Get the free OIL AND GAS TAX PAYMENT VOUCHER - North Dakota

Show details

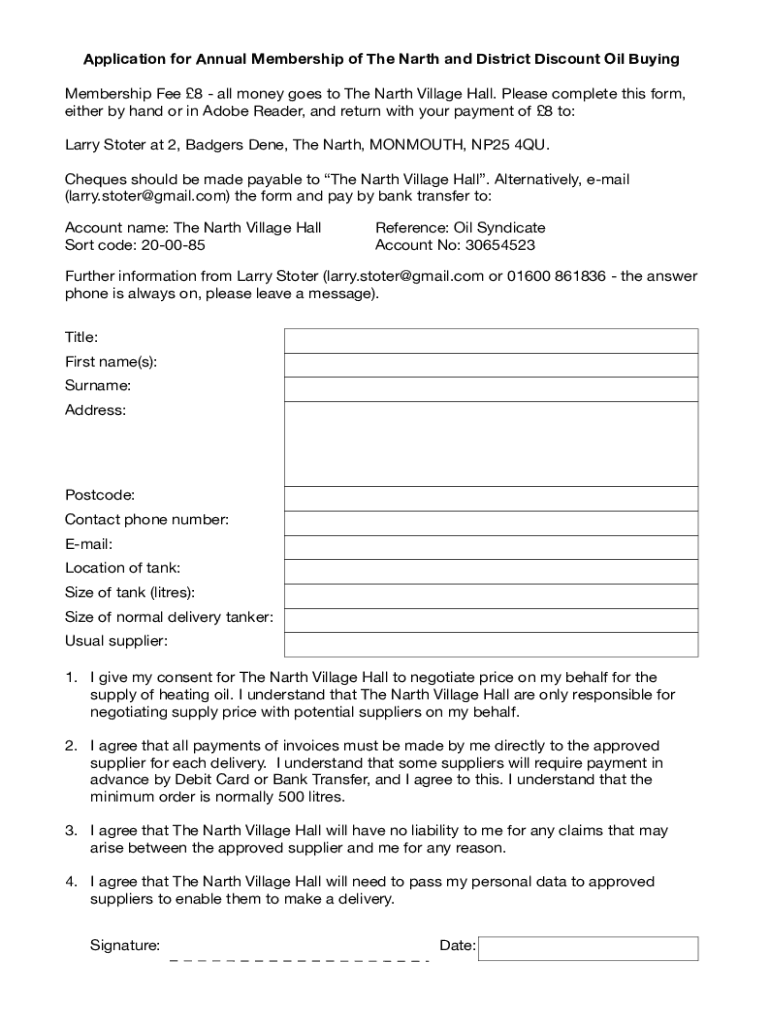

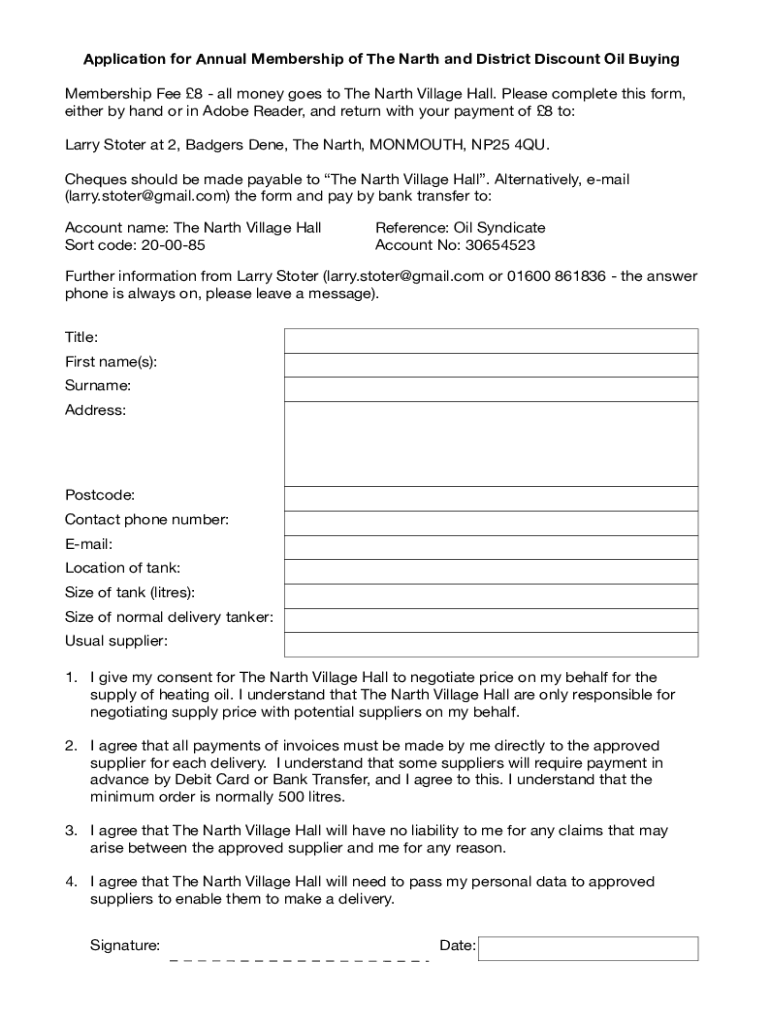

Application for Annual Membership of The North and District Discount Oil Buying Membership Fee 8 all money goes to The North Village Hall. Please complete this form, either by hand or in Adobe Reader,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oil and gas tax

Edit your oil and gas tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oil and gas tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oil and gas tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oil and gas tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oil and gas tax

How to fill out oil and gas tax

01

Obtain the necessary tax forms and documents from the relevant tax authority.

02

Gather all the required information, such as income from oil and gas production, expenses, and deductions related to the industry.

03

Fill out the tax forms accurately and completely, ensuring that all relevant fields are filled in with the correct information.

04

Calculate the tax liability by applying the appropriate tax rates and taking into account any applicable exemptions or deductions.

05

Double-check the completed forms for any errors or omissions before submitting them to the tax authority.

06

Pay the calculated tax amount in a timely manner, following the payment instructions provided by the tax authority.

07

Keep copies of all the filed tax forms, supporting documents, and payment receipts for future reference or potential audits.

Who needs oil and gas tax?

01

Oil and gas tax is primarily relevant for individuals, companies, or organizations engaged in the exploration, extraction, production, or sale of oil and gas.

02

This includes oil and gas companies, oilfield service providers, landowners with oil and gas leases, and individuals who receive royalty or rental income from oil and gas activities.

03

