MS DoR Form 80-108 2020 free printable template

Show details

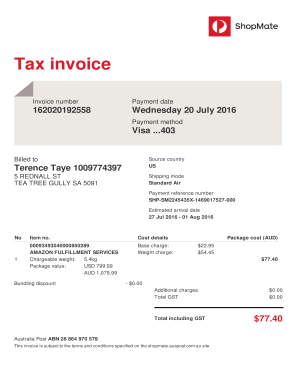

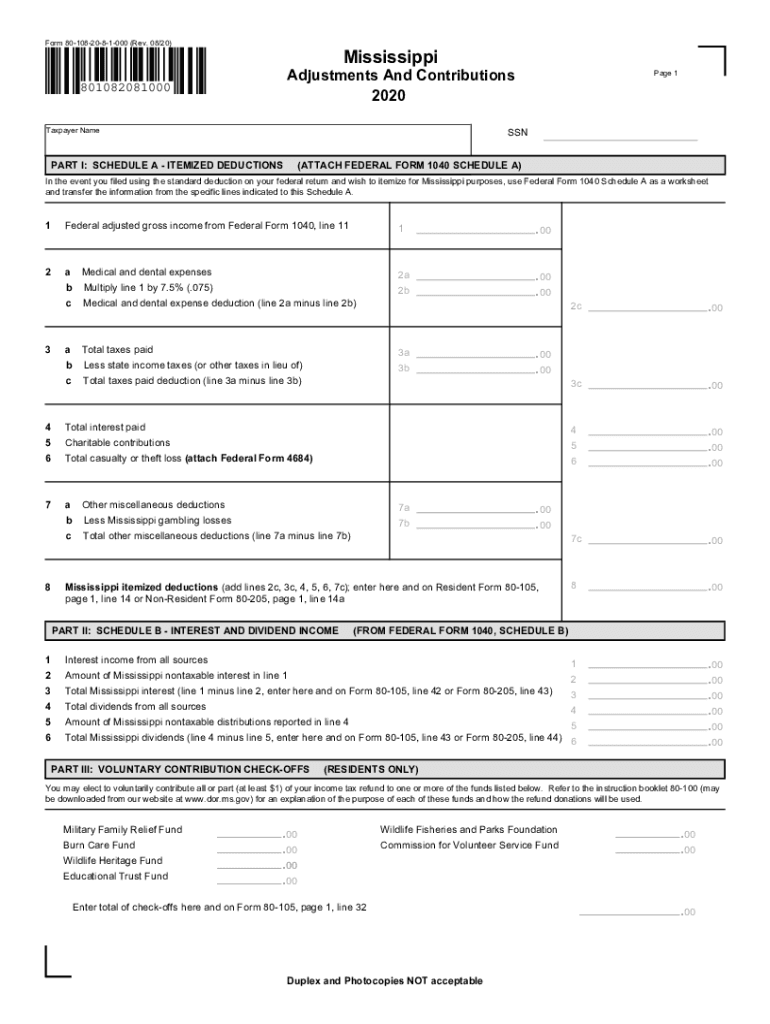

Reset Form 801082081000 (Rev. 08/20)Print FormMississippiAdjustments And Contributions 2020801082081000 Taxpayer Name Page 1SSNPART I: SCHEDULE A ITEMIZED DEDUCTIONS(ATTACH FEDERAL FORM 1040 SCHEDULE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MS DoR Form 80-108

Edit your MS DoR Form 80-108 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MS DoR Form 80-108 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MS DoR Form 80-108 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MS DoR Form 80-108. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR Form 80-108 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MS DoR Form 80-108

How to fill out MS DoR Form 80-108

01

Obtain the MS DoR Form 80-108 from the appropriate agency or their website.

02

Read the instructions carefully to understand the requirements for completing the form.

03

Fill in your personal information in the specified fields, including your name, address, and contact details.

04

Provide relevant details about the document or request you are submitting with the form.

05

Ensure all sections are completed fully and accurately, without leaving any required fields blank.

06

Review the completed form for any errors or missing information.

07

Sign and date the form where indicated.

