Get the free (Use credit card if ordering online

Show details

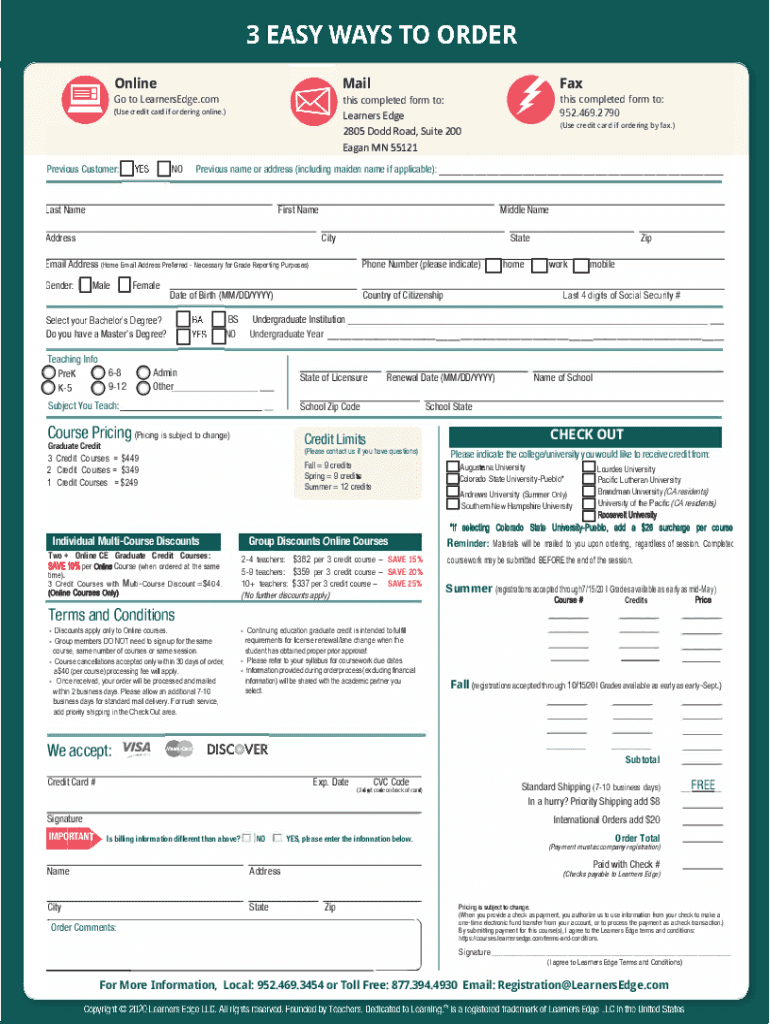

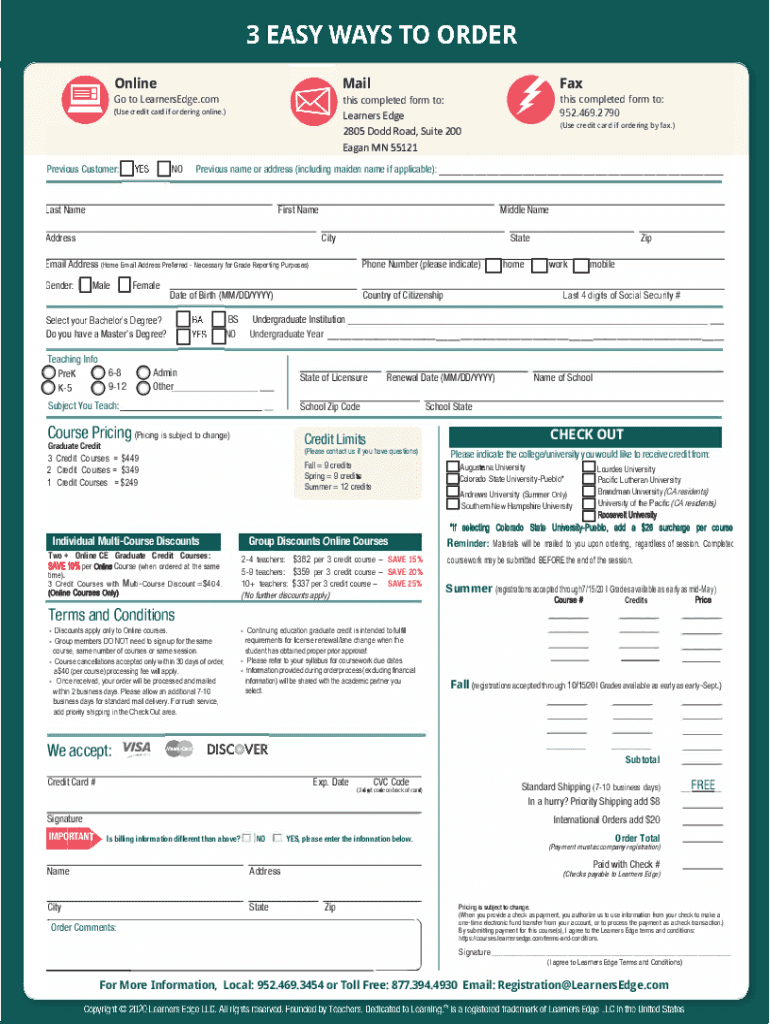

OnlineMailGo to LearnersEdge.com (Use credit card if ordering online.)this completed form to: Learners Edge2805 Dodd Road, Suite 200 Reagan MN 55121 Previous Customer:First NameAddressStateEmail Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign use credit card if

Edit your use credit card if form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your use credit card if form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit use credit card if online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit use credit card if. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out use credit card if

How to fill out use credit card if

01

To fill out and use a credit card, follow these steps:

02

Choose a credit card provider: Research and compare different credit card providers to find one that suits your needs and offers favorable terms and benefits.

03

Apply for a credit card: Visit the website or branch of your chosen credit card provider and fill out an application form with your personal and financial information.

04

Wait for approval: The credit card provider will review your application and decide whether to approve or reject it. This process may take a few days.

05

Receive your credit card: If your application is approved, you will receive your credit card in the mail. Activate it by following the instructions provided.

06

Understand the terms and conditions: Read through the terms and conditions carefully to understand the interest rates, fees, and payment deadlines associated with your credit card.

07

Use your credit card responsibly: Only make purchases that you can afford to pay off in full each month to avoid accumulating excessive debt. Keep track of your expenses and pay your bill on time.

08

Monitor your credit score: Regularly check your credit score to ensure that your credit card usage is not negatively impacting your creditworthiness.

09

Protect your credit card information: Guard your credit card information and avoid sharing it with unauthorized individuals or websites. Be cautious of any fraudulent activities or suspicious transactions.

10

Contact your credit card provider for assistance: If you have any questions, concerns, or issues with your credit card, contact your credit card provider's customer service for help.

11

Remember to use your credit card responsibly and make informed financial decisions.

Who needs use credit card if?

01

Various individuals may benefit from using a credit card if:

02

- They want to build or improve their credit history: Responsible credit card usage can help establish a positive credit history or repair a damaged credit score.

03

- They prefer the convenience of electronic payments: Credit cards offer a secure and efficient way to make purchases online, in-store, or over the phone.

