Get the free Client Relationship Summary Disclosure Form. 00208430.DOCX

Show details

CLIENT RELATIONSHIP SUMMARY

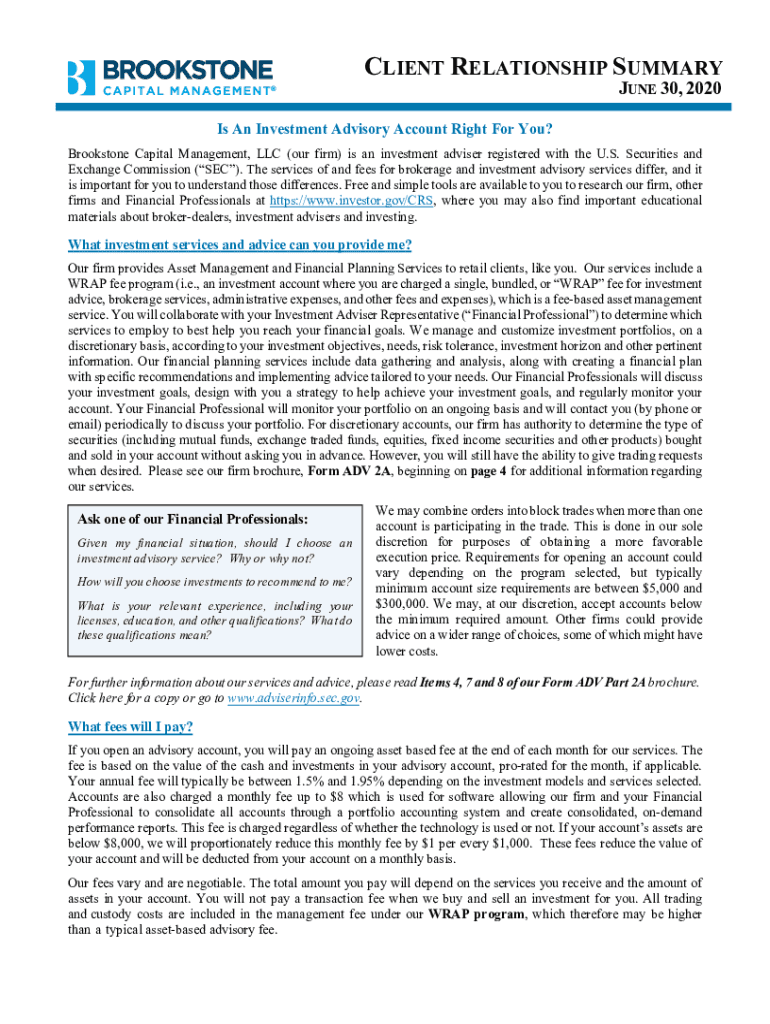

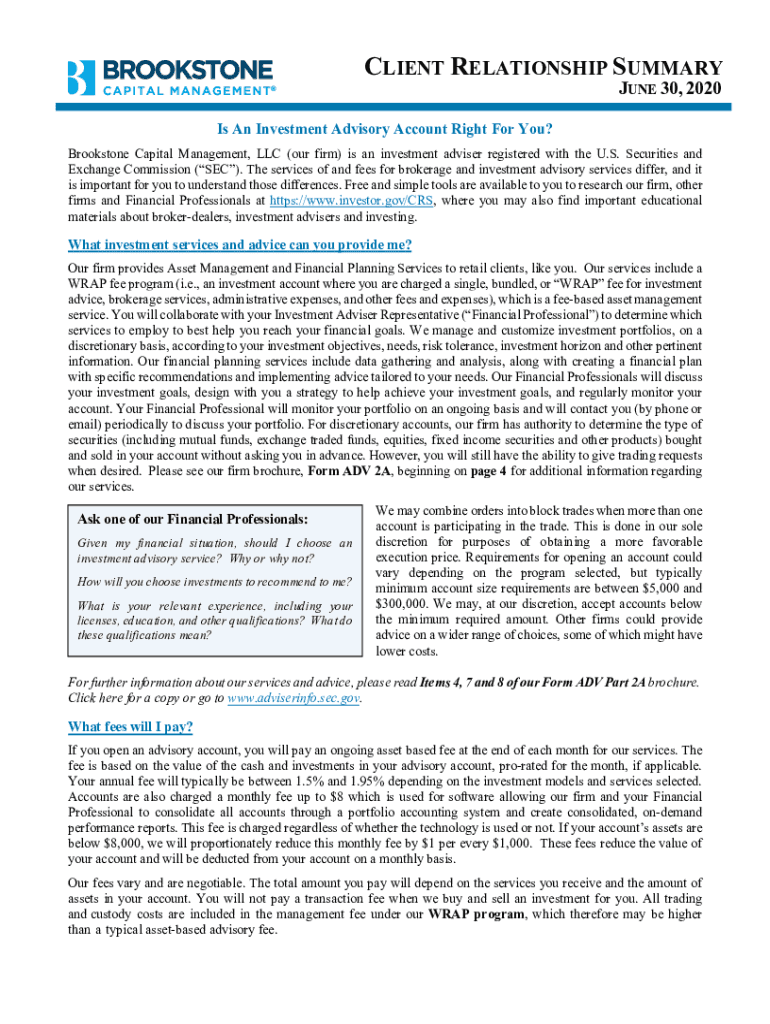

JUNE 30, 2020Is An Investment Advisory Account Right For You?

Brook stone Capital Management, LLC (our firm) is an investment adviser registered with the U.S. Securities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign client relationship summary disclosure

Edit your client relationship summary disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your client relationship summary disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit client relationship summary disclosure online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit client relationship summary disclosure. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out client relationship summary disclosure

How to fill out client relationship summary disclosure

01

To fill out the client relationship summary disclosure, follow these steps:

02

Start by including the name and contact information of your firm, including its website address.

03

Provide a summary of your firm's services and fees. This should include information about the types of services you offer and the corresponding fees or charges for each service.

04

Explain the standard of conduct your firm follows. This may include details about whether your firm is a fiduciary or follows a suitability standard.

05

Discuss any disciplinary history your firm may have. If there have been any legal or disciplinary events that are material to a client's evaluation of your firm or its representatives, you should disclose them.

06

Describe potential conflicts of interest. This should include any financial incentives or affiliations that could compromise your firm's objectivity in providing services to clients.

07

Provide information about the ways clients can access your firm's research and make investments through your firm.

08

Explain whether there are any minimum account sizes or minimum investment amounts required by your firm.

09

Discuss the types of clients that your firm generally services. This may include information about the types of individuals or entities that your firm typically works with.

10

Provide contact information for clients who have questions or concerns about their relationship with your firm. This should include the name and phone number or email address of a representative that clients can reach out to.

11

Finally, make sure to include the date of the disclosure document and any required signatures at the end.

Who needs client relationship summary disclosure?

01

