Get the free FAQs about Retirement Plans and ERISA - DOL

Show details

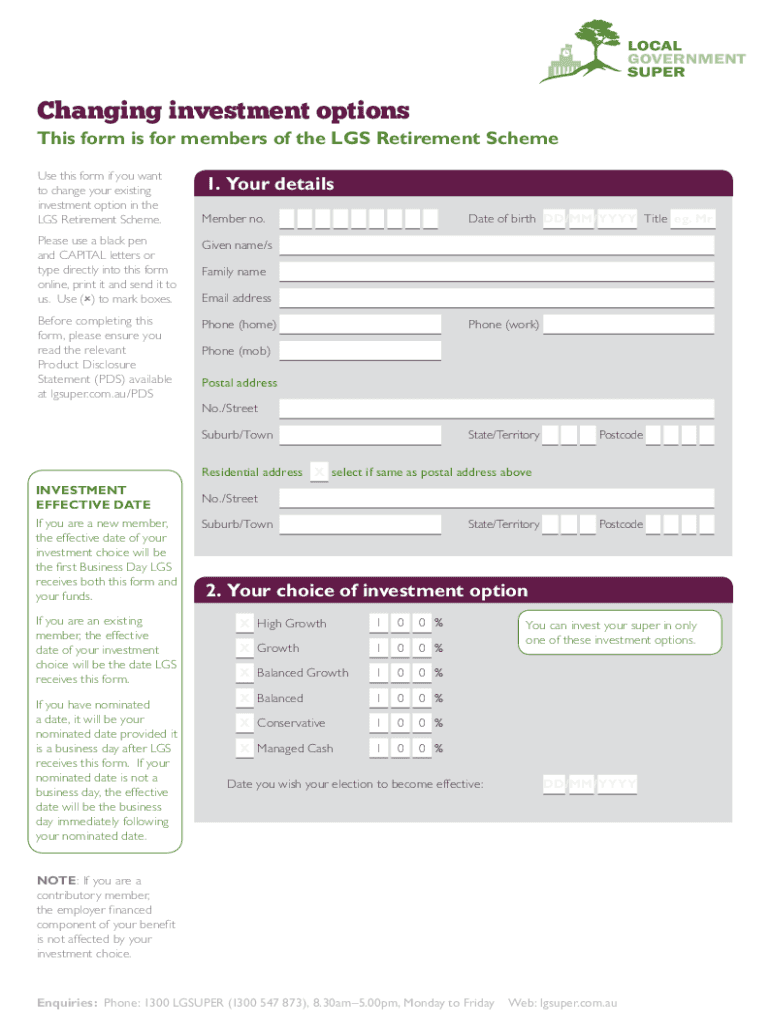

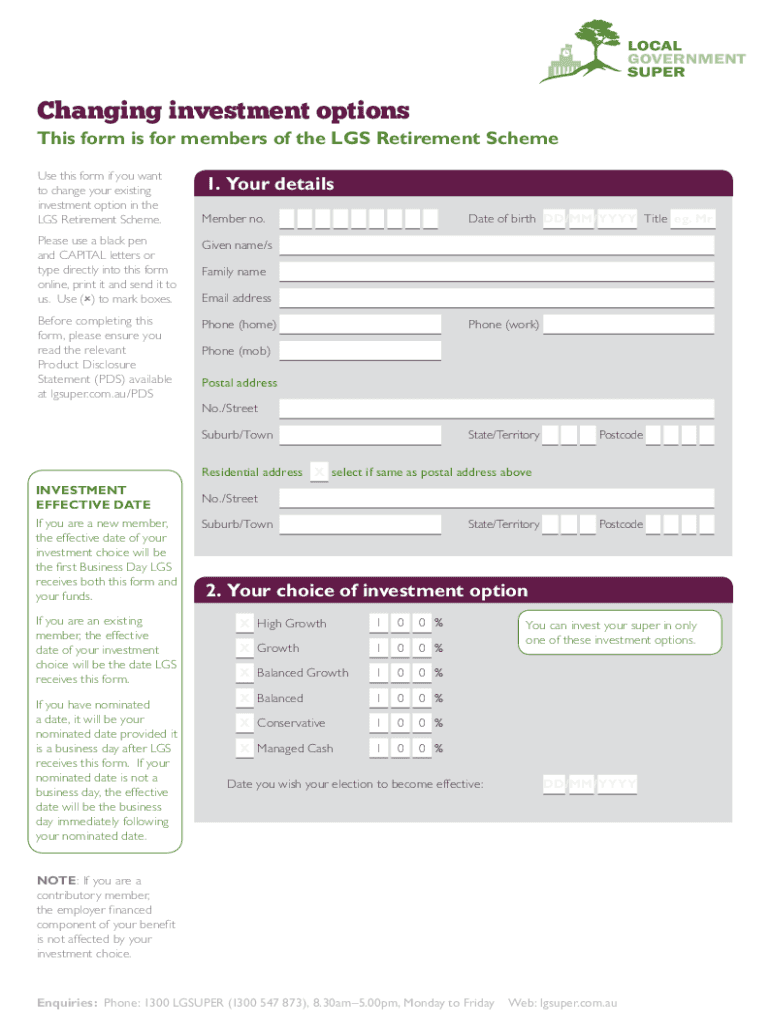

Changing investment optionsThis form is for members of the LGS Retirement Scheme

Use this form if you want

to change your existing

investment option in the

LGS Retirement Scheme.1. Your details

Member

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign faqs about retirement plans

Edit your faqs about retirement plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your faqs about retirement plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit faqs about retirement plans online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit faqs about retirement plans. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out faqs about retirement plans

How to fill out faqs about retirement plans

01

Start by organizing the information: before filling out the FAQs about retirement plans, gather all the relevant information and documents related to retirement plans including plan details, eligibility criteria, contribution options, withdrawal rules, etc.

02

Identify the most common questions: think about what questions individuals frequently have about retirement plans and make a list of these questions. This will help you prioritize the most important information to include in the FAQs.

03

Provide clear and concise answers: when writing the answers to the FAQs, ensure they are easy to understand and provide accurate information. Use simple language and avoid jargon to make it accessible to a wider audience.

04

Use a question-and-answer format: present the FAQs in a question-and-answer format to make it easier for readers to find specific information. This format also allows for quick scanning of the FAQs.

05

Include relevant links or references: if there are any external resources or documents that can provide more comprehensive information on specific topics, include them as references or provide hyperlinks for readers to access additional details.

06

Update regularly: retirement plans and regulations might change over time, so it's important to review and update the FAQs regularly to ensure they remain accurate and up to date.

07

Format and structure: pay attention to the formatting and structure of the FAQs. Use headings, bullet points, and paragraph breaks to make the FAQs visually appealing and easy to read.

08

Seek feedback: after you have filled out the FAQs, consider getting feedback from colleagues, experts, or potential users. This will help you identify any gaps or areas for improvement.

Who needs faqs about retirement plans?

01

Employees: Individuals who are employed and have access to a retirement plan through their employers may benefit from FAQs about retirement plans. They can seek answers to common questions regarding eligibility, contribution options, vesting, and withdrawal rules.

