Get the free Annuity Plan: Immediate Annuity Plan for Retirement - PNB MetLife

Show details

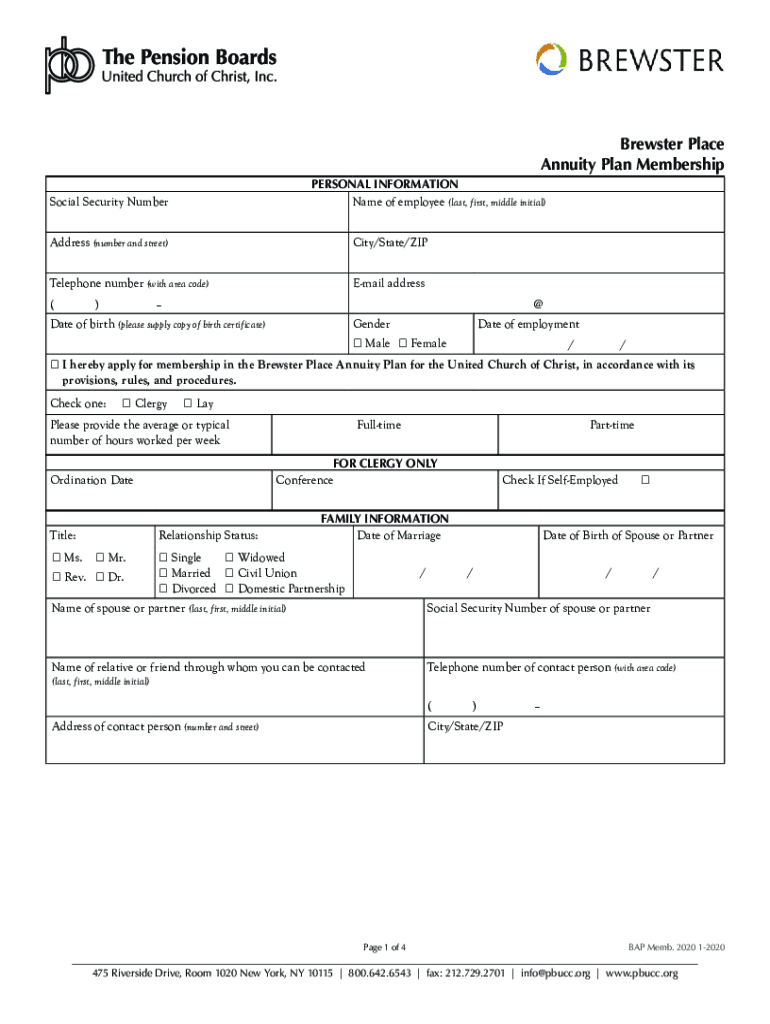

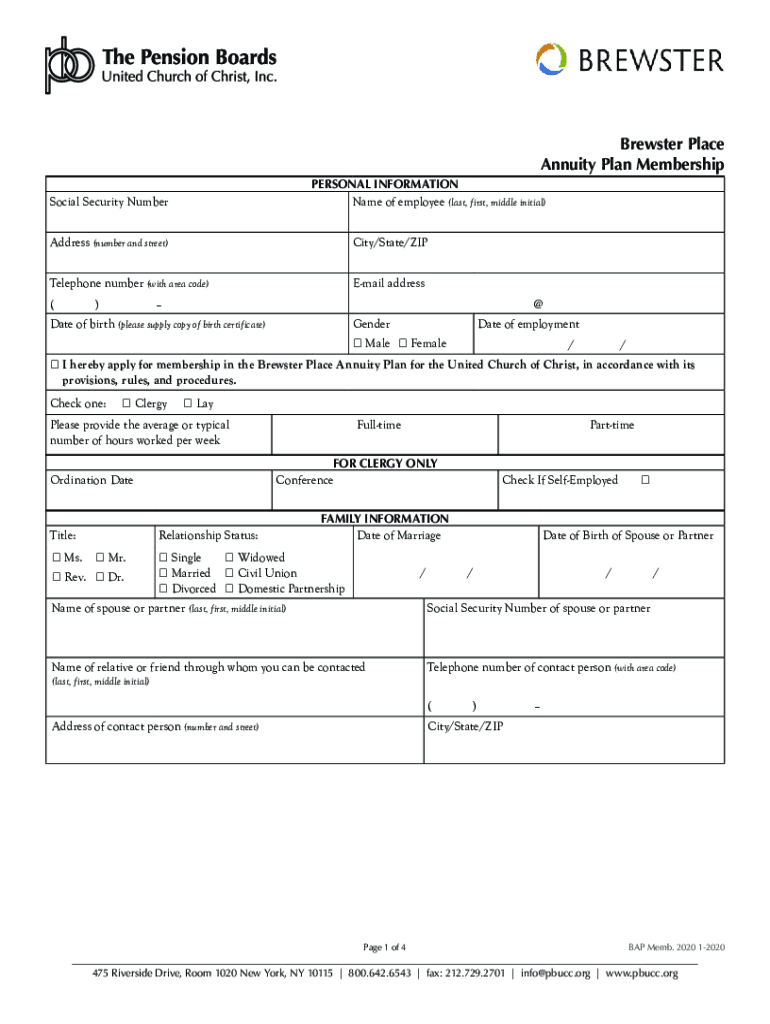

Brewster Place Annuity Plan Membership PERSONAL INFORMATIONSocial Security Cumbersome of employee (last, first, middle initial)Address (number and street)City/State/Telephone number (with area code)Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity plan immediate annuity

Edit your annuity plan immediate annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity plan immediate annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annuity plan immediate annuity online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annuity plan immediate annuity. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annuity plan immediate annuity

How to fill out annuity plan immediate annuity

01

To fill out an immediate annuity plan, follow these steps:

02

Gather all important information and documents, such as identification proof, social security number, birth certificate, and income details.

03

Research and choose a reputable insurance company that offers immediate annuity plans.

04

Contact the insurance company's customer service or visit their website to obtain the necessary forms for applying for an immediate annuity plan.

05

Fill out the application form accurately and provide all the required information, including personal details, beneficiaries, payment options, and desired annuity payout amounts.

06

Double-check all the entered information to ensure its accuracy and completeness.

07

Attach any supporting documents, if required, such as proof of income or medical records.

08

Review the filled application form and supporting documents one last time for any errors or missing information.

09

Submit the completed application form along with any required documents to the insurance company through the designated method (e.g., mail, online submission).

10

Keep a copy of the application form and supporting documents for your records.

11

Wait for the insurance company to process your application, and they will provide further instructions on how to fund your annuity account and start receiving payments.

Who needs annuity plan immediate annuity?

01

Immediate annuity plans are beneficial for individuals who:

02

- Want a stable and guaranteed stream of income during their retirement years.

03

- Desire to convert a lump sum of money, such as retirement savings or an inheritance, into regular fixed payments.

