Get the free $5,000 family deductible - elevatehealthplans

Show details

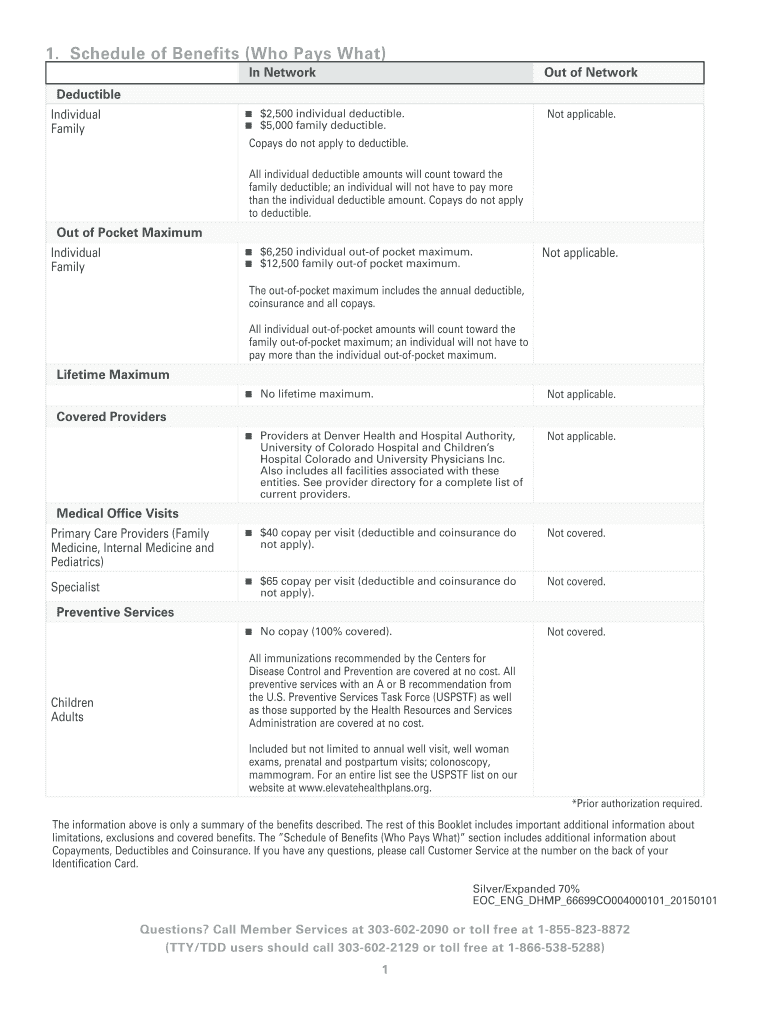

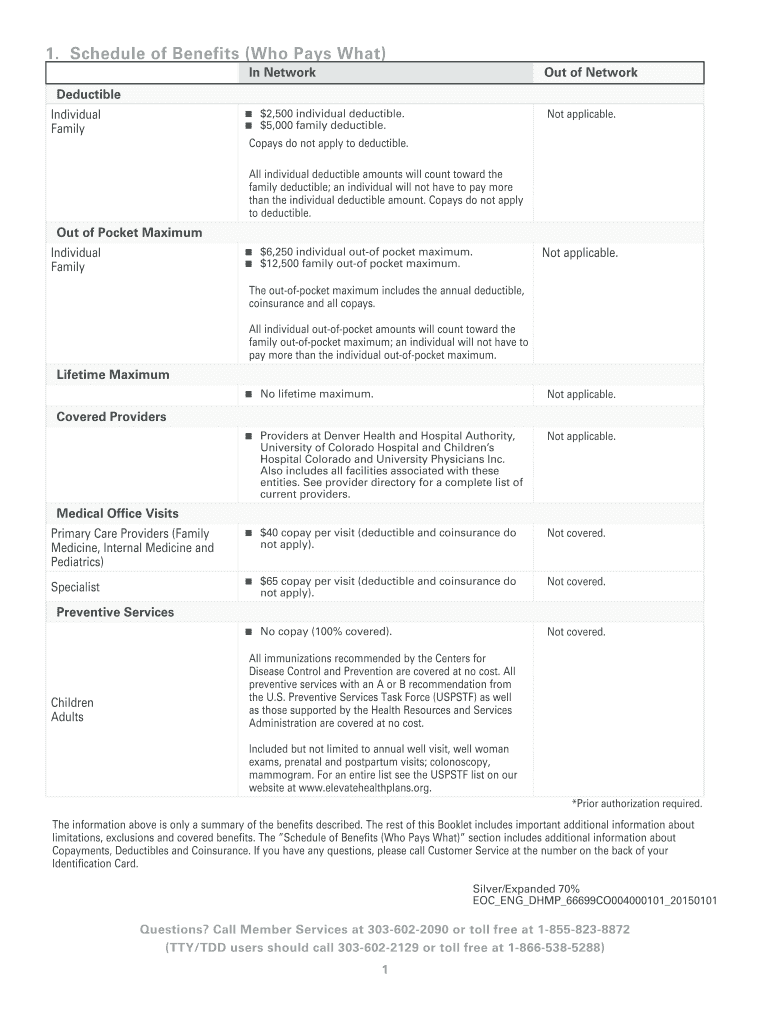

1. Schedule of Benefits (Who Pays What) In Network Out of Network Deductible Individual Family Not applicable. $2,500 individual deductible. $5,000 family deductible. Copay do not apply to deductible.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 5000 family deductible

Edit your 5000 family deductible form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5000 family deductible form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 5000 family deductible online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 5000 family deductible. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 5000 family deductible

How to fill out 5000 family deductible:

01

Gather necessary information: Before filling out the 5000 family deductible, make sure you have all relevant information readily available. This includes details about your family members, their ages, any pre-existing health conditions, and the specifics of your health insurance plan.

02

Understand the terms: Familiarize yourself with the terms and conditions associated with your 5000 family deductible. This includes knowing what expenses qualify towards meeting the deductible and any limitations or exclusions that may apply.

03

Track medical expenses: Keep track of all medical expenses incurred by your family members throughout the coverage period. This could include bills from doctor visits, prescriptions, hospital stays, surgeries, or any other eligible healthcare services.

04

Calculate deductible progress: Add up all the eligible medical expenses to determine how much progress you have made towards meeting the 5000 family deductible. This will help you understand how close you are to fulfilling the deductible requirement.

05

Submit documentation: Once you have met the deductible, gather all relevant documentation, including receipts and medical bills, to support your claim. Ensure these documents are organized and accurate to avoid any potential issues during the submission process.

06

File the claim: Contact your health insurance provider or visit their online portal to file the claim for the 5000 family deductible. Follow the instructions provided, attach the necessary documentation, and submit the claim within the designated timeframe.

Who needs a 5000 family deductible?

01

Families with frequent healthcare needs: Individuals or families who anticipate regular medical expenses throughout the year might opt for a 5000 family deductible. This ensures that a portion of their healthcare costs is covered before the health insurance kicks in.