The tax may also be applicable to government entities that receive revenue from oil and gas resources, such as countries or states with significant oil and gas reserves.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in oil and gas tax?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your oil and gas tax to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit oil and gas tax in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your oil and gas tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit oil and gas tax on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share oil and gas tax from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is oil and gas tax?

Oil and gas tax refers to taxes imposed on the extraction and production of oil and natural gas. These taxes can vary by jurisdiction and may include severance taxes, production taxes, and excise taxes.

Who is required to file oil and gas tax?

Companies and individuals engaged in the extraction, production, or sale of oil and natural gas are typically required to file oil and gas tax returns. This includes exploration companies, production firms, and operators.

How to fill out oil and gas tax?

To fill out oil and gas tax forms, taxpayers must provide detailed information about their production volumes, sales, and associated expenses. Specific forms and instructions vary by jurisdiction, so it is essential to follow local guidelines.

What is the purpose of oil and gas tax?

The purpose of oil and gas tax is to generate revenue for governments based on the extraction of natural resources, fund public services and infrastructure, and regulate the industry to ensure sustainable practices.

What information must be reported on oil and gas tax?

Taxpayers must report information such as production volumes, revenue from sales, operational expenses, and any applicable deductions or credits on their oil and gas tax returns.

Fill out your oil and gas tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oil And Gas Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.