Get the free Audit of Financial Statements - Mercy Center

Show details

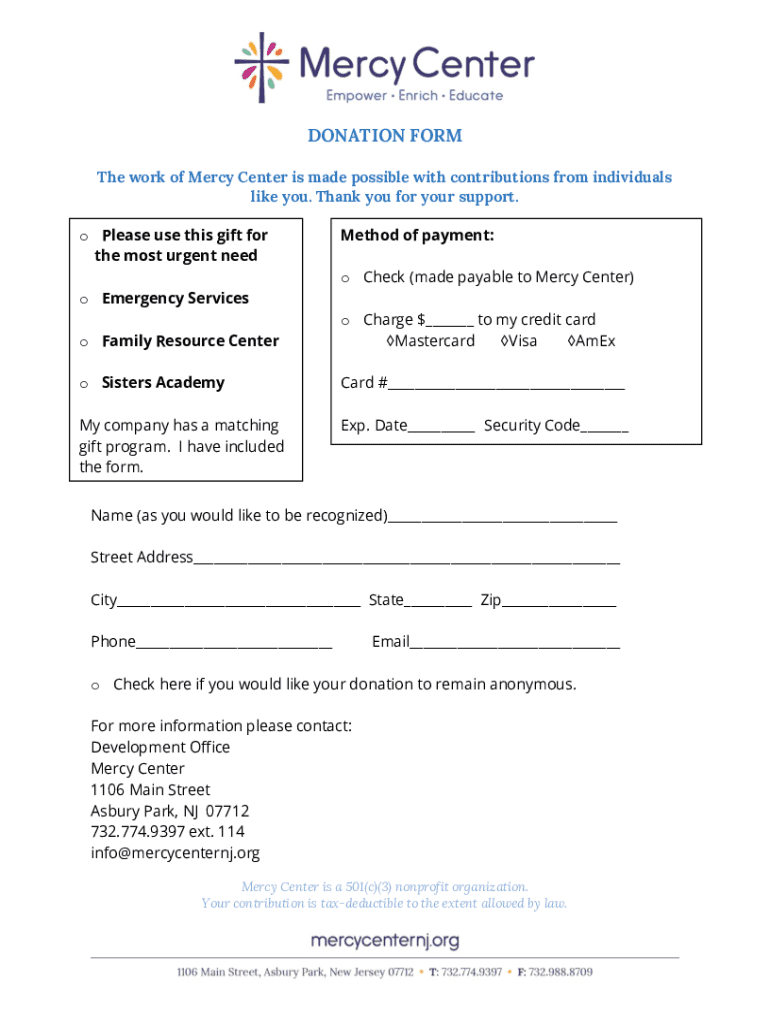

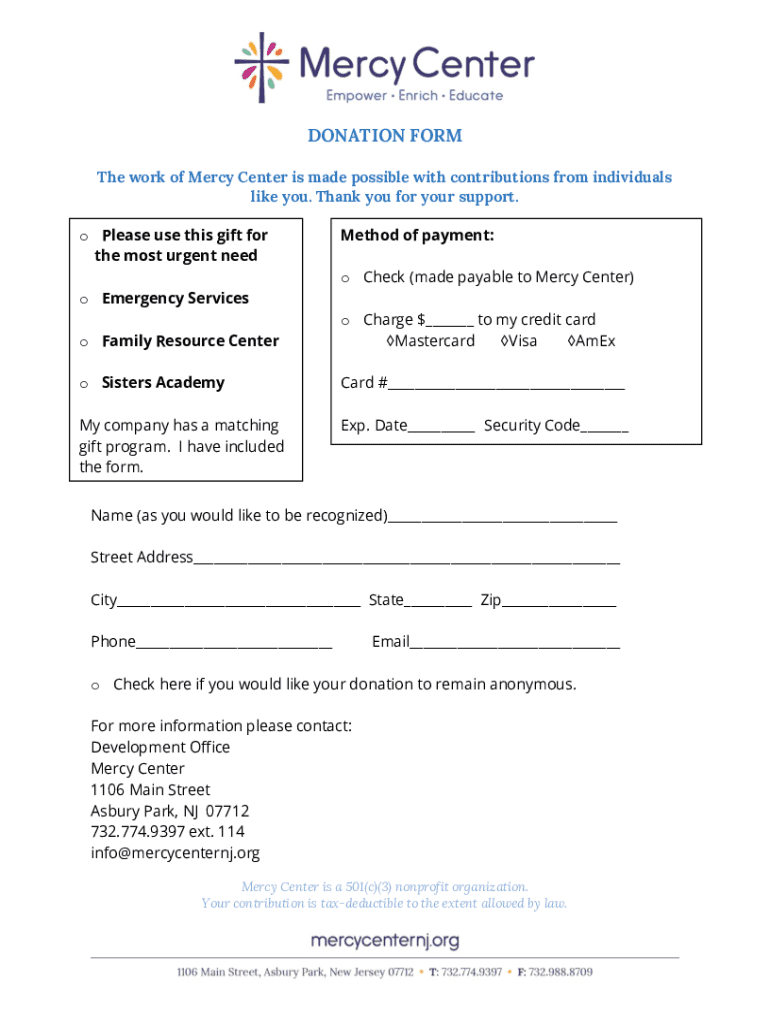

DONATION From The work of Mercy Center is made possible with contributions from individuals like you. Thank you for your support. O Please use this gift for the most urgent needMethod of payment:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit of financial statements

Edit your audit of financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit of financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing audit of financial statements online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit audit of financial statements. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit of financial statements

How to fill out audit of financial statements

01

To fill out an audit of financial statements, follow these steps:

02

Collect all relevant financial documents, including balance sheets, income statements, cash flow statements, and any supporting documentation.

03

Review the financial statements to ensure accuracy and completeness.

04

Verify the mathematical accuracy of the financial statements.

05

Analyze the financial statements for any potential errors, inconsistencies, or irregularities.

06

Conduct a thorough examination of the financial records, including bank statements, invoices, receipts, and other financial documents.

07

Cross-check all financial data with supporting documents to ensure accuracy and consistency.

08

Test the internal controls and procedures in place to ensure they are effective in preventing and detecting financial fraud or misstatements.

09

Assess the overall financial health and performance of the organization based on the audited financial statements.

10

Prepare a comprehensive audit report that summarizes the findings, identifies any issues or areas of concern, and provides recommendations for improvement.

11

Present the audit report to the relevant stakeholders, such as company management, shareholders, or regulatory authorities.

Who needs audit of financial statements?

01

The audit of financial statements is needed by various entities, including:

02

- Publicly traded companies: In order to provide assurance to shareholders and investors that the financial statements are reliable and accurately represent the company's financial position.

03

- Private companies: To satisfy lenders, creditors, or potential investors who require audited financial statements as part of their due diligence process.

04