08

Submit the form according to the provided submission guidelines, either by mail or online, if applicable.

Who needs MS DoR Form 80-108?

01

Individuals or organizations applying for a specific permit, registration, or documentation required by the agency.

02

Anyone seeking to formalize a request or provide information as stipulated by the agency's guidelines.

Fill

form

: Try Risk Free

People Also Ask about

Does Mississippi have a state tax form?

These 2021 forms and more are available: Mississippi Form 80-105 – Resident Return. Mississippi Form 80-205 – Nonresident and Part-Year Resident Return. Mississippi Form 80-108 – Adjustments and Contributions.

How do I check my refund status with IRS?

For refund information on federal tax returns other than Form 1040, U.S. Individual Income Tax Return, call, toll free, at 800-829-4933. From outside the U.S., call 267-941-1000. TTY/TDD: 800-829-4059.

How long does it take to get state tax refund in MS?

The state says it could take eight to 12 weeks. The Where's My Refund Page only allows you to check the current year's tax return.

How do I pay my MS state taxes?

Pay all or some of your Mississippi income taxes online via: Mississippi Department of Revenue. Paying your MS taxes online on time will be considered a MS tax extension and you do not have to mail in Form 80-106. Complete Form 80-106, include a Check or Money Order, and mail both to the address on Form 80-106.

What happens if you don't pay Mississippi State taxes?

Interest and Penalties Interest is calculated at 1 percent per month on any portion of a month in which the payment is past due, and continues to accrue until all taxes, penalties and interest are paid. Penalties are charged in addition to interest.

Where can I pick up IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How do I pay my state taxes in Mississippi?

Pay all or some of your Mississippi income taxes online via: Mississippi Department of Revenue. Paying your MS taxes online on time will be considered a MS tax extension and you do not have to mail in Form 80-106. Complete Form 80-106, include a Check or Money Order, and mail both to the address on Form 80-106.

Who do I call about my MS state tax refund?

Mississippi State Tax Refund Status Information You may also call the automated refund line at 601-923-7801.

Can I call to check on my tax refund?

Use Where's My Refund, call us at 800-829-1954 (toll-free) and use the automated system, or speak with a representative by calling 800-829-1040 (see telephone assistance for hours of operation). If you filed a married filing jointly return, you can't initiate a trace using the automated systems.

Do I have to pay Mississippi state taxes?

Who Pays Mississippi Tax? If you earn an income or live in Mississippi, you must pay Mississippi income taxes. As a traditional W-2 employee, your Mississippi taxes will usually be withheld and deposited from each paycheck automatically.

What app can I check my tax refund status?

IRS2Go is the official mobile app of the IRS Check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more!

How can I check my taxes online?

Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

When can I expect my refund 2022?

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MS DoR Form 80-108 directly from Gmail?

MS DoR Form 80-108 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify MS DoR Form 80-108 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including MS DoR Form 80-108, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit MS DoR Form 80-108 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as MS DoR Form 80-108. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is MS DoR Form 80-108?

MS DoR Form 80-108 is a document used for reporting and documenting certain transactions or information as required by the regulatory body to ensure compliance with the relevant laws and regulations.

Who is required to file MS DoR Form 80-108?

Entities or individuals who engage in transactions that fall under the jurisdiction of the regulatory body are required to file MS DoR Form 80-108.

How to fill out MS DoR Form 80-108?

To fill out MS DoR Form 80-108, ensure that you have all necessary documentation at hand, accurately enter the required information in the designated sections, review for completeness and accuracy, and submit the form as per the guidelines provided by the regulatory authority.

What is the purpose of MS DoR Form 80-108?

The purpose of MS DoR Form 80-108 is to collect and maintain accurate records of certain transactions to ensure compliance with regulatory obligations and facilitate oversight.

What information must be reported on MS DoR Form 80-108?

Information that must be reported on MS DoR Form 80-108 typically includes transaction details, participant information, dates, amounts, and any other relevant data required by the regulatory authority.

Fill out your MS DoR Form 80-108 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MS DoR Form 80-108 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.