02

Families with multiple dependents: Families with multiple dependents, such as children or elderly parents, might benefit from a 5000 family deductible. It allows them to combine the healthcare expenses of all family members to meet the deductible amount more efficiently.

03

Those seeking lower premiums: Opting for a higher deductible like the 5000 family deductible can often result in lower monthly premiums. This can be advantageous for families who want to save on their health insurance costs but are comfortable with taking on a higher out-of-pocket expense initially.

Ultimately, the decision to choose a 5000 family deductible depends on individual circumstances, financial considerations, and the expected healthcare needs of the family. It is essential to carefully evaluate your options and consult with a healthcare or insurance professional to determine the most suitable deductible for your family's requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 5000 family deductible straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 5000 family deductible.

How do I fill out 5000 family deductible using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 5000 family deductible and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit 5000 family deductible on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 5000 family deductible from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is 5000 family deductible?

The 5000 family deductible is the total amount that a family must pay out-of-pocket for covered services before the insurance company starts to pay.

Who is required to file 5000 family deductible?

The primary policyholder who holds the insurance policy for the family is typically responsible for filing the 5000 family deductible.

How to fill out 5000 family deductible?

To fill out the 5000 family deductible, the policyholder must keep track of all medical expenses for family members and submit the documentation to the insurance company.

What is the purpose of 5000 family deductible?

The purpose of the 5000 family deductible is to help control healthcare costs by requiring families to pay a portion of their medical expenses before insurance coverage kicks in.

What information must be reported on 5000 family deductible?

The 5000 family deductible requires the reporting of all medical expenses incurred by family members, including co-pays, coinsurance, and any other out-of-pocket costs.

Fill out your 5000 family deductible online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

5000 Family Deductible is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.