Get the free Bankruptcy Records Order Form - utb uscourts

Show details

This document is a request form for obtaining bankruptcy records from the U.S. Bankruptcy Court for the District of Utah, with options for fax or mail orders. It includes case location information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bankruptcy records order form

Edit your bankruptcy records order form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy records order form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bankruptcy records order form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bankruptcy records order form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bankruptcy records order form

How to fill out Bankruptcy Records Order Form

01

Obtain the Bankruptcy Records Order Form from the official website or your local bankruptcy court.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide details about the bankruptcy case, including the case number and the court where it was filed.

04

Specify the type of records you are requesting (e.g., case documents, discharge papers).

05

Include any applicable fees for processing the request, and check the payment methods accepted.

06

Review the completed form for accuracy and completeness.

07

Submit the form via mail or in person to the appropriate bankruptcy court.

Who needs Bankruptcy Records Order Form?

01

Individuals or businesses seeking to review their own bankruptcy records.

02

Creditors or legal representatives requiring access to bankruptcy documents for claims or proceedings.

03

Researchers or individuals conducting background checks involving bankruptcy history.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 309A for bankruptcy?

A Bankruptcy Application is filed in the High Court by either the debtor or a creditor. The debtor owes debts of at least $15,000 which he cannot repay. The High Court may then declare him a bankrupt at the court hearing. Applying for one's bankruptcy should not be viewed as an easy solution to one's debt woes.

What are three things that don t go away after you file for bankruptcy?

Q: What Are Three Things That Don't Go Away After You File for Bankruptcy? A: Bankruptcy doesn't discharge all debts. Child support and alimony obligations remain, as well as certain taxes, including back taxes owed to the IRS. Student loans are also difficult to discharge unless you can prove undue hardship.

Do I need to keep bankruptcy paperwork?

The most common types of bankruptcy are chapter 7, which are liquidating bankruptcy, and chapter 13 cases, often used by individuals who want to catch up on past due mortgage or car loan payments and keep their assets.

What happens if you forgot to list a creditor in Chapter 13?

If a debtor forgets to list a creditor on their bankruptcy papers or carelessly misstates a creditor's name or address, then the creditor will likely not be duly notified of the bankruptcy. In that situation, the debt will most likely survive the bankruptcy.

What is the 2 year rule for bankruptcy?

Determine Income Tax Dischargeability: 1. 3-Year Rule – The taxes were due at least three years before the bankruptcy filing including valid extensions. 2. 2-Year Rule – The tax return was filed at least 2 years before the filing.

How far back do bank statements go for bankruptcy?

The bankruptcy trustee typically asks for the most recent 2–3 months of bank statements, but they have the authority to request more if needed. In most Chapter 7 cases, trustees review statements from the 60–90 days before your filing date to verify your balance, income deposits, and spending patterns.

How do I get a bankruptcy letter?

It's advisable to retain your bankruptcy paperwork indefinitely. These documents serve as a permanent record of your financial history and can be essential for various future scenarios, such as applying for loans, mortgages, or even certain job applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bankruptcy Records Order Form?

The Bankruptcy Records Order Form is a document used to request access to bankruptcy records maintained by the court. These records may include documents related to filed bankruptcy cases, including petitions, schedules, and orders.

Who is required to file Bankruptcy Records Order Form?

Individuals who wish to access bankruptcy records, such as creditors, attorneys, or researchers, may be required to file the Bankruptcy Records Order Form to formally request this information.

How to fill out Bankruptcy Records Order Form?

To fill out the Bankruptcy Records Order Form, you need to provide your personal information, specify the records you are requesting, and sometimes justify your need for the information. It usually requires details about the case, such as the case number and the names of the individuals involved.

What is the purpose of Bankruptcy Records Order Form?

The purpose of the Bankruptcy Records Order Form is to facilitate the request and retrieval of bankruptcy records while ensuring that access is regulated and documented for privacy and security reasons.

What information must be reported on Bankruptcy Records Order Form?

The information that must be reported on the Bankruptcy Records Order Form typically includes the requestor's name and contact information, the case number, names of the parties involved, and the specific documents being requested.

Fill out your bankruptcy records order form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy Records Order Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

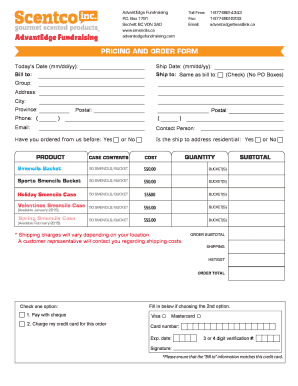

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.