04

- They like the flexibility of borrowing money: Credit cards provide a revolving line of credit, allowing users to borrow money up to a certain limit and pay it back over time.

05

- They want to earn rewards or cashback: Many credit cards offer rewards programs, including cashback, travel points, or discounts on specific purchases.

06

- They need a backup for emergencies: Having a credit card can provide a financial safety net in case of unexpected expenses or emergencies.

07

- They want to take advantage of introductory offers and promotional rates: Credit card providers often offer special promotions, such as low or 0% interest rates for a certain period.

08

- They travel frequently: Credit cards with travel benefits, such as airline miles or travel insurance, can be advantageous for frequent travelers.

09

Ultimately, the decision to use a credit card depends on individual financial goals, spending habits, and responsible financial management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify use credit card if without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including use credit card if, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete use credit card if online?

With pdfFiller, you may easily complete and sign use credit card if online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my use credit card if in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your use credit card if and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is use credit card if?

Use Credit Card If refers to the conditions under which an individual or entity may use a credit card for certain types of purchases or expenditures that may qualify for specific tax deductions or reporting.

Who is required to file use credit card if?

Typically, businesses and individuals who have made certain types of taxable purchases using a credit card may be required to file Use Credit Card If in order to report those transactions.

How to fill out use credit card if?

To fill out Use Credit Card If, one must provide detailed information about transactions, including date, amount, vendor, and purpose of the expenditure, as well as any applicable identification numbers.

What is the purpose of use credit card if?

The purpose of Use Credit Card If is to ensure accurate reporting of credit card transactions for tax purposes, aiding in compliance with applicable tax laws and regulations.

What information must be reported on use credit card if?

The information that must be reported includes transaction dates, amounts, vendor names, descriptions of the purchases, and relevant identification numbers.

Fill out your use credit card if online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Use Credit Card If is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.