Get the free Common Mortgage Servicer Violations in Loan ModificationsNolo

Show details

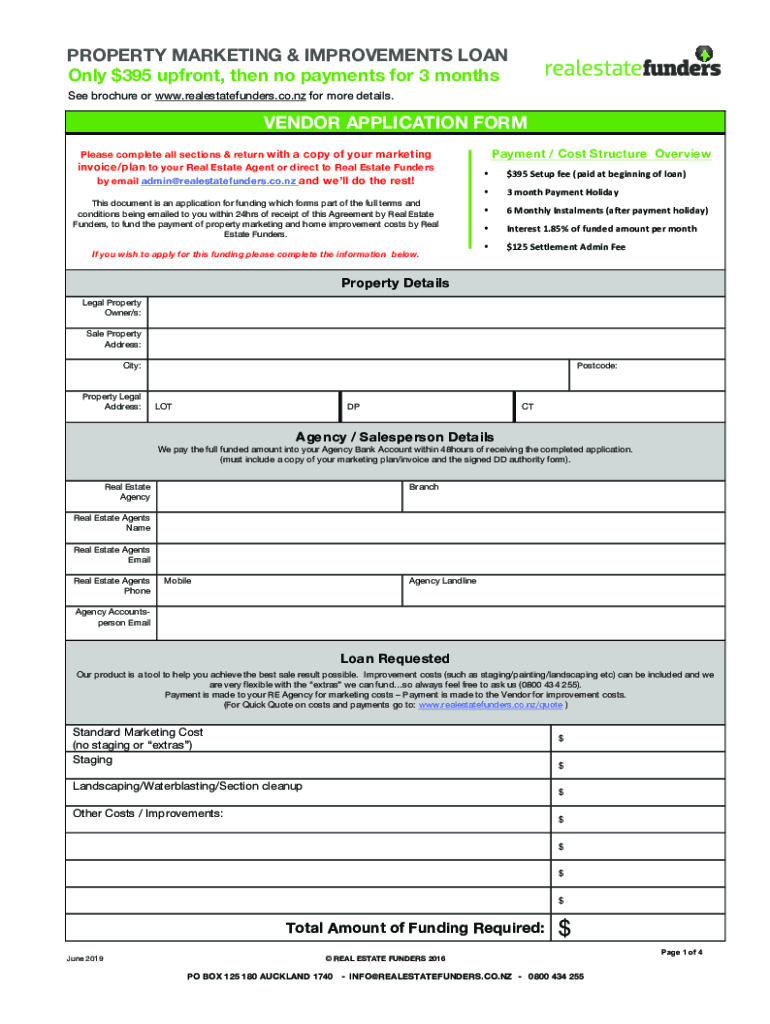

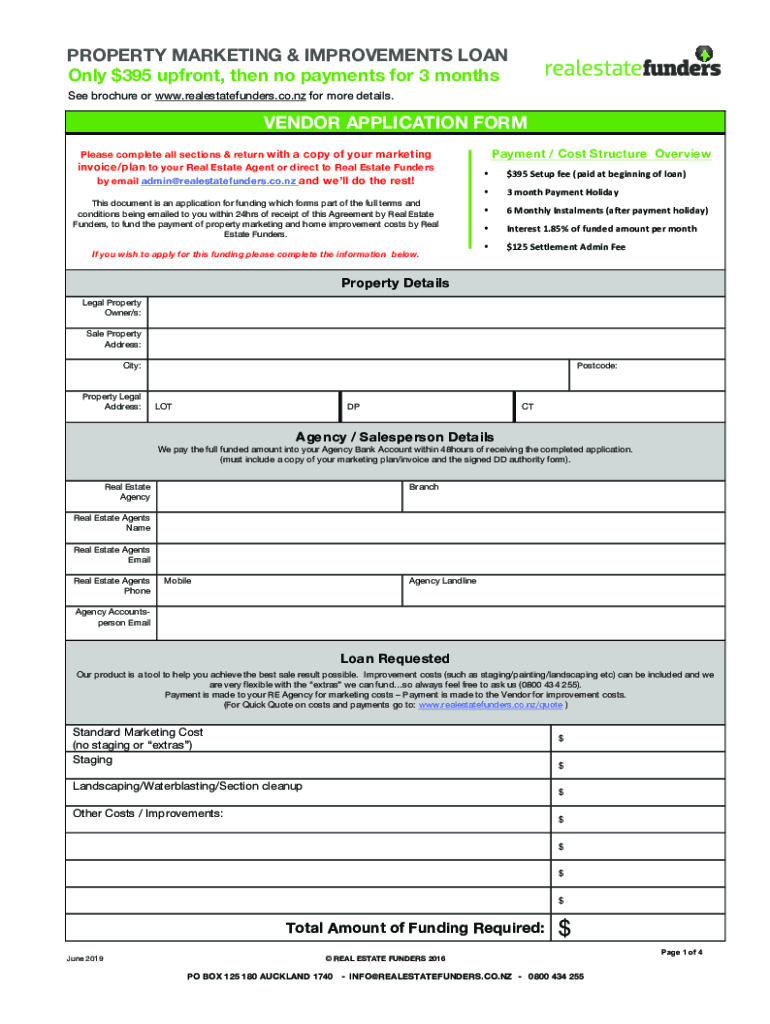

PROPERTY MARKETING & IMPROVEMENTS LOAN Only $395 upfront, then no payments for 3 months See brochure or www.realestatefunders.co.nz for more details. VENDOR APPLICATION FORM Please complete all sections

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign common mortgage servicer violations

Edit your common mortgage servicer violations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your common mortgage servicer violations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit common mortgage servicer violations online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit common mortgage servicer violations. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out common mortgage servicer violations

How to fill out common mortgage servicer violations

01

To fill out common mortgage servicer violations, follow these steps:

02

Gather all the necessary documents related to the violation, such as loan statements, correspondence with the mortgage servicer, and any supporting evidence.

03

Clearly identify the specific violation and summarize the details in writing.

04

Organize your evidence and create a timeline of events to support your claim.

05

Consult with an attorney or housing counselor who specializes in mortgage servicer violations to understand your rights and legal options.

06

Draft a formal complaint letter addressing the violation and include all relevant details and supporting documents.

07

Send the complaint letter to the appropriate authorities, such as state consumer protection agencies, the Consumer Financial Protection Bureau (CFPB), or any other relevant regulatory bodies.

08

Follow up on your complaint by keeping track of any responses or actions taken by the authorities.

09

Consider seeking legal representation if your case requires further action, such as filing a lawsuit against the mortgage servicer.

10

Stay informed about your rights as a homeowner and any updates or developments in mortgage servicer regulations.

11

Document and keep records of all communication and interactions regarding the violation.

Who needs common mortgage servicer violations?

01

Common mortgage servicer violations are typically relevant to individuals who have a mortgage loan and believe their mortgage servicer has engaged in wrongful or illegal practices.

02