02

Retirees: Individuals who have already retired and are receiving retirement benefits may have questions about managing their retirement plans, tax implications, or making additional contributions in retirement.

03

Individuals planning for retirement: People who are planning for retirement can benefit from FAQs about retirement plans to gain a better understanding of how retirement plans work, explore different plan options, and learn about strategies to maximize their retirement savings.

04

Human Resources or Benefits Administrators: Professionals responsible for managing retirement plans within an organization may use FAQs as a resource to assist employees or provide guidance on retirement plan-related inquiries.

05

Financial Advisors or Consultants: Financial professionals who advise clients on retirement planning may utilize FAQs about retirement plans to enhance their knowledge, address common client questions, and provide valuable information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find faqs about retirement plans?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the faqs about retirement plans in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit faqs about retirement plans on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit faqs about retirement plans.

How can I fill out faqs about retirement plans on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your faqs about retirement plans, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is faqs about retirement plans?

FAQs about retirement plans are commonly asked questions and answers regarding retirement plans, covering topics such as contribution limits, eligibility requirements, investment options, and distribution rules.

Who is required to file faqs about retirement plans?

Employers and plan administrators are typically required to provide FAQs about retirement plans to employees and participants.

How to fill out faqs about retirement plans?

FAQs about retirement plans can be filled out by including commonly asked questions and providing clear and concise answers. It is important to ensure the information is accurate and up-to-date.

What is the purpose of faqs about retirement plans?

The purpose of FAQs about retirement plans is to provide participants with important information about their retirement benefits, helping them make informed decisions about saving and investing for retirement.

What information must be reported on faqs about retirement plans?

Information that must be reported on FAQs about retirement plans may include plan rules, contribution limits, vesting schedules, investment options, and distribution rules.

Fill out your faqs about retirement plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Faqs About Retirement Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.