Get the free pwd 885 w7000 - comalad

Show details

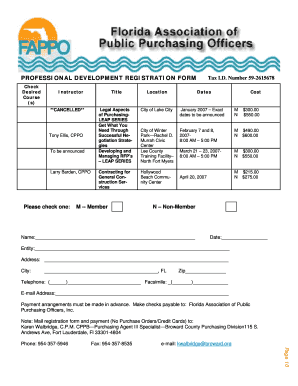

Form PhD 885-W7000 1-D-1 Open Space Agricultural Valuation Wildlife Management Plan Instructions This form is intended for use by landowners wishing to manage for wildlife under the 1-d-1 Open Space

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pwd 885 w7000

Edit your pwd 885 w7000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pwd 885 w7000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pwd 885 w7000 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pwd 885 w7000. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How many acres do you need to qualify for wildlife exemption in Texas?

Is There A Minimum Acreage To Qualify For A Wildlife Exemption? No, there is no minimum acreage to qualify for a wildlife exemption unless your property acreage has decreased in size last January 1st. In that case, qualifications for a wildlife exemption can vary by where your property is located.

What animals qualify for tax exemption in Texas?

Which animals qualify? Cattle, sheep, goats and bees typically qualify for special ag valuation. However, each Texas county has its own rules. To understand your specific opportunities, contact the appraisal district in which your property is located.

How much does a wildlife exemption save in Texas?

Tax Savings Property 1Property 2Taxable Value with Wildlife Exemption$73,180$2,200Taxes without Wildlife$196,367$3,115Taxes with Wildlife$1,551$29Annual Tax Savings$194,815$3,0863 more rows

How do you qualify for wildlife exemption in Texas?

How Do I Qualify For A Wildlife Exemption? 1) Your land must already be qualified for Agricultural use (1-D-1) in order for you to convert it to wildlife management use. 2) A wildlife management plan and application needs to be written and submitted to the County Appraisal District before May 1st.

What are the wildlife exemption activities in Texas?

Bird watching, hiking, hunting, photography and other non-passive recreational or hobby-type activities are qualifying recreational uses. The owner's passive enjoyment in owning the land and managing it for wildlife also is a qualifying recreational use.

What is the difference between ag exemption and wildlife exemption in Texas?

When a property has a wildlife exemption, it is in wildlife management. Ranchers with an ag exemption manage livestock which requires actions to ensure the domesticated animals have what they need to thrive and be productive. Wildlife management requires actions for wildlife, but not just any wildlife.

What is the minimum acreage for wildlife exemption in Texas?

There is no minimum acreage to qualify ing to the Texas Property Tax Code; however, individual appraisal districts set their own acreage guidelines. The typical minimum acreage for an agricultural exemption is ten acres.

What is wildlife habitat tax exemption in Texas?

Texas wildlife exemption eligibility requires actively using the land. To meet this requirement, landowners must conduct at least three of seven wildlife management practices, also known as activities, each year to keep a wildlife exemption in good standing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pwd 885 w7000?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific pwd 885 w7000 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit pwd 885 w7000 online?

With pdfFiller, the editing process is straightforward. Open your pwd 885 w7000 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit pwd 885 w7000 on an iOS device?

Create, modify, and share pwd 885 w7000 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is pwd 885 w7000?

pwd 885 w7000 is a tax form used to report income earned from self-employment.

Who is required to file pwd 885 w7000?

Individuals who have income from self-employment exceeding a certain threshold are required to file pwd 885 w7000.

How to fill out pwd 885 w7000?

pwd 885 w7000 can be filled out manually or electronically by providing information about income and expenses related to self-employment.

What is the purpose of pwd 885 w7000?

The purpose of pwd 885 w7000 is to calculate and report the amount of self-employment income for tax purposes.

What information must be reported on pwd 885 w7000?

On pwd 885 w7000, individuals must report their self-employment income, expenses, and calculate the net profit.

Fill out your pwd 885 w7000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pwd 885 w7000 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.