Homeowners who experience issues such as improper foreclosure proceedings, misapplication of payments, failure to communicate effectively, unfair billing practices, or other violations may need to address these common mortgage servicer violations.

03

It is important for homeowners to understand their rights and options when dealing with mortgage servicer violations to protect their interests and seek appropriate remedies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify common mortgage servicer violations without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including common mortgage servicer violations, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I edit common mortgage servicer violations on an iOS device?

You certainly can. You can quickly edit, distribute, and sign common mortgage servicer violations on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit common mortgage servicer violations on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share common mortgage servicer violations on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is common mortgage servicer violations?

Common mortgage servicer violations include failure to provide accurate mortgage statements, mishandling of payments, improper foreclosure procedures, and failure to communicate effectively with borrowers.

Who is required to file common mortgage servicer violations?

Mortgage servicers who manage loans on behalf of lenders and are regulated by state and federal laws are required to file common mortgage servicer violations.

How to fill out common mortgage servicer violations?

To fill out common mortgage servicer violations, servicers should provide detailed information regarding the nature of the violation, affected borrowers, the timeline of events, and corrective actions taken.

What is the purpose of common mortgage servicer violations?

The purpose of reporting common mortgage servicer violations is to ensure compliance with laws and regulations, protect consumer rights, and promote accountability within the mortgage industry.

What information must be reported on common mortgage servicer violations?

Information that must be reported includes the type of violation, date of occurrence, number of borrowers affected, actions taken to resolve the issue, and any penalties incurred.

Fill out your common mortgage servicer violations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Common Mortgage Servicer Violations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.