the voluntary giving of property or assets from one individual to another without receiving anything in return. This can include cash, real estate, stocks, or other valuable items.

Who is required to file gift or transfer of?

Any individual who makes a gift exceeding the annual exclusion amount set by the IRS in a given tax year is required to file a gift tax return. Additionally, if you are transferring certain types of property, you must also file.

How to fill out gift or transfer of?

To fill out a gift tax return, you will need to complete IRS Form 709. This involves providing information about the donor and recipient, the value of the gift, and any applicable deductions or exclusions.

What is the purpose of gift or transfer of?

The purpose of filing a gift tax return is to report the transfer of gifts that may be subject to federal gift tax, to track cumulative lifetime gifts, and to ensure compliance with tax laws.

What information must be reported on gift or transfer of?

You must report the donor's name and address, the recipient's name and address, a description of the property transferred, its fair market value at the time of the gift, and any deductions or exclusions that apply.

Fill out your gift or transfer of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Or Transfer Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.