Get the free New Rules for Charitable Contribution Deductions ... - NoloMIRA - Charitable Organiz...

Show details

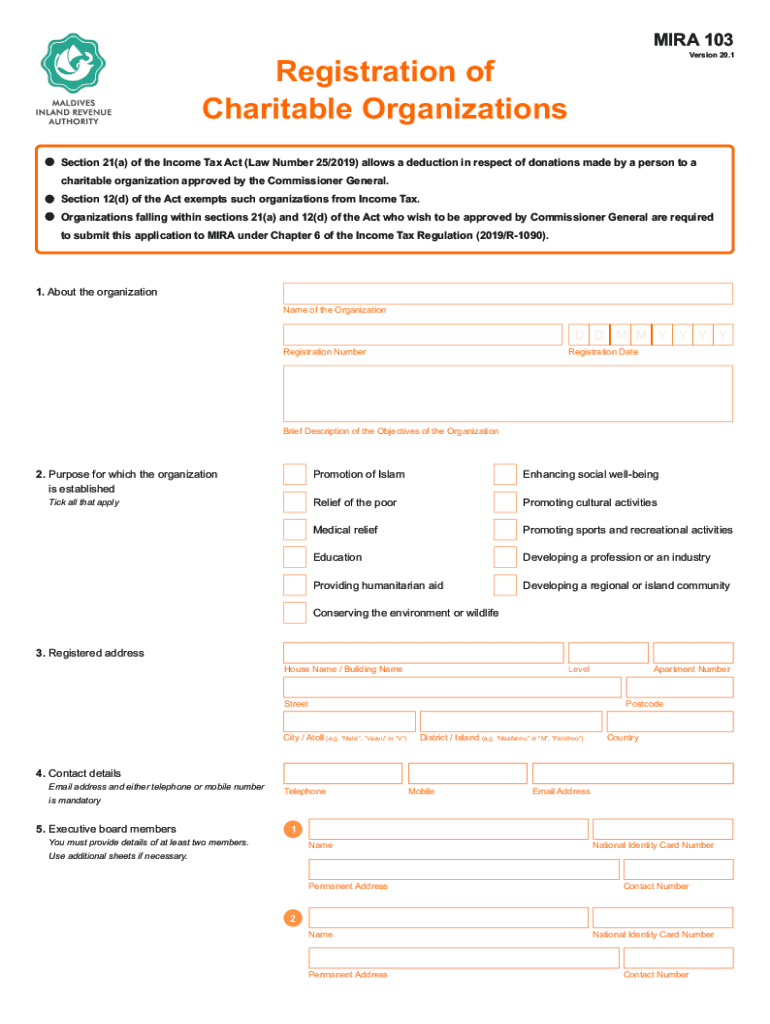

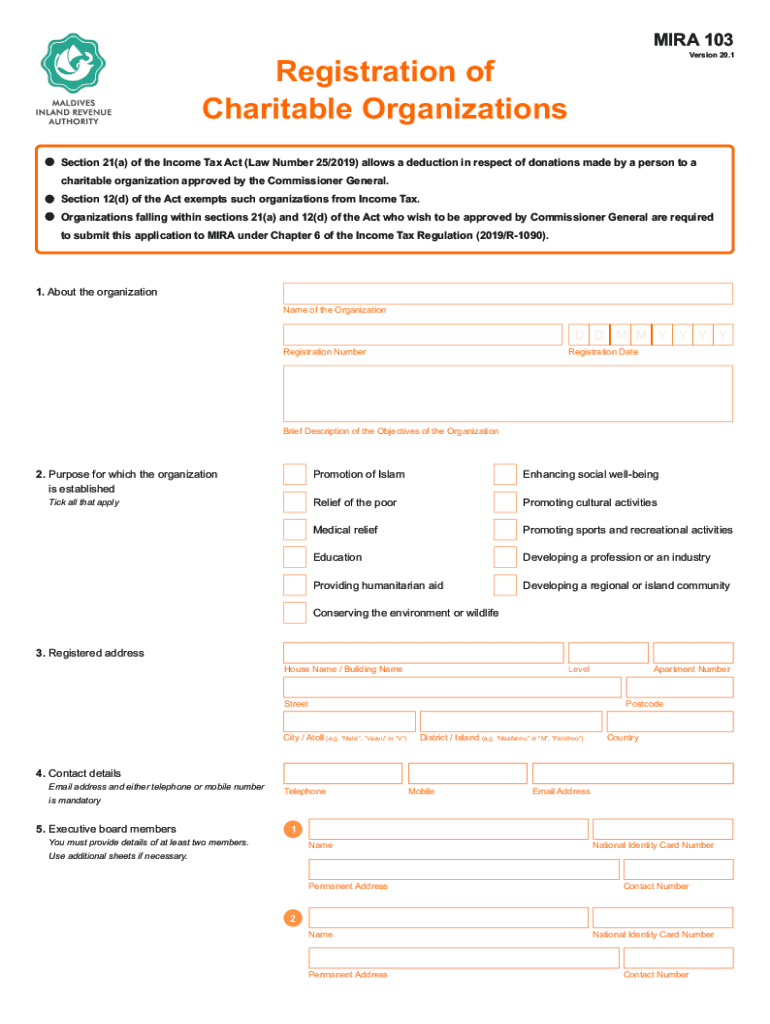

MIRA 103

Version 20.1Registration of

Charitable Organizations

Section 21(a) of the Income Tax Act (Law Number 25/2019) allows a deduction in respect of donations made by a person to a

charitable organization

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new rules for charitable

Edit your new rules for charitable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new rules for charitable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new rules for charitable online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new rules for charitable. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new rules for charitable

How to fill out new rules for charitable

01

To fill out new rules for charitable, follow these steps:

02

Begin by researching the specific requirements and regulations for charitable organizations in your country or region.

03

Consult with legal experts or professionals who specialize in nonprofit law to ensure compliance with all necessary guidelines.

04

Clearly define the purpose and mission of your charitable organization.

05

Draft a comprehensive set of rules that outline the governance structure, decision-making processes, membership requirements, financial management, and ethical guidelines for the organization.

06

Include provisions for transparency and accountability, such as regular reporting and auditing procedures.

07

Ensure that your rules align with the objectives and principles of your charitable organization.

08

Review and revise the draft rules in consultation with all relevant stakeholders, including board members, employees, volunteers, and beneficiaries.

09

Once finalized, distribute and communicate the new rules to all members and stakeholders of the charitable organization.

10

Regularly review and update the rules to adapt to changing circumstances and comply with any new legal or regulatory requirements.

Who needs new rules for charitable?

01

New rules for charitable are needed by any organization or individuals who are involved in charitable activities.

02

