Get the free Charity Trusts and grants fundraiser, JobsCharityjob.co.uk

Show details

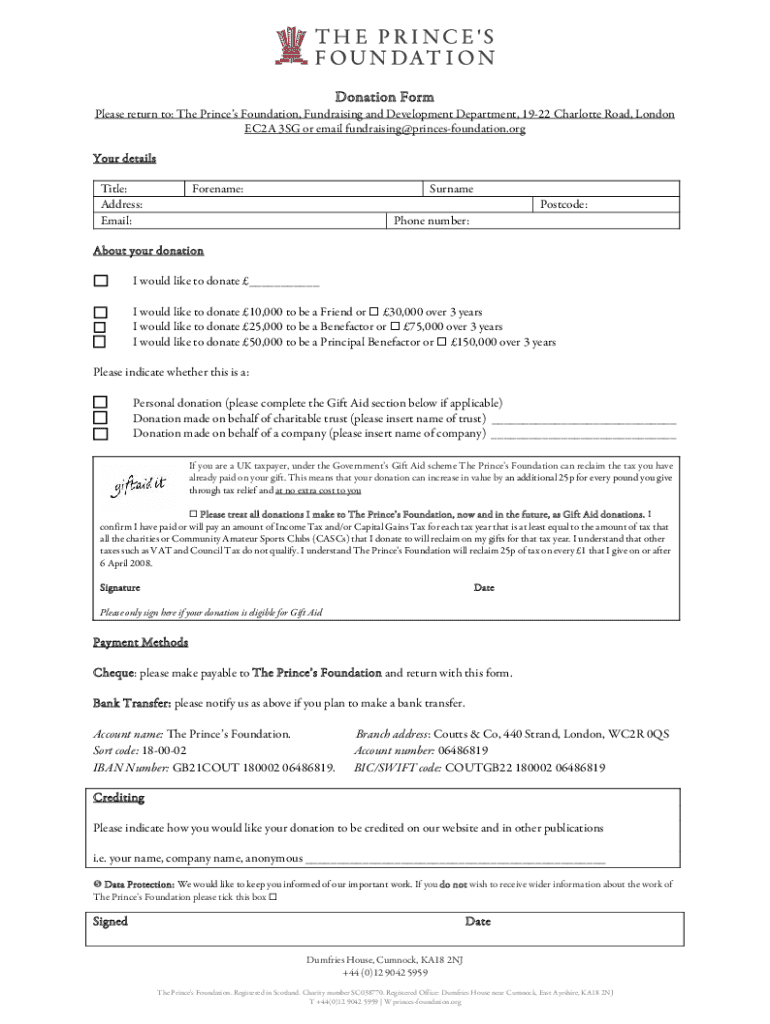

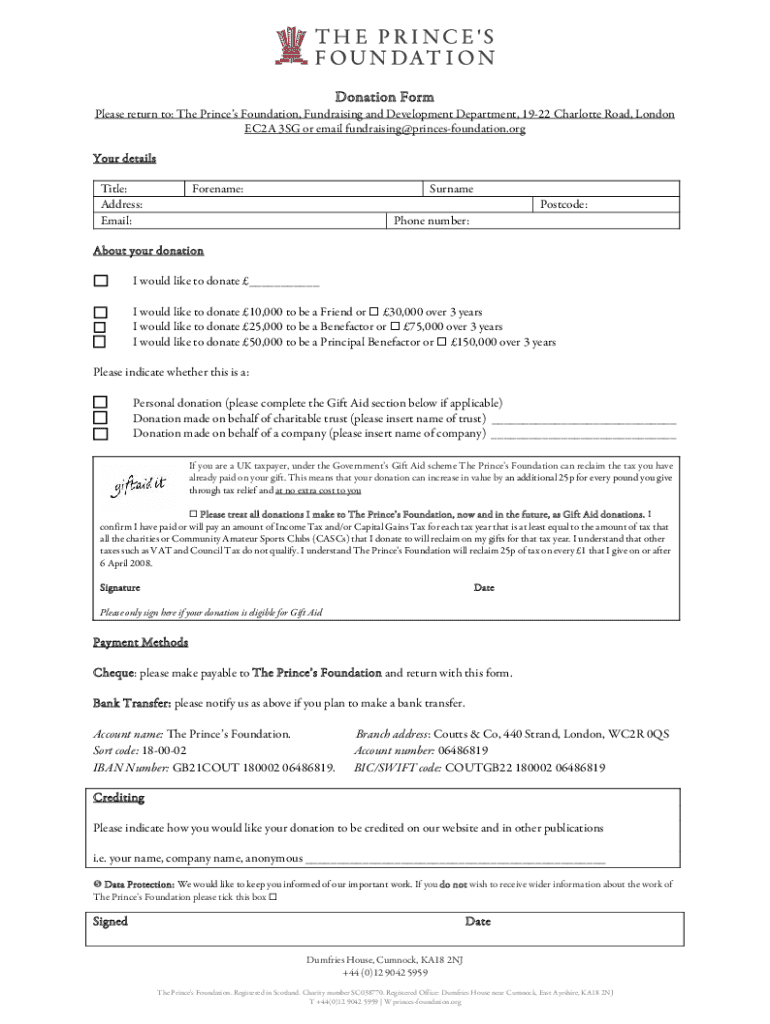

Donation Form Please return to: The Princes Foundation, Fundraising and Development Department, 1922 Charlotte Road, London EC2A 3SG or email fundraising princes foundation.org Your details Title:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charity trusts and grants

Edit your charity trusts and grants form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charity trusts and grants form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charity trusts and grants online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charity trusts and grants. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charity trusts and grants

How to fill out charity trusts and grants

01

To fill out charity trusts and grants, follow these steps:

02

Research: Start by conducting thorough research to identify the available charity trusts and grants that align with your cause or organization.

03

Read guidelines: Carefully read the guidelines and eligibility criteria provided by each trust or grant to determine if you meet the requirements.

04

Gather required information: Collect all the necessary information and documents needed to complete the application, such as financial statements, project proposals, and supporting materials.

05

Follow instructions: Ensure that you understand and follow the instructions given in the application form, as each trust or grant may have specific requirements.

06

Complete the application: Fill out the application form accurately and provide all the requested information.

07

Review and revise: Review your application thoroughly and make any necessary revisions before submission.

08

Submit the application: Submit the completed application by the specified deadline, either electronically or through mail as per the instructions.

09

Follow-up: After submitting the application, be proactive and follow up to ensure it has been received and review any additional steps or information required by the trust or grant.

10

Maintain communication: Maintain regular communication with the trust or grant organization to provide any requested updates or additional information.

11

Review decision: Finally, carefully review any decision made by the trust or grant organization and take appropriate action based on the outcome.

Who needs charity trusts and grants?

01

Charity trusts and grants are typically needed by:

02

- Non-profit organizations: Non-profit organizations often rely on charity trusts and grants to secure funding for their programs and projects.

03

