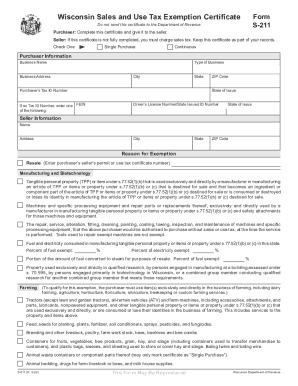

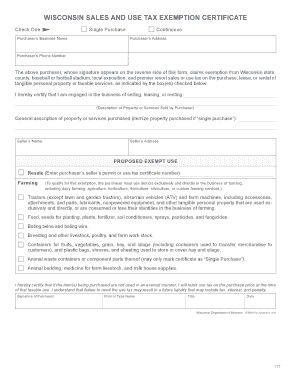

WI DoR S-211 2012 free printable template

Get, Create, Make and Sign WI DoR S-211

How to edit WI DoR S-211 online

Uncompromising security for your PDF editing and eSignature needs

WI DoR S-211 Form Versions

How to fill out WI DoR S-211

How to fill out WI DoR S-211

Who needs WI DoR S-211?

Instructions and Help about WI DoR S-211

The NASCAR Sprint Cup Series was on track at Balladeer Super speedway a little early due to impending rain, but the green flag flew in pole sitter chase Elliott leads the field to green in the GEICO 500 the yellow flag flew on lap 49 as Dale jr. gets loose and collects the 5 of Kasey Kane and Matt Benedetto the incident looked identical to the accident that took Dale out of the Daytona 500 and the car that Dale jr. won this race in last year the one that he named Amelia would be taken behind the wall along with the 5 car under that caution the highly anticipated driver swap between Tony Stewart and Ty Dillon took place smoke hopped out of the car thank you, Dillon jumped in and the 14 team hooked all of those hoses and tightened his belts and Ty Dillon would rejoin the race in 33rd place 59 laps in Martin True Jr gets into the back of his former owner Michael Walt rip gets shoved down onto the apron of the racetrack he comes back up and collects the 13 of Kasey Mares ARIC admiral also goes for a spin, but Walt rip ends up collecting his car keeps it off of the wall Mares however would suffer damage and would have to go behind the wall through the paint just past halfway the yellow comes out when Austin Dillon gets into the wall watch Jimmie Johnson go around here the 34 car flips down the backstretch luckily all the safety equipment does its job and the rookie was able to climb out of the car under his own power on lap 110 Dale Earnhardt jr. 'He's bad day gets worse Carl Edwards has a problem on the right front and jr. was in the wrong place at the wrong time both cars were destroyed in the accident, but both drivers walked way and were checked and released from the infield care center after the race restarted it was discovered that Dale Earnhardt wheel came off earlier in the race take a look at the end car camera here as he gets the wheel back on and continues in the race before that lap 110 crash took him out lap 160 we see the big one when Jimmie Johnson gets turned into the wall he goes off the nose of Kurt Busch's car, but several good cars get caught up in the aftermath including Martin True Jr Paul Menard Ryan Alana Ricky Steakhouse and many more fast-forward 21 laps, and we saw the big one part two Michael McDowell gets into the back of Danica Patrick she Clips Matt Kenneth goes airborne slides on the roof of that car he did get back on his wheels luckily all drivers walked away from the accident, but several good cars were taken out including Joey Logan and Kevin Warwick got a little piece of that action during that wreck on the final restart Brad Keselowski jumps out in front of the 2 he holds off the field to get the win as they crash behind him coming to the checkered flag the 2 car earns its second win of the year in the GEICO 500 for NASCAR calm I'm Jonathan Mary me.

People Also Ask about

What is a Wisconsin sales and use tax exemption Certificate S 211E?

What sales are exempt from sales tax in Wisconsin?

What is WI manufacturing sales tax exemption?

How do I get a Wisconsin resale certificate?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WI DoR S-211 in Gmail?

How can I get WI DoR S-211?

Can I edit WI DoR S-211 on an iOS device?

What is WI DoR S-211?

Who is required to file WI DoR S-211?

How to fill out WI DoR S-211?

What is the purpose of WI DoR S-211?

What information must be reported on WI DoR S-211?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.