Get the free Donate a Privately Held Business Interest Form

Show details

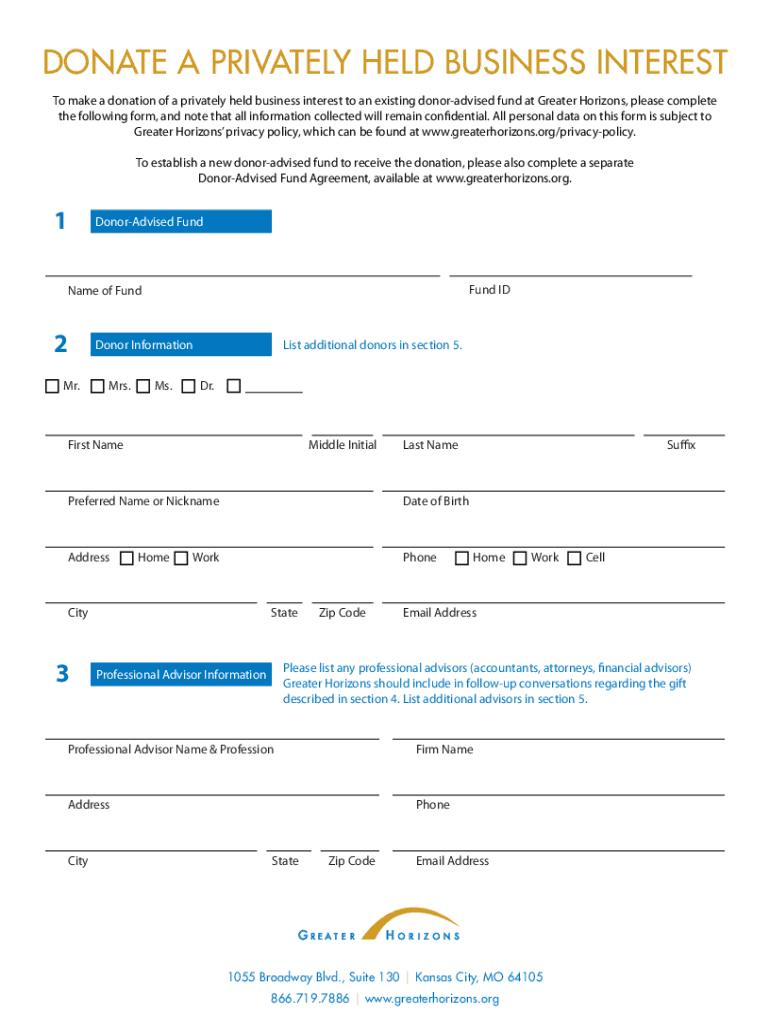

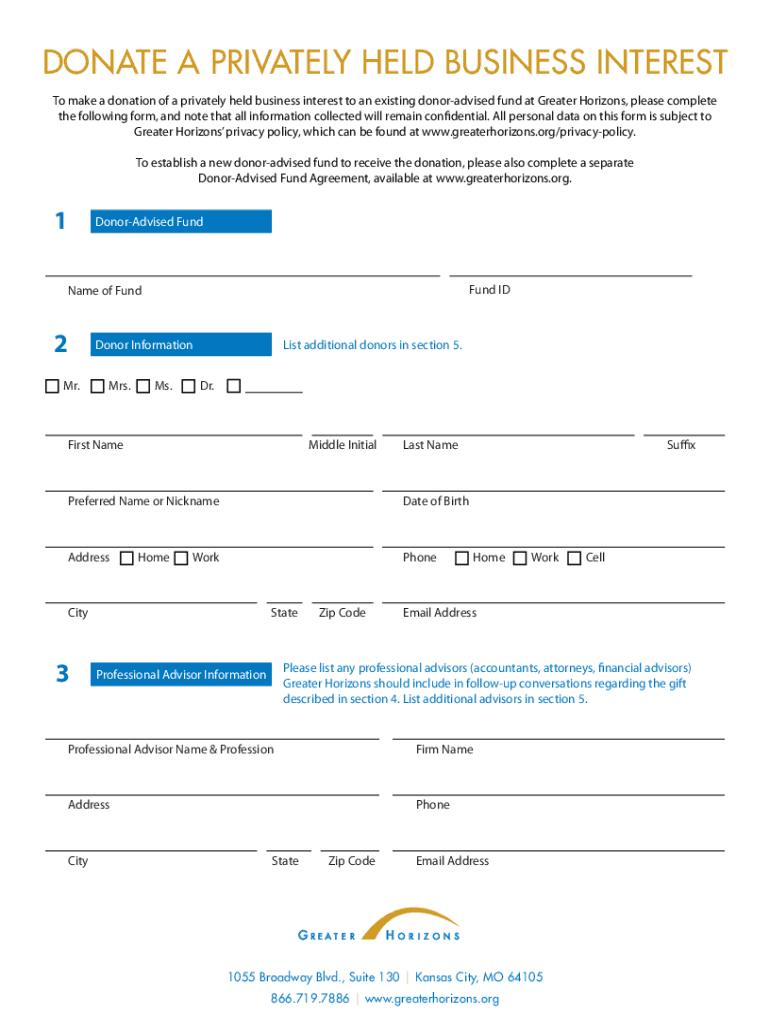

DONATE A PRIVATELY HELD BUSINESS INTEREST

To make a donation of a privately held business interest to an existing donor advised fund at Greater Horizons, please complete

the following form, and note

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donate a privately held

Edit your donate a privately held form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donate a privately held form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donate a privately held online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit donate a privately held. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donate a privately held

How to fill out donate a privately held

01

To fill out and donate a privately held, follow these steps:

02

Research charitable organizations: Take time to find a reputable charitable organization that accepts donations of privately held assets.

03

Contact the organization: Reach out to the chosen organization to inquire about their donation process and any specific requirements.

04

Gather relevant information: Collect all the necessary information about the privately held asset, such as its current value, ownership details, and any supporting documentation.

05

Appraise the asset: Consider getting a professional appraisal to determine the accurate value of the asset.

06

Consult with tax professionals: Consult with tax professionals or financial advisors to understand the tax implications and potential benefits of donating a privately held asset.

07

Complete necessary forms: Obtain the required forms from the charitable organization and fill them out accurately. Provide all the requested information and supporting documents.

08

Submit the donation: Once the forms are completed, submit them to the charitable organization along with any additional documentation they may require.

09

Follow up: Keep a record of the donation and follow up with the organization to ensure they have received everything and the process is complete.

Who needs donate a privately held?

01

Individuals or organizations who have privately held assets and wish to support charitable causes may consider donating privately held assets.

02

Some potential examples include:

03

- Business owners who want to donate shares of their privately held company to a charitable organization.

04

- Individuals who own real estate or property and would like to donate it to a nonprofit organization.

05

