Get the free January 2009 - Jay County REMC

Show details

Jay County REM 484 S 200 W P.O. Box 904, Portland, IN 47371 PHONE NUMBERS & HOURS Local ............................... 260-726-7121 Toll Free ........................... 800-835-7362 Fax ..................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign january 2009 - jay

Edit your january 2009 - jay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your january 2009 - jay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing january 2009 - jay online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit january 2009 - jay. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out january 2009 - jay

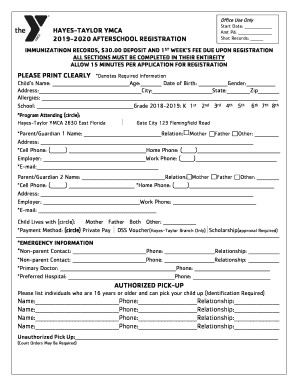

How to fill out January 2009 - Jay:

01

Begin by gathering all relevant information and documents for the month of January 2009. This may include financial statements, receipts, invoices, and any other records that need to be compiled for this period.

02

Prepare a spreadsheet or use accounting software to organize the data. Create different columns for specific categories such as income, expenses, taxes, and any other relevant categories.

03

Start by inputting the income earned during January 2009. This can include wages, any freelance or side income, rental income, or any other sources of revenue for that particular month. Be sure to enter accurate amounts and record the sources of income.

04

Move on to recording the expenses for January 2009. This may include bills, rent/mortgage payments, utilities, transportation costs, groceries, and any other recurring or one-time expenses incurred during that month. Assign each expense to the appropriate category in the spreadsheet.

05

Next, address any outstanding invoices or payments to be made. Ensure that all invoices are accurately recorded and accounted for in the spreadsheet. Set reminders for any future payments that need to be made.

06

If applicable, calculate and record any taxes due for the month of January 2009. This may include income tax, sales tax, or any other taxes relevant to your specific situation. It's important to accurately calculate and record these amounts to ensure compliance with tax regulations.

07

Double-check all entries and calculations to ensure accuracy. Review the spreadsheet for any missing or incorrect information and make any necessary adjustments.

08

Once the January 2009 - Jay spreadsheet is complete and accurate, save a copy for your records and consider creating a backup. This will serve as a valuable reference in the future and can be used for tax purposes, financial analyses, and budgeting.

Who needs January 2009 - Jay:

01

Individuals or households who need to track their income, expenses, and taxes for the month of January 2009.

02

Small business owners or freelancers who need to maintain accurate financial records for that particular month.

03

Accountants or financial professionals who require detailed information and documentation for the month of January 2009.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my january 2009 - jay directly from Gmail?

january 2009 - jay and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make edits in january 2009 - jay without leaving Chrome?

january 2009 - jay can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out january 2009 - jay on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your january 2009 - jay from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is january - jay county?

January - Jay County is a form/report that needs to be filed for tax purposes in Jay County in the month of January.

Who is required to file january - jay county?

Any individual or business entity that earned income in Jay County during the tax year may be required to file January - Jay County.

How to fill out january - jay county?

To fill out January - Jay County, you will need to gather all relevant financial information and complete the form according to the instructions provided by the Jay County tax department.

What is the purpose of january - jay county?

The purpose of January - Jay County is to report income earned in Jay County during the tax year and calculate the associated tax liability.

What information must be reported on january - jay county?

Information such as total income earned in Jay County, deductions, credits, and tax owed must be reported on January - Jay County.

Fill out your january 2009 - jay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

January 2009 - Jay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.