- Non-profit organizations: To demonstrate transparency and accountability to donors, funding agencies, and the public.

05

- Government entities: To ensure compliance with accounting standards, legal requirements, and budgetary regulations.

06

- Financial institutions: To evaluate the creditworthiness and financial stability of borrowers or clients.

07

- Regulators and oversight agencies: To monitor compliance with financial regulations and detect any potential fraud or misconduct.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send audit of financial statements for eSignature?

To distribute your audit of financial statements, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get audit of financial statements?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific audit of financial statements and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit audit of financial statements online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your audit of financial statements to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is audit of financial statements?

An audit of financial statements is an independent examination of financial information prepared by an organization, which provides assurance that the financial statements are free from material misstatement and conform with applicable accounting standards.

Who is required to file audit of financial statements?

Generally, publicly traded companies, certain large private companies, and organizations that meet specific criteria set by accounting standards or regulatory bodies are required to file audited financial statements.

How to fill out audit of financial statements?

The process of filling out an audit of financial statements involves gathering financial documents, conducting tests of transactions and controls, reviewing accounting policies, and ultimately preparing an audit report based on the findings.

What is the purpose of audit of financial statements?

The purpose of an audit of financial statements is to provide an independent assessment of the financial position and performance of an organization, enhance the reliability of financial reporting, and ensure compliance with laws and regulations.

What information must be reported on audit of financial statements?

The audit report must typically include the auditor's opinion on the fairness of the financial statements, the basis for that opinion, and any significant issues encountered during the audit, along with required disclosures.

Fill out your audit of financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Of Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.