Get the free Single Audits and Federal Awards Compliance Audits - Baker Tilly

Show details

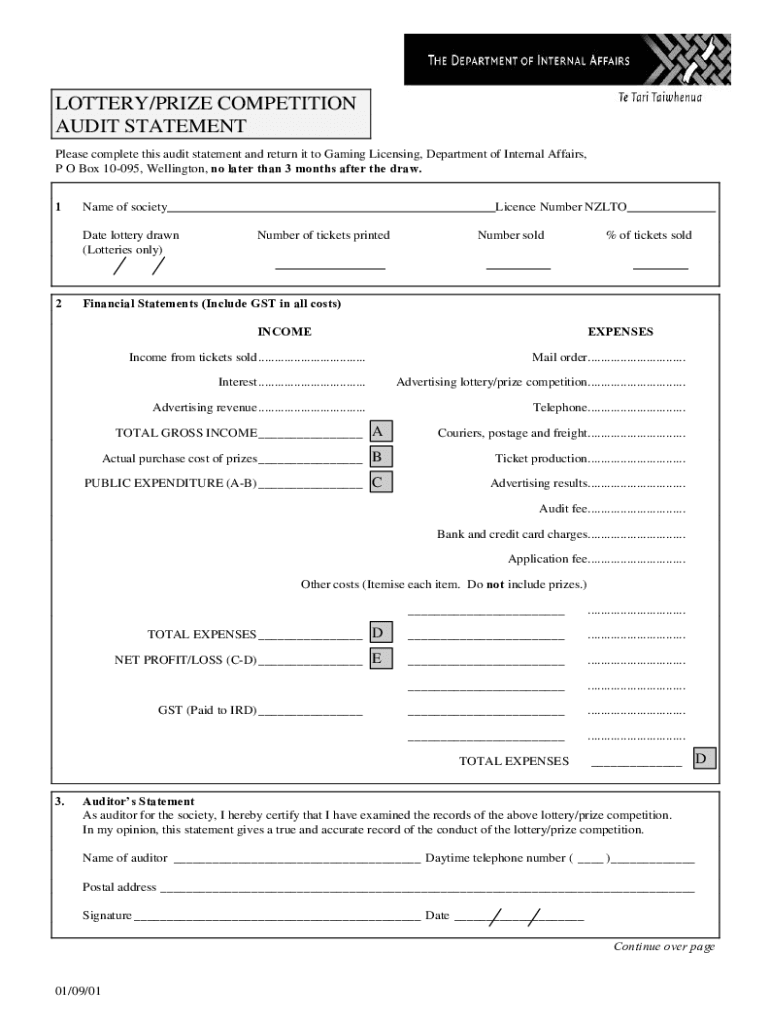

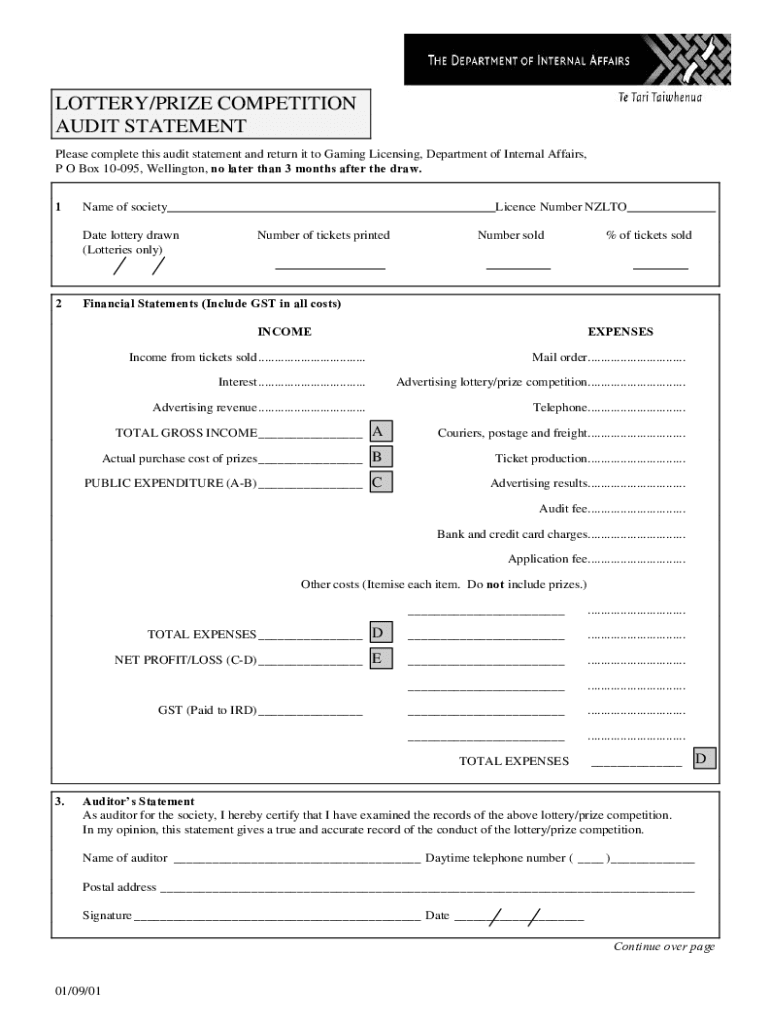

LOTTERY/PRIZE COMPETITION

AUDIT STATEMENT

Please complete this audit statement and return it to Gaming Licensing, Department of Internal Affairs,

P O Box 10095, Wellington, no later than 3 months

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single audits and federal

Edit your single audits and federal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single audits and federal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit single audits and federal online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit single audits and federal. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single audits and federal

How to fill out single audits and federal

01

To fill out single audits and federal forms, follow these steps:

1. Gather all the necessary documents and information related to the project or program being audited.

2. Familiarize yourself with the specific requirements and guidelines for single audits and federal reporting.

02

Begin by completing the basic information section of the audit form, including the name of the audited entity, the fiscal year being audited, and the date of the audit report.

03

Fill out the financial statements section, including the balance sheet, income statement, and statement of cash flows, ensuring that all amounts are accurately recorded and supported by appropriate documentation.

04

Provide detailed information on any significant deficiencies or material weaknesses in internal controls that were identified during the audit.

05

Complete the schedule of federal awards, listing all federal programs, grants, and loans received by the audited entity, along with relevant information such as the awarding agency, program title, and CFDA (Catalog of Federal Domestic Assistance) number.

06

Ensure that all required attachments, such as notes to the financial statements, management representation letter, and auditor's opinion, are included and properly completed.

07

Review the completed audit and federal forms for accuracy and completeness before submitting them to the appropriate authorities or stakeholders.

08

Keep a copy of the filled-out forms and supporting documentation for your records.

09

Note: It is recommended to consult with a qualified accountant or auditor familiar with single audits and federal reporting requirements to ensure compliance and accuracy.

Who needs single audits and federal?

01