Client relationship summary disclosure is necessary for financial advisory firms who are registered with the U.S. Securities and Exchange Commission (SEC) or state securities regulators.

02

These firms are required to provide the client relationship summary disclosure to both new and existing clients.

03

It is important for clients to receive this disclosure to understand important information about the firm's services, fees, conflicts of interest, and disciplinary history.

04

The purpose of this disclosure is to help clients make informed decisions when choosing a financial advisor and to ensure transparency in the client-advisor relationship.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify client relationship summary disclosure without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your client relationship summary disclosure into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send client relationship summary disclosure for eSignature?

Once your client relationship summary disclosure is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I fill out client relationship summary disclosure on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your client relationship summary disclosure. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is client relationship summary disclosure?

Client relationship summary disclosure is a document that provides clients with essential information about the services offered by financial advisors, including potential conflicts of interest, fees, and the nature of the relationship.

Who is required to file client relationship summary disclosure?

Registered investment advisers and broker-dealers are required to file client relationship summary disclosures with the Securities and Exchange Commission (SEC) and provide them to their clients.

How to fill out client relationship summary disclosure?

To fill out a client relationship summary disclosure, firms must provide accurate and clear information about their services, fees, investment strategies, risks, disciplinary history, and any conflicts of interest in a standardized format.

What is the purpose of client relationship summary disclosure?

The purpose of client relationship summary disclosure is to enhance transparency and help clients make informed decisions regarding their investments and the financial professionals they choose to work with.

What information must be reported on client relationship summary disclosure?

Required information includes the firm's fees, investment offerings, services, the disciplinary history of brokers, conflicts of interest, and how clients can reach the firm with questions.

Fill out your client relationship summary disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Client Relationship Summary Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.