Get the free 2015 Delinquent Tax Sale Withdrawal Form

Show details

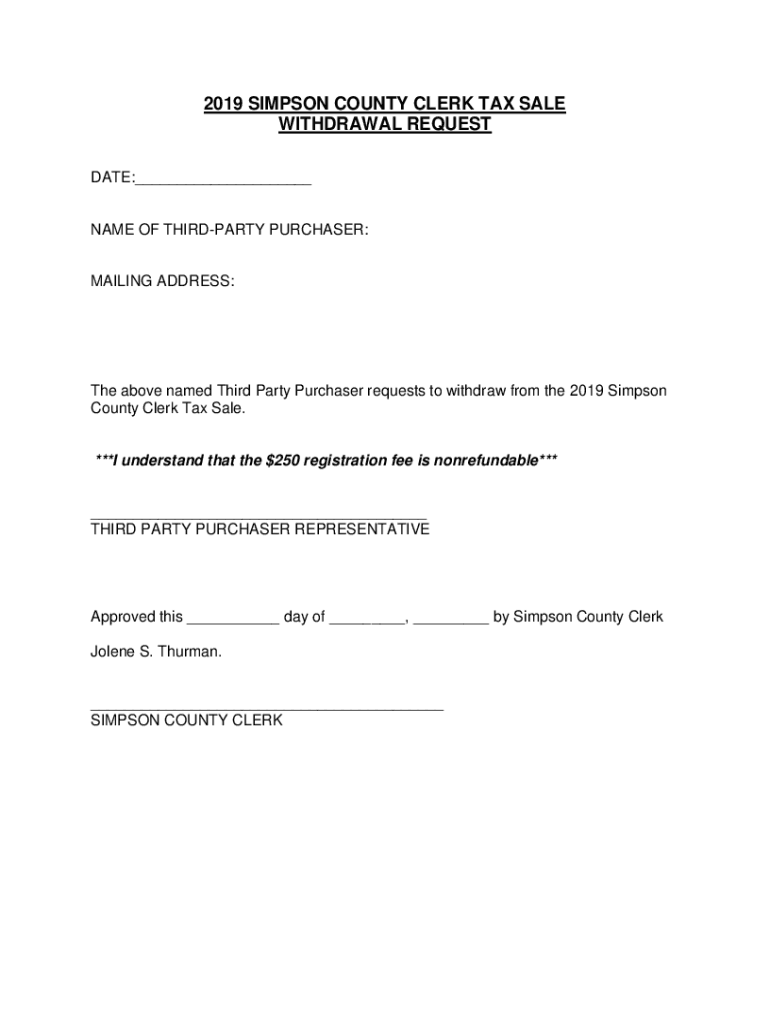

2019 SIMPSON COUNTY CLERK TAX SALE WITHDRAWAL REQUEST DATE: NAME OF THIRDPARTY PURCHASER: MAILING ADDRESS:The above named Third Party Purchaser requests to withdraw from the 2019 Simpson County Clerk

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2015 delinquent tax sale

Edit your 2015 delinquent tax sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 delinquent tax sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2015 delinquent tax sale online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2015 delinquent tax sale. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2015 delinquent tax sale

How to fill out 2015 delinquent tax sale

01

Obtain a list of properties that are part of the 2015 delinquent tax sale.

02

Review the list and identify the properties you are interested in purchasing.

03

Gather all the necessary documents and information required for the purchase, such as proof of identification and payment method.

04

Attend the scheduled delinquent tax sale auction or online bidding platform.

05

Listen carefully to the auctioneer or follow the instructions on the online platform.

06

When your desired property comes up for bidding, raise your bid paddle or enter your maximum bid online.

07

If you win the auction, follow the necessary procedures for completing the purchase, including paying the required amount within the specified time frame.

08

After completing the purchase, ensure that all required documentation is filed and recorded properly.

09

If you encounter any issues or have questions during the process, consult with legal or financial professionals for guidance.

Who needs 2015 delinquent tax sale?

01

Individuals or real estate investors who are interested in purchasing properties that have unpaid taxes from the year 2015 may need the 2015 delinquent tax sale. This could include anyone looking for potential real estate investment opportunities or individuals interested in potentially acquiring properties at a lower cost. Additionally, local government authorities may also need to conduct the delinquent tax sale in order to recover unpaid taxes from property owners.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2015 delinquent tax sale to be eSigned by others?

2015 delinquent tax sale is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the 2015 delinquent tax sale in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 2015 delinquent tax sale in minutes.

Can I create an electronic signature for signing my 2015 delinquent tax sale in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 2015 delinquent tax sale directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is delinquent tax sale withdrawal?

Delinquent tax sale withdrawal is the process of canceling a tax sale on a property that is in default of paying property taxes.

Who is required to file delinquent tax sale withdrawal?

The property owner or the person responsible for paying the property taxes is required to file delinquent tax sale withdrawal.

How to fill out delinquent tax sale withdrawal?

Delinquent tax sale withdrawal forms can be obtained from the local tax assessor's office and must be completed with the necessary information regarding the property and the tax sale.

What is the purpose of delinquent tax sale withdrawal?

The purpose of delinquent tax sale withdrawal is to remove the property from the list of properties eligible for tax sale and to prevent the property from being sold at auction.

What information must be reported on delinquent tax sale withdrawal?

The delinquent tax sale withdrawal form typically requires information such as the property owner's name, property address, tax map and lot number, and the reason for the withdrawal.

Fill out your 2015 delinquent tax sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015 Delinquent Tax Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.