04

- Seek to eliminate the risk of outliving their savings by receiving regular annuity payouts for a specified period or their lifetime.

05

- Don't have a pension plan or need an additional source of income in retirement.

06

- Want to transfer the investment risk to an insurance company in exchange for a secured income stream.

07

- Wish to provide financial security to their beneficiaries by including them in the annuity plan.

08

- Prefer the simplicity and convenience of receiving regular payments without the need for active management or investment decisions.

09

- Are willing to commit their funds to an annuity plan for a certain period or their entire life.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my annuity plan immediate annuity directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your annuity plan immediate annuity as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send annuity plan immediate annuity to be eSigned by others?

To distribute your annuity plan immediate annuity, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the annuity plan immediate annuity in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your annuity plan immediate annuity.

What is annuity plan immediate annuity?

An immediate annuity is a financial product that provides a stream of income payments that start almost immediately after a lump sum investment is made, typically used for retirement income.

Who is required to file annuity plan immediate annuity?

Individuals or entities who have purchased immediate annuities may be required to file for tax reporting purposes or if they are receiving income from the annuity.

How to fill out annuity plan immediate annuity?

Filling out an immediate annuity form typically involves providing personal information, beneficiary details, and the amount to be invested in the annuity, along with selecting the payment options.

What is the purpose of annuity plan immediate annuity?

The purpose of an immediate annuity is to provide a reliable income stream for individuals, particularly retirees, seeking financial security during retirement.

What information must be reported on annuity plan immediate annuity?

Information such as the total amount invested, payment amount, frequency of payments, and details about beneficiaries must typically be reported on an immediate annuity.

Fill out your annuity plan immediate annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity Plan Immediate Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.