- Investors who want to donate stocks, bonds, or other securities to support a cause.

06

- Artists who own valuable artwork or collectibles and wish to contribute them to a museum or cultural institution.

07

- Entrepreneurs who have valuable intellectual property or patents and want to support research or educational institutions.

08

Ultimately, anyone who owns privately held assets and believes in the mission of a charitable organization can choose to donate privately held assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my donate a privately held directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign donate a privately held and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit donate a privately held from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your donate a privately held into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute donate a privately held online?

With pdfFiller, you may easily complete and sign donate a privately held online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is donate a privately held?

Donate a privately held refers to the process of giving a contribution or transfer of assets from a privately held entity, such as a corporation or limited liability company, typically to a charitable organization or cause.

Who is required to file donate a privately held?

Entities that engage in donations or contributions as part of their business operations are required to file donate a privately held, including private corporations, partnerships, or LLCs that wish to deduct their donations on their tax returns.

How to fill out donate a privately held?

To fill out donate a privately held, entities must provide information about the donation, including the amounts, recipient organization details, and ensure all tax identification numbers are correct, matching IRS requirements.

What is the purpose of donate a privately held?

The purpose of donate a privately held is to document charitable contributions made by a private entity, ensuring that they can claim tax deductions and verify their philanthropic activities for regulatory compliance.

What information must be reported on donate a privately held?

Information that must be reported includes the name and tax identification number of the donating entity, details of the charitable organization, amount donated, date of the donation, and any valuation information for non-cash contributions.

Fill out your donate a privately held online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donate A Privately Held is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.