Get the free CONSUMER LOAN SKIP-A-PAY APPLICATION - Members ...

Show details

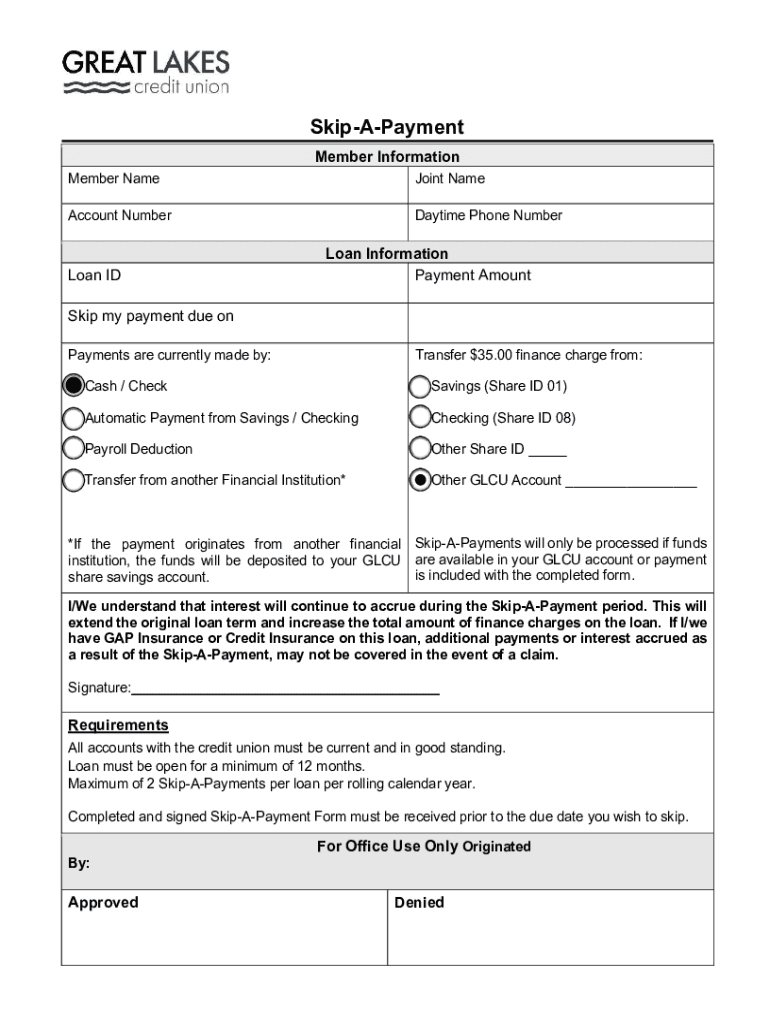

SkipAPayment Member Information Member Adjoint NameAccount NumberDaytime Phone Cumberland Loan Information Payment Amount Skip my payment due on Payments are currently made by:Transfer $35.00 finance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer loan skip-a-pay application

Edit your consumer loan skip-a-pay application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer loan skip-a-pay application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer loan skip-a-pay application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consumer loan skip-a-pay application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer loan skip-a-pay application

How to fill out consumer loan skip-a-pay application

01

To fill out a consumer loan skip-a-pay application, follow these steps:

02

Obtain a skip-a-pay application form from the lending institution. This can usually be found on their website or obtained from a customer service representative.

03

Gather all necessary information and documents. This typically includes your loan account details, personal information, and proof of financial hardship (if applicable).

04

Carefully read and understand the terms and conditions associated with the skip-a-pay program. Make sure you are aware of any fees or consequences involved.

05

Complete the application form accurately and legibly. Double-check all the information provided to avoid any errors or delays in the processing.

06

Attach any required supporting documents, such as pay stubs or proof of income, if requested.

07

Make a copy of the completed application and supporting documents for your own records.

08

Submit the application to the lending institution through the designated channel. This can be done online, through email, by mail, or in person. Follow the instructions provided by the institution.

09

Wait for the application to be processed. This may take a few days to a couple of weeks depending on the institution's procedures.

10

Once the application is approved, the lending institution will inform you about the next steps. This may include adjusting your loan repayment schedule or deferring payments for a specified period.

11

Keep track of any changes made to your loan and ensure that you resume regular payments after the skip-a-pay period ends.

12

Note: It is important to remember that skipping a payment may not be free and could result in additional interest charges or an extended loan term. Make sure to understand the implications before proceeding with a skip-a-pay application.

Who needs consumer loan skip-a-pay application?

01

Consumers who are facing temporary financial hardships or unexpected expenses may need a consumer loan skip-a-pay application.

02

Common situations where individuals may utilize a skip-a-pay program include:

03

- Loss of income due to job loss or reduced work hours

04

- Medical emergencies or unexpected medical expenses

05

- Repairing or replacing essential household appliances or vehicles

06

- Unforeseen home repairs

07

- Unexpected travel or relocation expenses

08

- Other temporary financial difficulties

09

It is crucial to review the terms and conditions of skip-a-pay programs offered by lending institutions to determine eligibility and understand the potential consequences before applying.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify consumer loan skip-a-pay application without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your consumer loan skip-a-pay application into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit consumer loan skip-a-pay application in Chrome?

consumer loan skip-a-pay application can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit consumer loan skip-a-pay application straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing consumer loan skip-a-pay application right away.

What is consumer loan skip-a-pay application?

Consumer loan skip-a-pay application is a form submitted by a borrower to request skipping a loan payment without negatively affecting their credit score.

Who is required to file consumer loan skip-a-pay application?

Borrowers who are experiencing financial difficulties and are unable to make a loan payment may be required to file a consumer loan skip-a-pay application.

How to fill out consumer loan skip-a-pay application?

To fill out a consumer loan skip-a-pay application, borrowers need to provide their personal information, loan details, reason for requesting to skip a payment, and any supporting documentation.

What is the purpose of consumer loan skip-a-pay application?

The purpose of consumer loan skip-a-pay application is to temporarily relieve borrowers from making a loan payment during a financially challenging time.

What information must be reported on consumer loan skip-a-pay application?

Information required on a consumer loan skip-a-pay application includes borrower's name, loan account number, reason for skip-a-payment request, and any additional documentation supporting the request.

Fill out your consumer loan skip-a-pay application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Loan Skip-A-Pay Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.