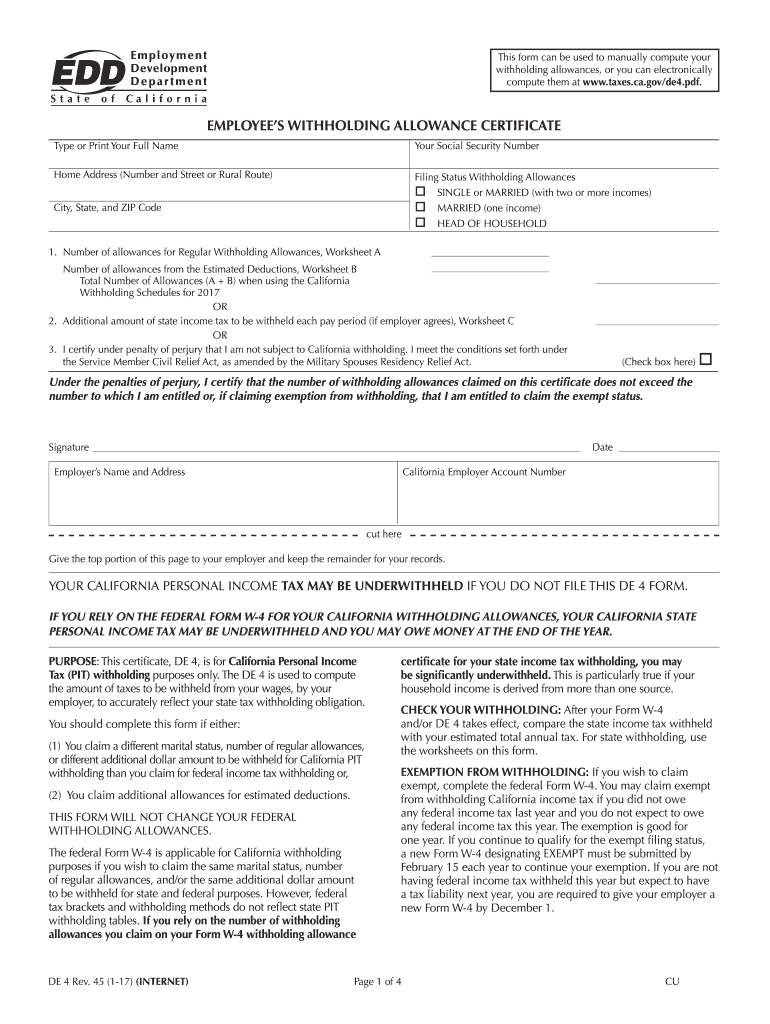

Who Needs Form DE 4?

Form DE 4 is a document commonly used by hiring managers and employers in the state of California. A person must fill out this form once they get hired.

What is Form DE 4 for?

It’s important to get Form DE filled out by each new employee. If, for some reason, an employee can’t fill out the form, an employer will have to withhold tax without exemptions. An employee should also specify their marital status case single employee’s withholding rates are usually higher than those of married people.

Instead of the Form DE 4 an employer can use Form W-4. The difference is that Form W-4 is used for federal income tax withholding purposes. However, if you decide to fill out Form W-4 you may owe money at the end of the year.

Is Form DE 4 Accompanied by Other Forms?

There are no additional documents to be attached to the form unless otherwise is required. An employee who fills out this form has to keep it for the records.

When is Form DE 4 due?

Although, there is no specific deadline for the form, an employee should complete it as soon as they get hired.

How Do I Fill out Form DE 4?

Form DE 4 consists of four pages including worksheets. On the first page enter such information:

- Name

- Address

- SSN

- Signature

Follow the instructions to calculate allowances and deductions and enter the result in the corresponding fields.

Where Do I Send Form DE 4?

Once you have completed Form DE 4, submit it to your employer.