Canada FIN 405 - British Columpia 2013 free printable template

Get, Create, Make and Sign Canada FIN 405 - British Columpia

How to edit Canada FIN 405 - British Columpia online

Uncompromising security for your PDF editing and eSignature needs

Canada FIN 405 - British Columpia Form Versions

How to fill out Canada FIN 405 - British Columpia

How to fill out Canada FIN 405 - British Columpia

Who needs Canada FIN 405 - British Columpia?

Instructions and Help about Canada FIN 405 - British Columpia

Welcome to FIN 405 Seminar in Finance To begin let's review what you will learn Financial managers face decisions based on internal and external variables cost of capital project hurdle rates compensation incentives taxes mergers and acquisitions and budgetary limitations Through the case study method you will learn to use financial analysis to use many financial tools such as discounting determining risk and incorporating it into discount rates economic value added calculations' software model development strategic financial planning and clear and concise writing skills What is most exciting about this course You're in the driver's seat These are your decisions and all that you have learned in prior courses you'll apply in your case analysis You will be able to develop financial models and experience trade-offs that you will face in your career You will learn in-depth methods about how to raise capital to support expansion and the optimal mix of debt and quittance mastered these techniques will serve you well install business or large corporate environments What is most challenging about this course You will have to study the nuances of financial analysis Even if your decision is financially correct will that mean that it is the best decision possible in the real world The real challenge in the actual business world is compromise and strategy Can you tell if your financial decision meets the strategy While these case studies may be nuanced they will give you the experience to bean effective leader in your financial community wherever that may be Finance inconstantly innovating, and you want to be on the cutting edges course will do that for you, We hope you enjoy your course Let'begin

People Also Ask about

How do I close my BC PST account?

What is taxable in BC?

What is exempt from PST regulations in BC?

When should you self assess PST BC?

What items are subject to PST in BC?

What is exempt from PST in BC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Canada FIN 405 - British Columpia in Gmail?

Can I create an electronic signature for the Canada FIN 405 - British Columpia in Chrome?

How do I complete Canada FIN 405 - British Columpia on an Android device?

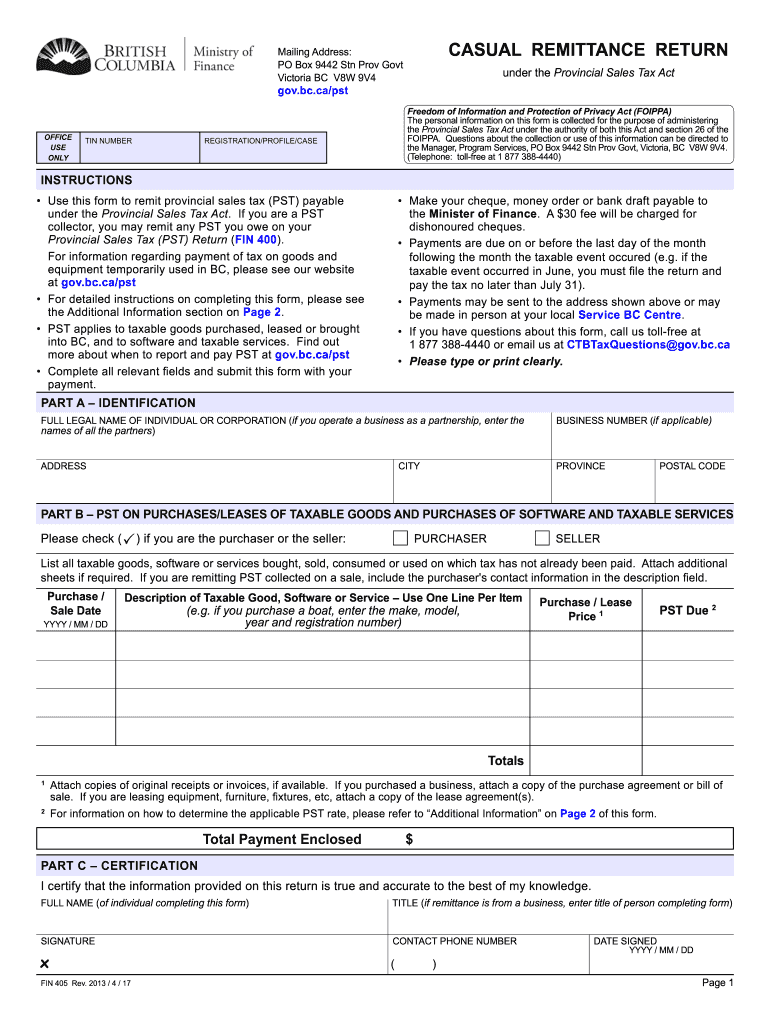

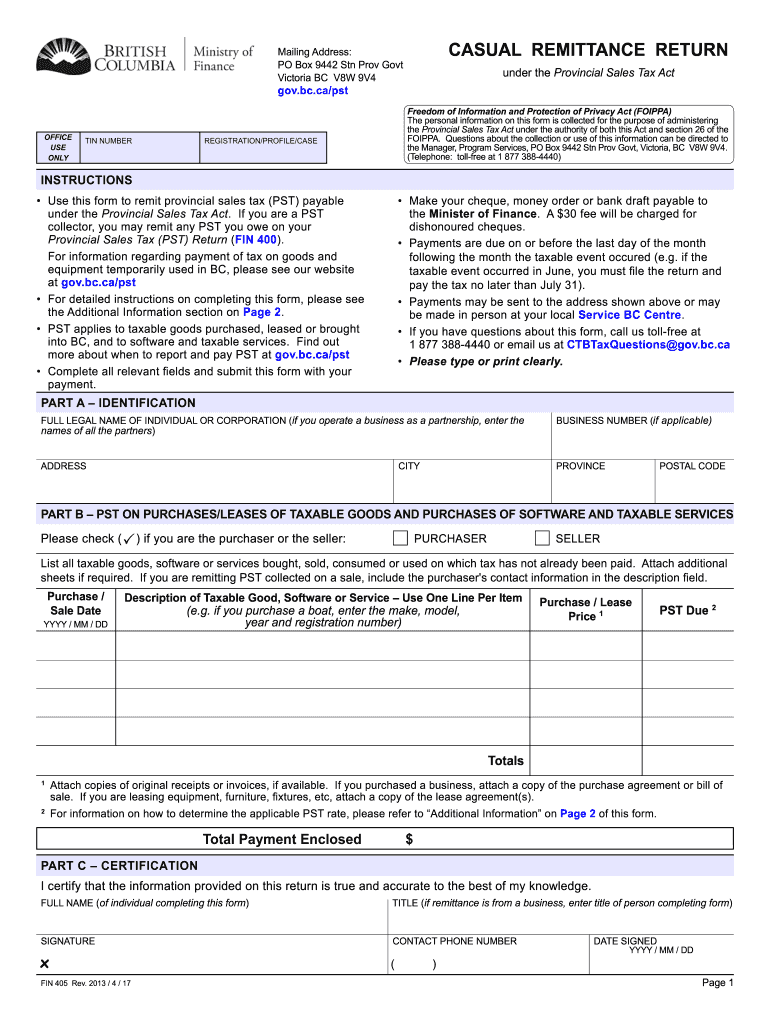

What is Canada FIN 405 - British Columbia?

Who is required to file Canada FIN 405 - British Columbia?

How to fill out Canada FIN 405 - British Columbia?

What is the purpose of Canada FIN 405 - British Columbia?

What information must be reported on Canada FIN 405 - British Columbia?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.