Get the free Elements of Customer Risk: Profiles and Relationships

Show details

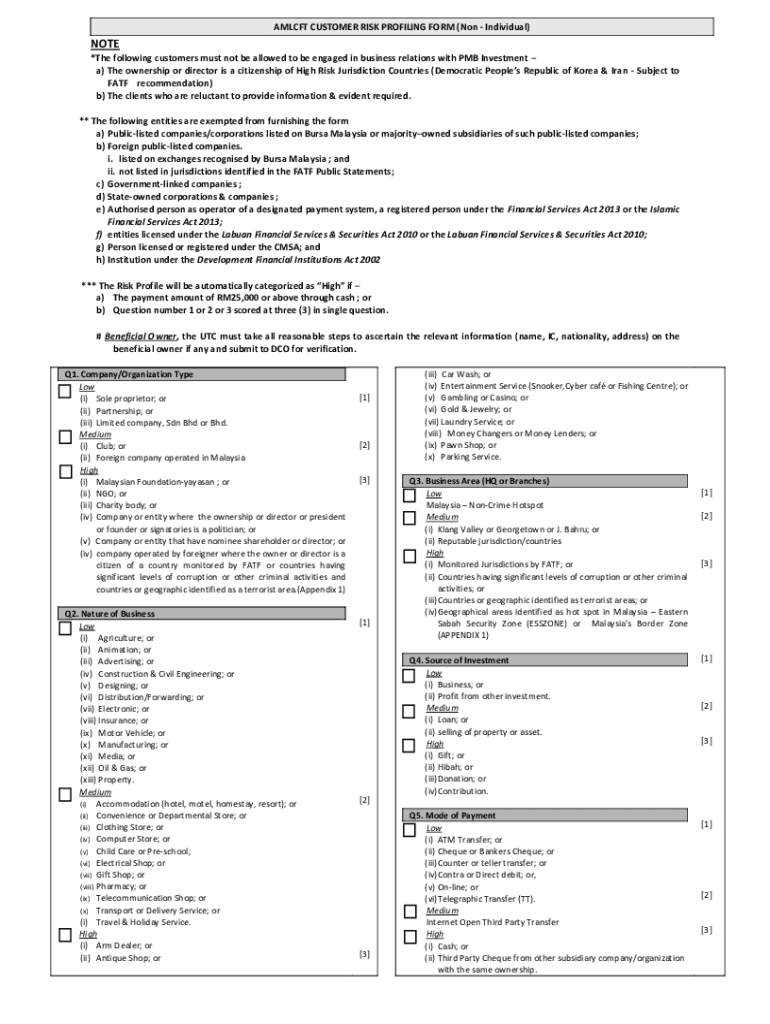

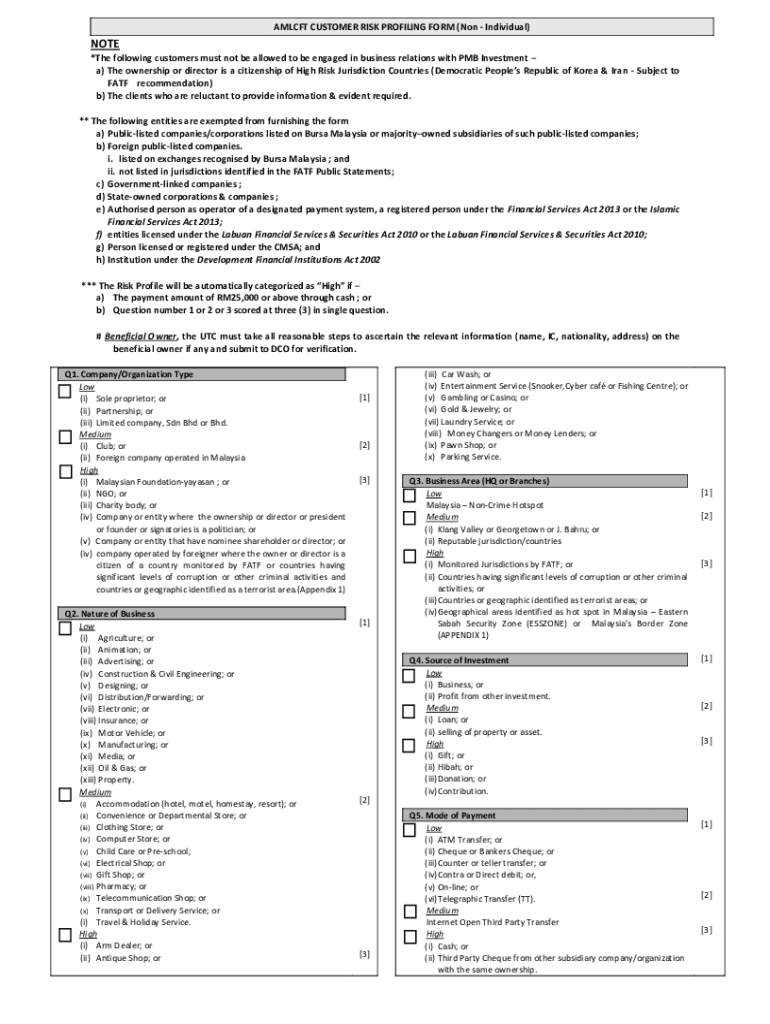

AML CFT CUSTOMER RISK PROFILING FORM (Non-Individual)NOTE *The following customers must not be allowed to be engaged in business relations with PMB Investment a) The ownership or director is a citizenship

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign elements of customer risk

Edit your elements of customer risk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your elements of customer risk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing elements of customer risk online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit elements of customer risk. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out elements of customer risk

How to fill out elements of customer risk

01

To fill out elements of customer risk, follow these steps:

02

Identify the customer: Start by gathering information about the customer, such as their name, contact details, and identification documents.

03

Assess financial information: Evaluate the customer's financial status, including their income, assets, liabilities, and credit history.

04

Determine risk tolerance: Understand the customer's willingness to accept financial risk by analyzing their investment preferences, goals, and time horizon.

05

Evaluate risk capacity: Assess the customer's ability to take on risk based on their financial capabilities and current financial obligations.

06

Analyze risk profile: Combine the information gathered to determine the customer's overall risk profile, classifying them as conservative, moderate, or aggressive.

07

Develop risk management strategies: Once the risk profile is established, create strategies to mitigate or manage risks based on the customer's risk tolerance and capacity.

08

Monitor and review: Regularly monitor the customer's risk profile, adjusting strategies as necessary and reviewing their financial situation periodically.

09

Document the process: Maintain proper records of the customer risk assessment process, including all the information gathered, analysis performed, and strategies implemented.

Who needs elements of customer risk?

01

Various financial institutions and professionals may require the elements of customer risk. This includes:

02

- Banks and credit unions: These institutions need to assess the risk associated with providing loans, mortgages, or other financial services to customers.

03

- Investment firms: Investment advisors and portfolio managers must evaluate customer risk to provide suitable investment recommendations and manage portfolios.

04

