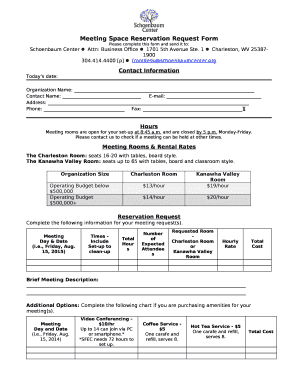

Get the Charities and CASC: Gift Aid declaration forms for a ...10+ Charity Gift Aid form Templat...

Show details

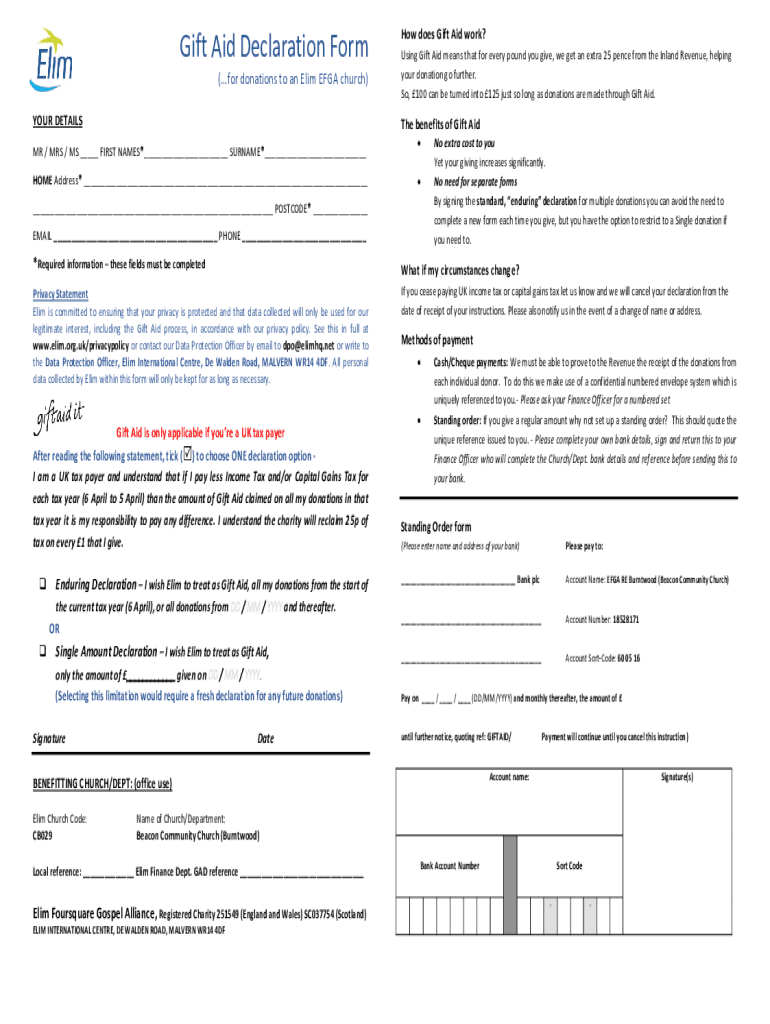

Gift Aid Declaration Form (for donations to an Elm EFA church) YOUR Details does Gift Aid work? Using Gift Aid means that for every pound you give, we get an extra 25 pence from the Inland Revenue,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charities and casc gift

Edit your charities and casc gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charities and casc gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charities and casc gift online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charities and casc gift. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charities and casc gift

How to fill out charities and casc gift

01

To fill out charities and CASC gift, follow these steps:

02

Gather all necessary information, including the name and address of the charity or CASC (Community Amateur Sports Club), as well as the details of the donation.

03

Use the appropriate forms or platforms provided by the charity or CASC to make the donation. This could be an online donation form, a paper form, or a direct bank transfer.

04

Provide accurate and complete information as required, including your own personal details and any additional information requested.

05

Specify the amount or value of the donation, and indicate if it's a one-time donation or a recurring donation.

06

If applicable, specify any specific purpose or project you wish to support with your donation.

07

Review and verify all the provided information to ensure its accuracy.

08

Submit the completed donation form or complete the donation process as per the instructions provided by the charity or CASC.

09

Keep a copy of the donation receipt or confirmation for your records, as it may be needed for tax or audit purposes.

10

Consider consulting with a tax professional to understand the potential tax benefits or implications of your donation.

11

Continue supporting charities and CASCs through regular donations or volunteering efforts to make a positive impact in your community.

Who needs charities and casc gift?

01

Charities and CASC gifts are needed by individuals, organizations, and causes that rely on public support to fulfill their missions and initiatives.

02

Here are some examples of who may need charities and CASC gifts:

03

- Non-profit organizations that provide healthcare services, education, environment protection, poverty alleviation, disaster relief, and other social services.

04

- CASCs focused on promoting amateur sports and facilitating sports activities for communities.

05

- Animal shelters, rescue organizations, and wildlife conservation initiatives.

06

- Art and cultural institutions that promote creativity, diversity, and community engagement.

07

- Research institutions conducting studies on diseases, scientific advancements, and societal issues.

08

- Religious organizations that support spiritual growth and provide assistance to those in need.

09

- Community development projects aiming to improve infrastructure, livelihoods, and social well-being.

10

- Individuals facing financial hardships, medical challenges, or other difficulties.

11

By donating to charities and CASCs, individuals can contribute to the betterment of society, support causes they are passionate about, and make a positive difference in the lives of others.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in charities and casc gift without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing charities and casc gift and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit charities and casc gift on an Android device?

You can make any changes to PDF files, such as charities and casc gift, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out charities and casc gift on an Android device?

On Android, use the pdfFiller mobile app to finish your charities and casc gift. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is charities and casc gift?

Charities and CASCs (Community Amateur Sports Clubs) gifts refer to donations made to registered charities and CASCs, which can qualify for tax relief under certain conditions.

Who is required to file charities and casc gift?

Individuals and organizations that make charitable donations and wish to claim tax relief or report charity gifts are required to file.

How to fill out charities and casc gift?

To fill out charities and CASC gift forms, you need to provide details of the donation including the amount, the charity's name, date of the gift, and any relevant tax relief claims.

What is the purpose of charities and casc gift?

The purpose is to provide a mechanism for individuals and organizations to receive tax benefits for their charitable donations, thereby encouraging philanthropy.

What information must be reported on charities and casc gift?

Information such as the donor's details, amount gifted, date of the gift, and the recipient charity or CASC's information must be reported.

Fill out your charities and casc gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charities And Casc Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.