This includes nonprofit organizations, foundations, trusts, community groups, religious institutions, and individuals who wish to establish and operate a charitable entity.

03

The new rules help ensure proper governance, accountability, transparency, and legal compliance in the operation of charitable organizations.

04

They are important for instilling trust and confidence among donors, beneficiaries, and the general public, as well as for optimizing the impact and effectiveness of charitable activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new rules for charitable to be eSigned by others?

When you're ready to share your new rules for charitable, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the new rules for charitable electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your new rules for charitable in minutes.

How can I fill out new rules for charitable on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your new rules for charitable by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is new rules for charitable?

The new rules for charitable organizations involve updated regulations for transparency, reporting standards, and governance practices to ensure accountability and maintain public trust.

Who is required to file new rules for charitable?

All registered charitable organizations are required to file under the new rules, including nonprofits that receive tax-exempt status.

How to fill out new rules for charitable?

Organizations must complete the designated forms provided by the regulatory authority, ensuring all required information on finances, governance, and activities is accurately reported.

What is the purpose of new rules for charitable?

The purpose of the new rules is to enhance the accountability and transparency of charitable organizations, prevent fraud, and ensure that donations are used effectively for charitable purposes.

What information must be reported on new rules for charitable?

Organizations must report financial information, governance structures, program descriptions, donor information, and compliance with applicable laws.

Fill out your new rules for charitable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Rules For Charitable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.