Get the free In-Kind Contributions - Internal Revenue Service

Show details

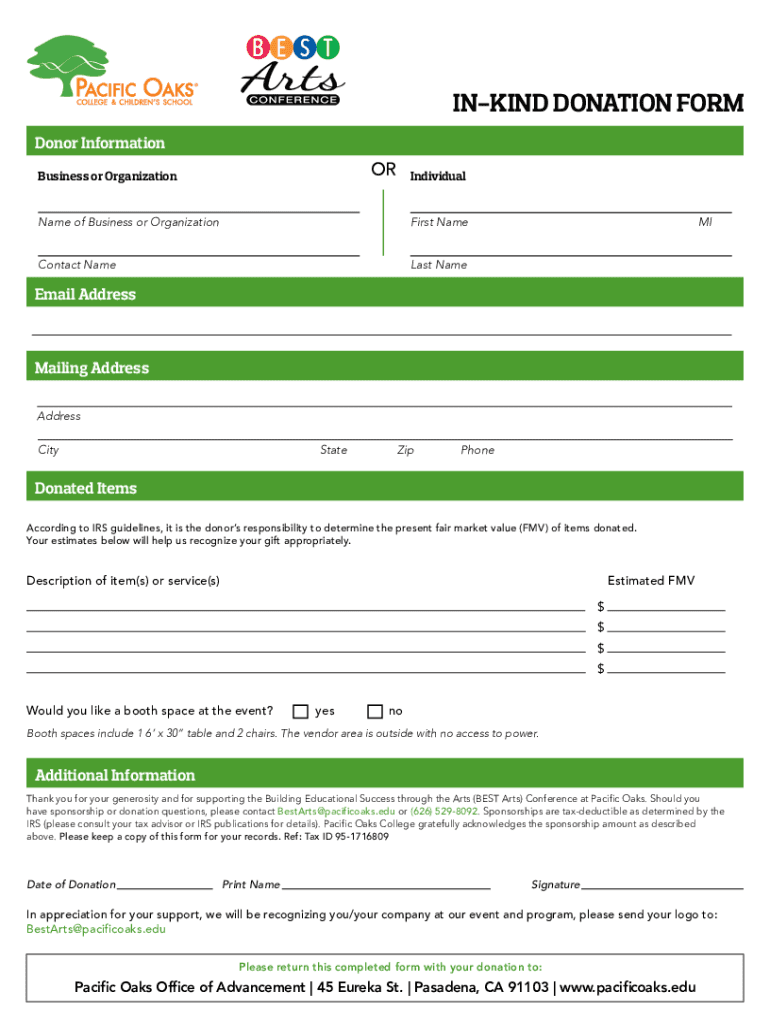

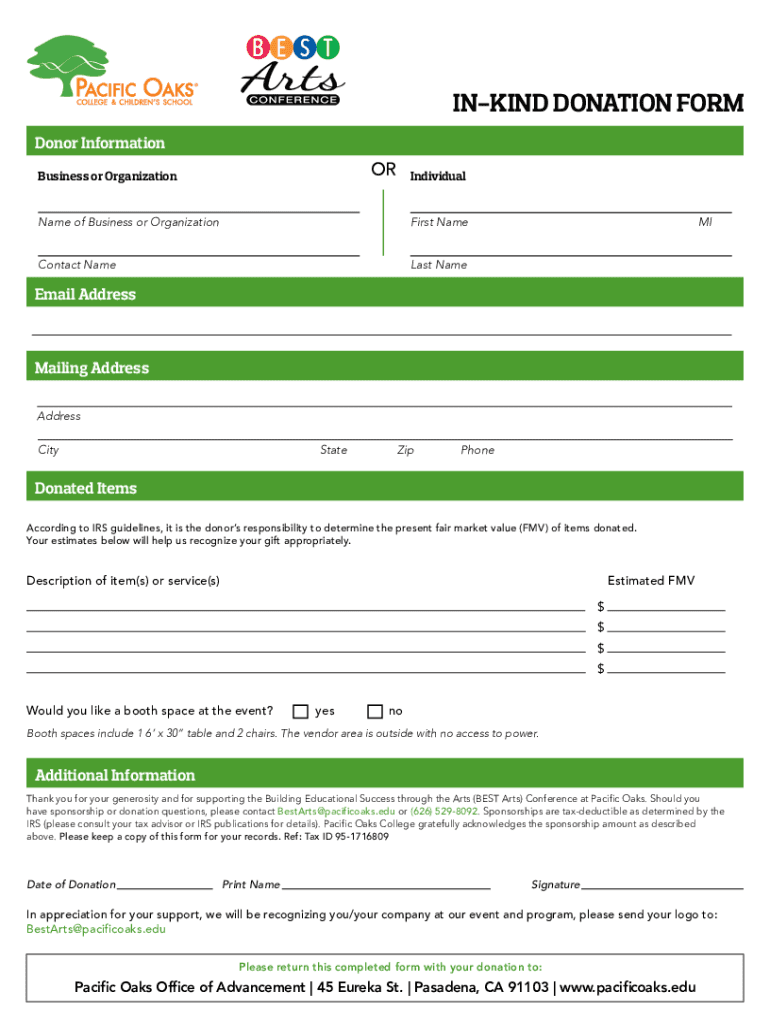

INKING DONATION FORM

Donor InformationORBusiness or OrganizationIndividualName of Business or OrganizationFirst Recontact Nameless NameMIEmail AddressMailing Address

CityStateZipPhoneDonated Items

According

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-kind contributions - internal

Edit your in-kind contributions - internal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-kind contributions - internal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing in-kind contributions - internal online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit in-kind contributions - internal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-kind contributions - internal

How to fill out in-kind contributions - internal

01

Identify the in-kind contributions that need to be filled out. These can include goods, services, or assets that are being used for a project or initiative.

02

Gather all the necessary information about the in-kind contributions, such as the description, quantity, value, and supplier.

03

Prepare a form or document specifically designed for recording in-kind contributions. This can be a spreadsheet, a template provided by the organization, or any other suitable format.

04

Start filling out the form by entering the details of each in-kind contribution. Use a point-by-point format to ensure clarity and accuracy.

05

Include any supporting documents or evidence of the in-kind contributions. This can include receipts, invoices, or agreements with suppliers.

06

Review and double-check all the information entered in the form to ensure accuracy and completeness.

07

Submit the filled-out form to the appropriate internal department or individual responsible for managing in-kind contributions.

08

Keep a copy of the filled-out form for your records and documentation purposes.

09

Follow up with the relevant internal department or individual to ensure the in-kind contributions are properly acknowledged and recorded.

10

Maintain proper communication and documentation throughout the process to facilitate transparency and accountability.

Who needs in-kind contributions - internal?

01

Internal teams within an organization may need in-kind contributions for various purposes, such as:

02

- Projects or initiatives that require additional resources or support beyond the organization's budget

