Get the free Estate Gift Planning Form - Redirecting to https ...

Show details

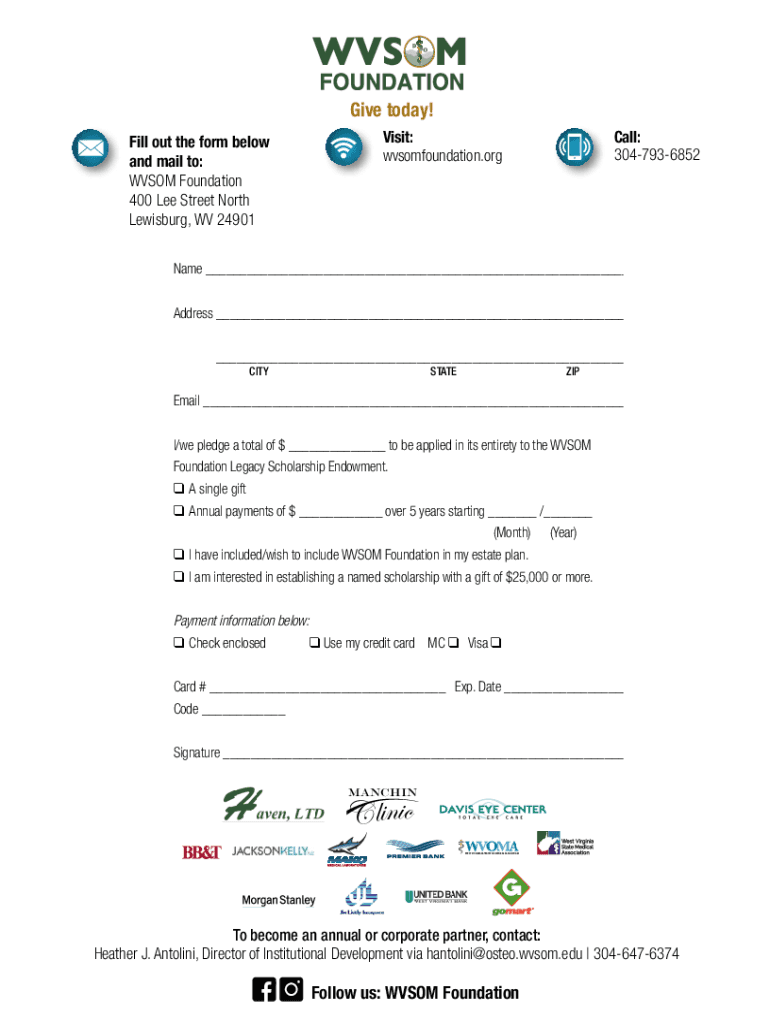

Give today! Call: 3047936852Visit: wvsomfoundation. Refill out the form below and mail to: WHOM Foundation 400 Lee Street North Lewis burg, WV 24901Name Address CITYSTATEZIPEmail I/we pledge a total

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate gift planning form

Edit your estate gift planning form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate gift planning form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate gift planning form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit estate gift planning form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate gift planning form

How to fill out estate gift planning form

01

Step 1: Gather all necessary documents such as property titles, bank statements, legal agreements, and insurance policies.

02

Step 2: Identify your assets and determine their value. This includes real estate, investment accounts, retirement savings, and personal belongings.

03

Step 3: Determine the beneficiaries of your estate. Decide who you want to leave your assets to and in what proportions.

04

Step 4: Consult with an estate planning attorney or financial advisor to understand the legal requirements and tax implications of gift planning.

05

Step 5: Fill out the estate gift planning form with accurate and detailed information. Be sure to provide information about yourself, your assets, and the chosen beneficiaries.

06

Step 6: Review the completed form for any errors or omissions. Make sure all information is correct and up to date.

07

Step 7: Sign and date the form in the presence of witnesses or a notary public, as required by law.

08

Step 8: Keep a copy of the completed and signed form for your records, and provide a copy to your attorney or financial advisor for safekeeping.

09

Step 9: Regularly review and update your estate gift planning form as your circumstances and preferences change.

Who needs estate gift planning form?

01

Anyone who wants to have control over the distribution of their assets after their death may need an estate gift planning form.

02

Individuals with substantial assets, complex family situations, or specific charitable intentions often require estate gift planning to ensure their wishes are carried out.

03

It is advisable to consult with an estate planning attorney or financial advisor to determine if an estate gift planning form is necessary for your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send estate gift planning form to be eSigned by others?

When your estate gift planning form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit estate gift planning form online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your estate gift planning form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete estate gift planning form on an Android device?

Use the pdfFiller app for Android to finish your estate gift planning form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is estate gift planning form?

An estate gift planning form is a document used to outline an individual's intentions regarding the distribution of their assets and gifts after their death, ensuring that their wishes are carried out.

Who is required to file estate gift planning form?

Individuals who are making gifts that exceed the annual exclusion limit or who are beneficiaries of an estate must file an estate gift planning form.

How to fill out estate gift planning form?

To fill out an estate gift planning form, gather all necessary information regarding assets, beneficiaries, and the value of gifts, then complete the form by following the instructions provided, ensuring all required fields are filled accurately.

What is the purpose of estate gift planning form?

The purpose of the estate gift planning form is to establish a clear plan for the distribution of one's assets and to comply with tax regulations concerning gifts and inheritances.

What information must be reported on estate gift planning form?

The form typically requires details such as the names and addresses of both the donor and recipient, the description and value of gifts, and the date of the gift.

Fill out your estate gift planning form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Gift Planning Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.