Single audits and federal reporting are typically required for organizations that receive federal funds, grants, or contracts.

02

This includes state and local governments, nonprofits, educational institutions, and certain private entities that receive federal financial assistance.

03

The specific threshold for single audit requirements may vary depending on the type and amount of federal funds received, but in general, any entity that expends $750,000 or more in federal awards during a fiscal year is subject to single audit requirements.

04

Federal reporting may also be required for entities that receive federal grants or contracts, regardless of the funding amount.

05

It is important for these organizations to comply with single audit and federal reporting requirements to ensure accountability and transparency in the use of federal funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send single audits and federal to be eSigned by others?

When your single audits and federal is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in single audits and federal?

The editing procedure is simple with pdfFiller. Open your single audits and federal in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit single audits and federal on an iOS device?

Create, edit, and share single audits and federal from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is single audits and federal?

A single audit is an audit that is conducted on an entity that expends $750,000 or more in federal funds in a fiscal year. It covers both the entity's financial statements and its compliance with federal regulations.

Who is required to file single audits and federal?

Entities that receive federal funds exceeding $750,000 in a fiscal year are required to file single audits.

How to fill out single audits and federal?

Single audits should be filled out by following the guidelines outlined in the Uniform Guidance (2 CFR Part 200), including preparing financial statements, assessing compliance, and completing the Data Collection Form for Audits.

What is the purpose of single audits and federal?

The purpose of single audits is to provide assurance that federal funds are being used in accordance with federal regulations and to ensure accountability and transparency in the use of those funds.

What information must be reported on single audits and federal?

Single audits must report on financial statements, compliance with federal program requirements, internal controls, and findings related to fraud, waste, and abuse.

Fill out your single audits and federal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Audits And Federal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.