03

- Fundraising campaigns that rely on donated goods or services

04

- Events or conferences where sponsors or partners contribute in-kind resources

05

- Grant applications that require a detailed breakdown of both monetary and in-kind contributions

06

Overall, any department or individual within the organization involved in project management, budgeting, fundraising, or grant applications may need to understand and utilize in-kind contributions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in in-kind contributions - internal without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing in-kind contributions - internal and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete in-kind contributions - internal on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your in-kind contributions - internal from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete in-kind contributions - internal on an Android device?

Complete in-kind contributions - internal and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is in-kind contributions - internal?

In-kind contributions - internal refer to non-monetary donations or resources provided by an organization to itself or within its own operations, such as services, goods, or volunteer time.

Who is required to file in-kind contributions - internal?

Organizations that receive or report in-kind contributions must file in-kind contributions - internal, including non-profit entities and other organizations receiving significant non-cash support.

How to fill out in-kind contributions - internal?

To fill out in-kind contributions - internal, organizations must document the details of the contribution, including the description, value, donor information, and relevant dates on the required filing forms.

What is the purpose of in-kind contributions - internal?

The purpose of in-kind contributions - internal is to accurately account for the total resources and support an organization receives, ensuring transparency and compliance with reporting regulations.

What information must be reported on in-kind contributions - internal?

In-kind contributions - internal must report the description of the contribution, its fair market value, the source or donor, and the date received.

Fill out your in-kind contributions - internal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Kind Contributions - Internal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.