Get the free Spouse Super Contributions - The Tax Offset ...Spouse Super Contributions - The Tax ...

Show details

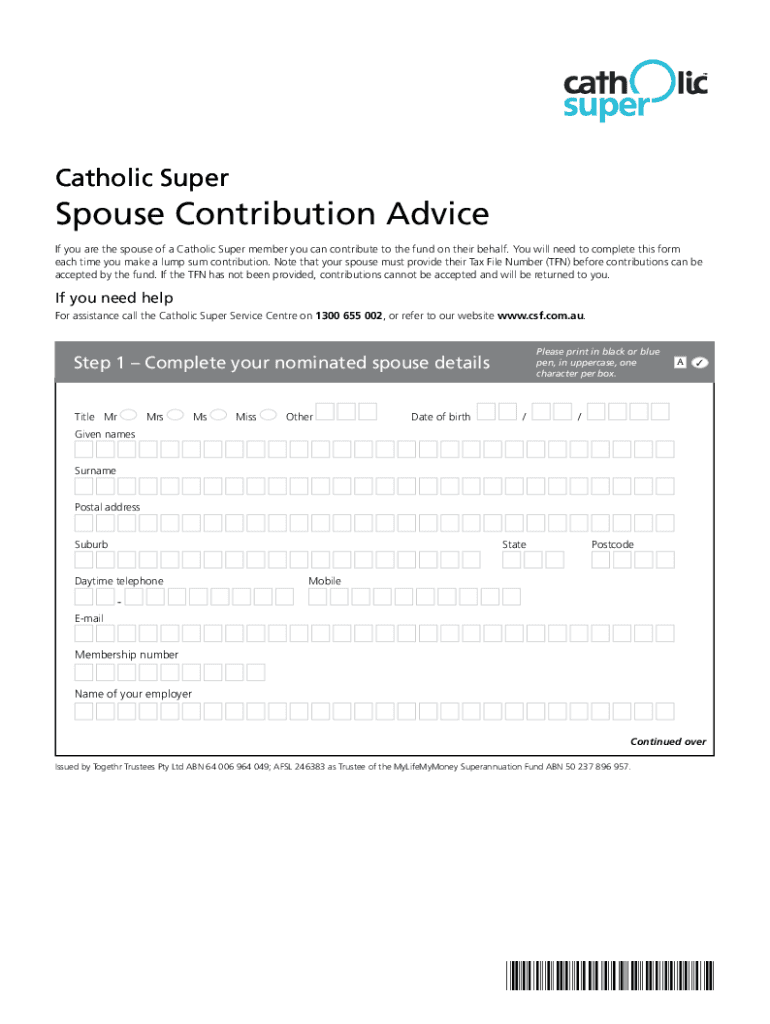

Catholic Superpose Contribution Advice

If you are the spouse of a Catholic Super member you can contribute to the fund on their behalf. You will need to complete this form

each time you make a lump

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign spouse super contributions

Edit your spouse super contributions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your spouse super contributions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing spouse super contributions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit spouse super contributions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out spouse super contributions

How to fill out spouse super contributions

01

To fill out spouse super contributions, follow these steps:

02

Identify your eligibility: Make sure you meet the eligibility criteria to make spouse super contributions. Generally, you need to be making contributions on behalf of your spouse who is earning a low income or not working.

03

Determine the maximum contribution: Check the maximum amount you can contribute on behalf of your spouse. This limit may vary based on your spouse's income.

04

Fill out the contribution form: Obtain the spouse super contribution form from your superannuation fund and complete it accurately. Provide the required details, including your spouse's name, date of birth, and other pertinent information.

05

Submit the form: Send the completed form to your superannuation fund along with any necessary supporting documentation or identification.

06

Track and confirm: Keep track of your spouse super contributions and ensure they are processed correctly by contacting your superannuation fund or checking your account statements.

07

Seek professional advice: If you are unsure about any aspect of filling out spouse super contributions, consider consulting a financial advisor or contacting your superannuation fund for assistance.

Who needs spouse super contributions?

01

Spouse super contributions are beneficial for individuals whose spouse has a low income or is not working. Some individuals who may benefit from spouse super contributions include:

02

- Individuals with a partner who takes time off from work to raise children or care for family members.

03

- Individuals with a partner who is studying or unable to work due to disabilities or health conditions.

04

- Individuals who want to help boost their spouse's retirement savings and provide them with financial support in the long term.

05

- Individuals who want to take advantage of potential tax benefits associated with spouse super contributions.

06

It is important to assess your personal circumstances and consult with a financial advisor to determine if making spouse super contributions is suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit spouse super contributions from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your spouse super contributions into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send spouse super contributions for eSignature?

Once your spouse super contributions is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit spouse super contributions on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing spouse super contributions, you need to install and log in to the app.

What is spouse super contributions?

Spouse super contributions are additional contributions made by a person's spouse into their superannuation fund.

Who is required to file spouse super contributions?

Spouse super contributions must be declared by the individual receiving the contributions.

How to fill out spouse super contributions?

Spouse super contributions can be completed by providing the necessary information on the individual's tax return form.

What is the purpose of spouse super contributions?

The purpose of spouse super contributions is to boost the superannuation savings of a person's spouse.

What information must be reported on spouse super contributions?

The amount of contributions made by the spouse and relevant details such as the spouse's name and tax file number must be reported.

Fill out your spouse super contributions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Spouse Super Contributions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.