Get the free Flexible Spending Accounts Office of Human Resources - onestop d umn

Show details

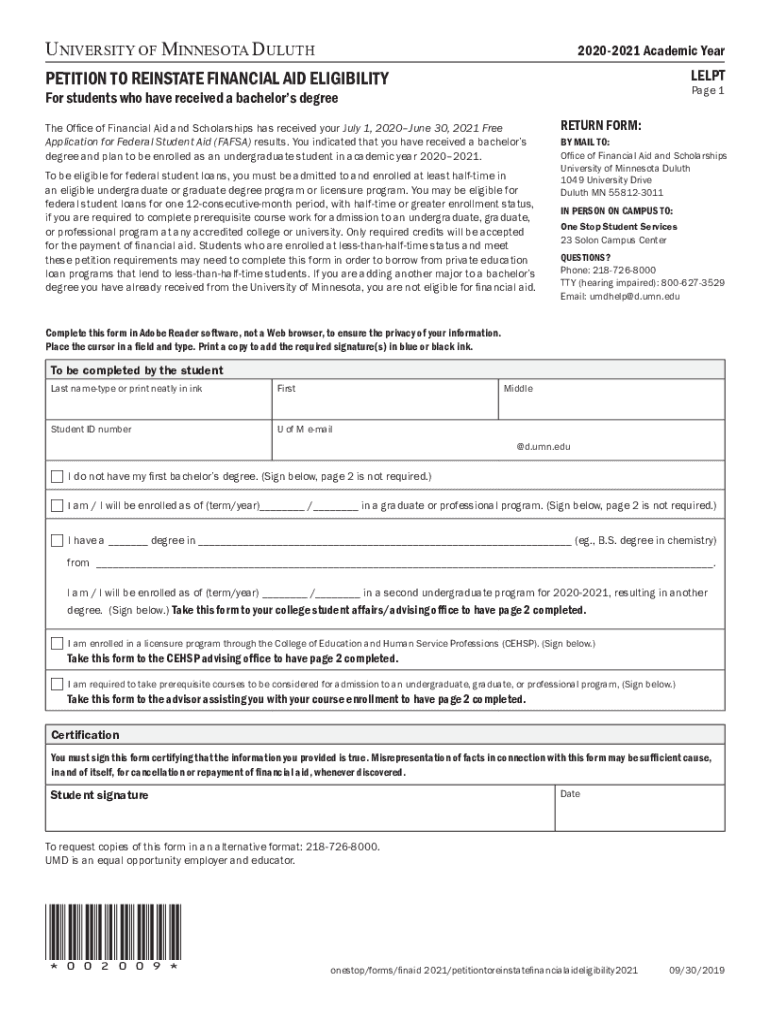

UNIVERSITY OF MINNESOTA DULUTHThis cover page includes instructions about where and how to turn in your form.

If you are submitting a form that contains personally identifiable information

(i.e. name,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible spending accounts office

Edit your flexible spending accounts office form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible spending accounts office form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flexible spending accounts office online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit flexible spending accounts office. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible spending accounts office

How to fill out flexible spending accounts office

01

Gather necessary information such as your employer's policies regarding flexible spending accounts (FSA), your expected eligible expenses, and the enrollment period for FSA.

02

Review the eligible expenses covered by FSA, which may include medical and dental expenses, prescription medications, childcare services, and dependent care expenses.

03

Determine the amount of money you want to allocate to your FSA for the year. This is important as FSA funds may only be used for eligible expenses within the allocated amount.

04

Fill out the FSA enrollment form provided by your employer. Provide accurate personal information and specify the desired contribution amount.

05

Keep track of your FSA expenses throughout the year. Save all receipts and documentation for eligible expenses as they may be required for reimbursement or verification purposes.

06

Submit reimbursement requests to your FSA administrator according to the specified procedures. This typically involves filling out a reimbursement form and attaching the necessary supporting documents.

07

Monitor your FSA balance and understanding the deadline for using funds. Some FSAs may allow a grace period or rollover of funds, while others may have a use-it-or-lose-it policy.

Who needs flexible spending accounts office?

01

Flexible spending accounts office are beneficial for individuals who anticipate out-of-pocket expenses for eligible healthcare, dependent care, or other designated expenses throughout the year.

02

Employees who have access to a flexible spending accounts office through their employer can take advantage of the pre-tax benefits offered by FSAs.

03

Individuals with regular medical, dental, or prescription medication expenses can benefit from using FSAs to save money on these expenses.

04

Parents or guardians who require childcare services or have dependent care expenses can utilize FSAs to allocate pre-tax funds towards these costs.

05

Those who want to minimize their taxable income and reduce their overall tax liability can benefit from participating in flexible spending accounts office.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the flexible spending accounts office electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your flexible spending accounts office.

Can I create an eSignature for the flexible spending accounts office in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your flexible spending accounts office right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the flexible spending accounts office form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign flexible spending accounts office and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is flexible spending accounts office?

Flexible spending accounts office is a benefit program that allows employees to contribute a portion of their pre-tax salary to an account that can be used to pay for eligible health care or dependent care expenses.

Who is required to file flexible spending accounts office?

Employees who wish to participate in a flexible spending account program are required to file paperwork with their employer's HR department.

How to fill out flexible spending accounts office?

Employees must complete the necessary forms provided by their employer, elect the amount they wish to contribute to their flexible spending account, and submit the paperwork to the HR department.

What is the purpose of flexible spending accounts office?

The purpose of flexible spending accounts office is to help employees save money on eligible health care or dependent care expenses by allowing them to contribute pre-tax dollars to an account.

What information must be reported on flexible spending accounts office?

Employees must report the amount they wish to contribute to their flexible spending account, as well as any eligible expenses they incur throughout the year.

Fill out your flexible spending accounts office online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Spending Accounts Office is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.