- Insurance companies: Insurers assess customer risk to determine the pricing and terms of insurance policies.

05

- Regulatory bodies: Government agencies and regulators may require financial institutions to conduct thorough customer risk assessments to ensure compliance with regulations.

06

- Financial advisors: Professionals providing financial planning and advisory services rely on customer risk assessments to develop appropriate financial strategies.

07

- Individuals: Individuals seeking to understand their own risk profile can utilize customer risk elements to make informed financial decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit elements of customer risk on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing elements of customer risk right away.

Can I edit elements of customer risk on an iOS device?

Use the pdfFiller mobile app to create, edit, and share elements of customer risk from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit elements of customer risk on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share elements of customer risk on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is elements of customer risk?

Elements of customer risk refer to the various factors that organizations must evaluate to determine the potential risk posed by a customer. These can include the customer's financial stability, credit history, transaction patterns, geographic location, and overall compliance with regulations.

Who is required to file elements of customer risk?

Financial institutions, banks, and businesses that engage in regulated activities are typically required to file elements of customer risk as part of their compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

How to fill out elements of customer risk?

To fill out elements of customer risk, organizations must gather relevant information about the customer, assess various risk factors using a standardized risk assessment form, and document their findings according to industry guidelines.

What is the purpose of elements of customer risk?

The purpose of elements of customer risk is to help organizations identify, assess, and mitigate potential risks associated with their customers. This is crucial for preventing financial crimes and ensuring regulatory compliance.

What information must be reported on elements of customer risk?

Information required to be reported on elements of customer risk includes customer identification details, transaction history, risk ratings, nature of business or services, and any flags for suspicious activities.

Fill out your elements of customer risk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Elements Of Customer Risk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.