Get the free CLAIM FOR REFUND FORM - pickensassessor.org

Show details

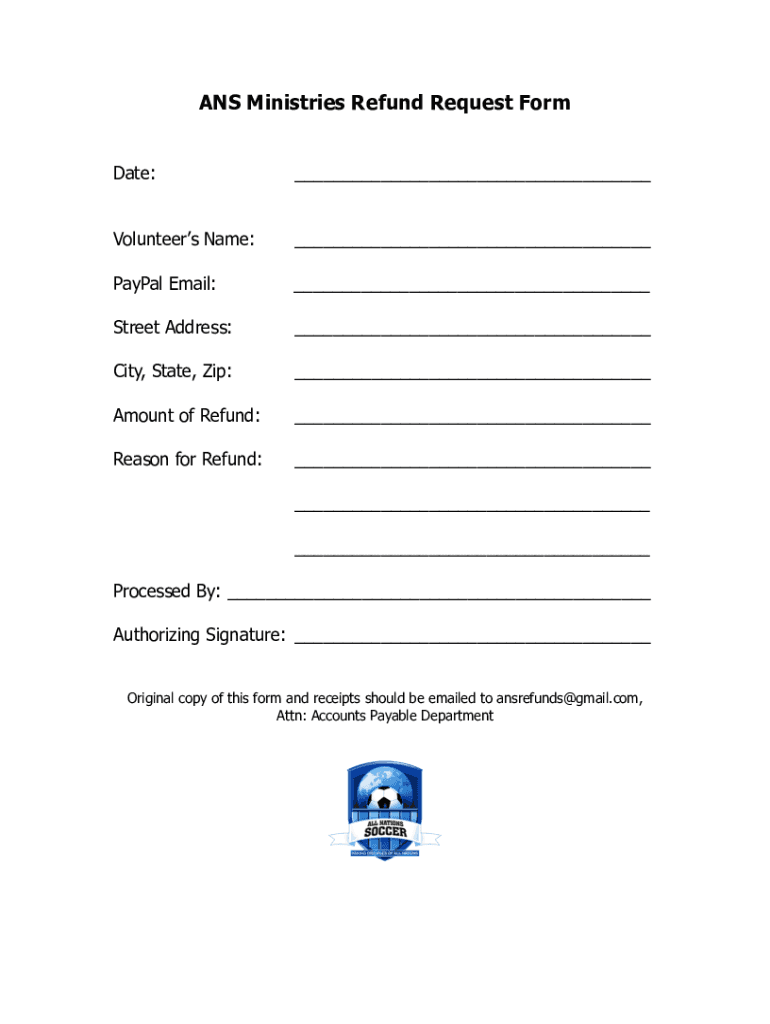

ANS Ministries Refund Request Form Date: Volunteers Name: PayPal Email: Street Address: City, State, Zip: Amount of Refund: Reason for Refund: Processed By: Authorizing Signature: Original copy of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for refund form

Edit your claim for refund form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for refund form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for refund form online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claim for refund form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for refund form

How to fill out claim for refund form

01

Start by obtaining the claim for refund form from the relevant authorities or organization.

02

Read the instructions on the form carefully to ensure that you understand the eligibility criteria and requirements for claiming a refund.

03

Gather all the necessary supporting documents that are required to support your claim, such as receipts, invoices, or any other relevant documentation.

04

Fill out the form accurately and honestly, providing all the requested information, including your personal details, the reason for the refund, and the amount being claimed.

05

Double-check your completed form to ensure that all the information is correct and there are no errors or omissions.

06

Attach the necessary supporting documents to the form, making sure they are properly organized and labeled.

07

Submit the completed form and supporting documents to the designated authorities or organization either in person, by mail, or through an online portal, depending on the specified submission method.

08

Keep copies of the completed form and all the supporting documents for your records.

09

Follow up with the authorities or organization to track the progress of your claim and to ensure that it is being processed in a timely manner.

10

If required, provide any additional information or documentation as requested by the authorities to support your claim.

11

Once your claim has been processed and approved, you will receive the refund amount through the specified method, which may include a direct deposit, a check, or any other agreed-upon method.

12

Verify that the refunded amount matches the claimed amount and report any discrepancies if found.

Who needs claim for refund form?

01

Claim for refund forms are typically needed by individuals or organizations who have made a payment or incurred expenses for which they believe they are entitled to a refund.

02

Common examples of individuals who may need to fill out a claim for refund form include taxpayers seeking a refund of overpaid taxes, consumers claiming refunds for faulty products or services, and individuals seeking reimbursement for eligible medical expenses.

03

Businesses may also need to fill out claim for refund forms for various reasons, such as claiming refunds for overpaid taxes, seeking reimbursements for business expenses, or requesting refunds for canceled services.

04

The specific eligibility criteria and requirements for claiming a refund may vary depending on the nature of the claim and the applicable laws or regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find claim for refund form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific claim for refund form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I fill out claim for refund form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your claim for refund form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit claim for refund form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as claim for refund form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is claim for refund form?

A claim for refund form is a document submitted to the tax authorities requesting a refund of overpaid taxes.

Who is required to file claim for refund form?

Taxpayers who believe they have overpaid their taxes, whether individuals, businesses, or entities, are required to file a claim for refund form.

How to fill out claim for refund form?

To fill out a claim for refund form, taxpayers must provide personal details, specify the tax years involved, detail the amounts paid, and explain the reason for seeking a refund.

What is the purpose of claim for refund form?

The purpose of a claim for refund form is to formally request the return of excess taxes paid, ensuring taxpayers can recover funds that were unnecessarily paid.

What information must be reported on claim for refund form?

Information that must be reported includes taxpayer identification, the tax periods for which a refund is requested, amounts overpaid, and the reasons for the claim.

Fill out your claim for refund form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Refund Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.