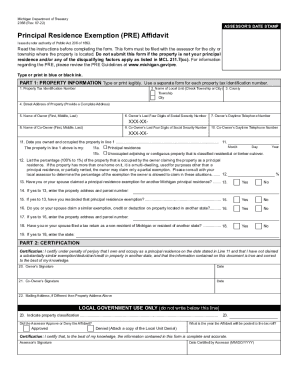

MI Form 2368 2016 free printable template

Show details

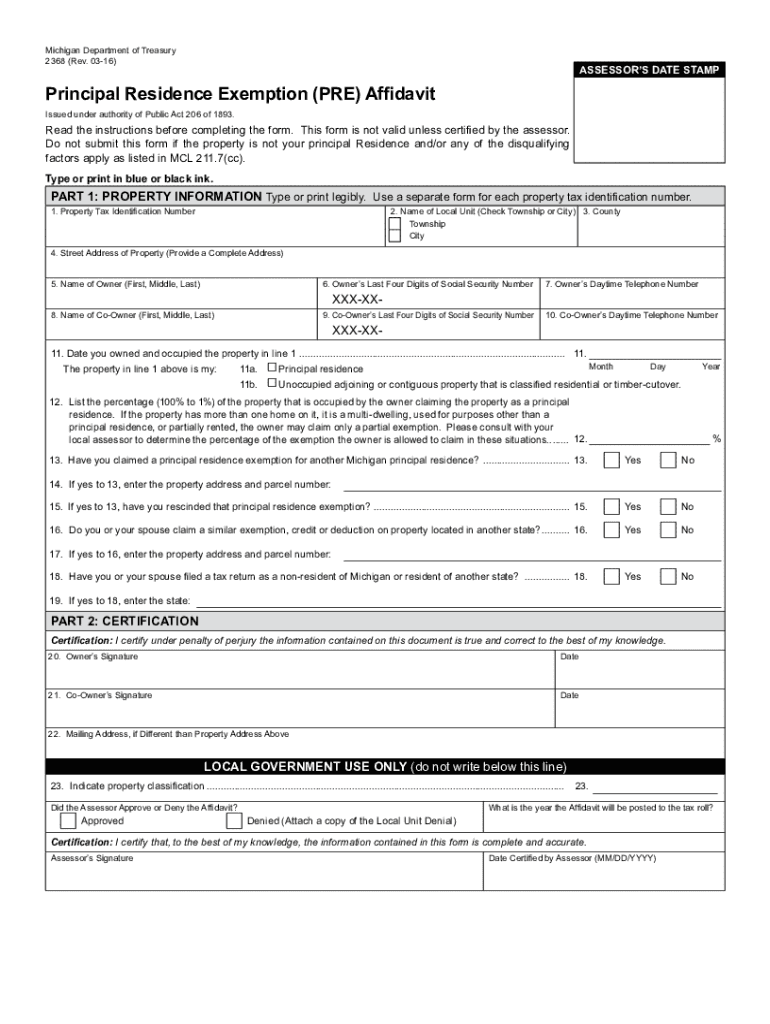

MCL 211. 7cc 3 Disqualifications An owner is ineligible to claim a PRE if any of the disqualifying factors apply listed in MCL 211. The property in line 1 above is my 11a. 11b. Month Day Unoccupied adjoining or contiguous property that is classified residential or timber-cutover. Properties that are classified residential or timber-cut over. Owners are defined in MCL 211. 7dd a. Line 6 Please list the last four digits of your Social Security Number SSN. The request for the last four digits of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Form 2368

Edit your MI Form 2368 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Form 2368 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI Form 2368 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI Form 2368. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Form 2368 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI Form 2368

How to fill out MI Form 2368

01

Gather all necessary personal information, including name, address, and contact details.

02

Provide details regarding the specific purpose for filling out MI Form 2368.

03

Complete all relevant sections of the form accurately, ensuring no fields are left blank.

04

Review the form for any errors or missing information.

05

Submit the completed form as per the provided instructions, either electronically or by mail.

Who needs MI Form 2368?

01

Individuals applying for a specific state service or benefit that requires MI Form 2368.

02

Organizations or entities that need to verify eligibility for certain programs.

03

Anyone who has been instructed to complete MI Form 2368 as part of a legal or administrative process.

Fill

form

: Try Risk Free

People Also Ask about

What is the homeowners exemption in Virginia?

Virginia homestead laws allow residents to designate up to $5,000 worth of real estate (including mobile homes) as a homestead, plus $500 for each dependent. If a resident is sixty-five years of age or older, or a married couples files for an exemption together, up to $10,000 may be exempted under the homestead laws.

What is the primary residence exclusion?

To qualify for the principal residence exclusion, you must have owned and lived in the property as your primary residence for two out of the five years immediately preceding the sale. Some exceptions apply for those who become disabled, die, or must relocate for reasons of health or work, among other situations.

What does it mean to claim as an exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

What is an exemption in Indiana?

Exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. Application for exemption must be filed before April 1 of the assessment year with the county assessor.

What is the purpose of an exemption?

Each exemption reduces the income subject to tax. The amount by which the income subject to tax is reduced for the taxpayer, spouse, and each dependent.

Who qualifies for property tax exemption in Virginia?

Owner/Applicant must be at least 65 or permanently disabled as of December 31 of the previous year. Sworn affidavits from two medical doctors licensed in Virginia or two military officers who practice medicine in the United States Armed Forces - use the Tax Relief Affidavit of Disability (PDF) for their completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MI Form 2368 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing MI Form 2368 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the MI Form 2368 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your MI Form 2368 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit MI Form 2368 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing MI Form 2368.

What is MI Form 2368?

MI Form 2368 is a tax form used in the state of Michigan for reporting certain business income and expenses.

Who is required to file MI Form 2368?

Businesses operating in Michigan that meet specific income thresholds or have particular tax obligations are required to file MI Form 2368.

How to fill out MI Form 2368?

To fill out MI Form 2368, provide accurate business information, including income generated, allowable expenses, and complete all required sections of the form as outlined in the instructions.

What is the purpose of MI Form 2368?

The purpose of MI Form 2368 is to report business income and claim related deductions, ensuring compliance with Michigan state tax laws.

What information must be reported on MI Form 2368?

The information that must be reported on MI Form 2368 includes total business income, detailed expenses, tax identification numbers, and other relevant financial data related to the business operations.

Fill out your MI Form 2368 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Form 2368 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.