- Charitable causes: Charitable causes such as education, healthcare, poverty alleviation, environmental conservation, and social services often require financial support through charity trusts and grants.

04

- Individuals in need: In some cases, individuals facing financial hardships, medical emergencies, or other challenging situations may also benefit from charity trusts and grants.

05

- Communities: Charity trusts and grants can also benefit entire communities or specific groups within them, such as disadvantaged youth, elderly citizens, or marginalized populations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send charity trusts and grants to be eSigned by others?

When you're ready to share your charity trusts and grants, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit charity trusts and grants online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your charity trusts and grants and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete charity trusts and grants on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your charity trusts and grants. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is charity trusts and grants?

Charity trusts and grants are financial resources provided to non-profit organizations, enabling them to carry out charitable activities. A charity trust is typically established to manage and distribute funds in accordance with the trust’s objectives, while grants are specific amounts of funding awarded to support particular projects or initiatives.

Who is required to file charity trusts and grants?

Organizations that receive charitable donations or grants and are classified as tax-exempt entities under the IRS code, such as 501(c)(3) organizations, are generally required to file charity trusts and grants.

How to fill out charity trusts and grants?

To fill out charity trusts and grants, applicants must complete specific forms provided by the granting organization or regulatory agency. This typically involves providing detailed information about the organization, the purpose of the funds, budget estimates, and anticipated outcomes.

What is the purpose of charity trusts and grants?

The purpose of charity trusts and grants is to provide financial support for charitable activities, promote community welfare, fund research, aid education, and assist various causes that contribute to the public good.

What information must be reported on charity trusts and grants?

Reported information typically includes the organization’s financial statements, project descriptions, grant amounts, allocation of funds, intended uses, and outcomes achieved. Additionally, compliance with specific regulatory requirements may need to be documented.

Fill out your charity trusts and grants online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charity Trusts And Grants is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.