Get the free The Small-Business Paycheck Loan Program Is Coming to an ...

Show details

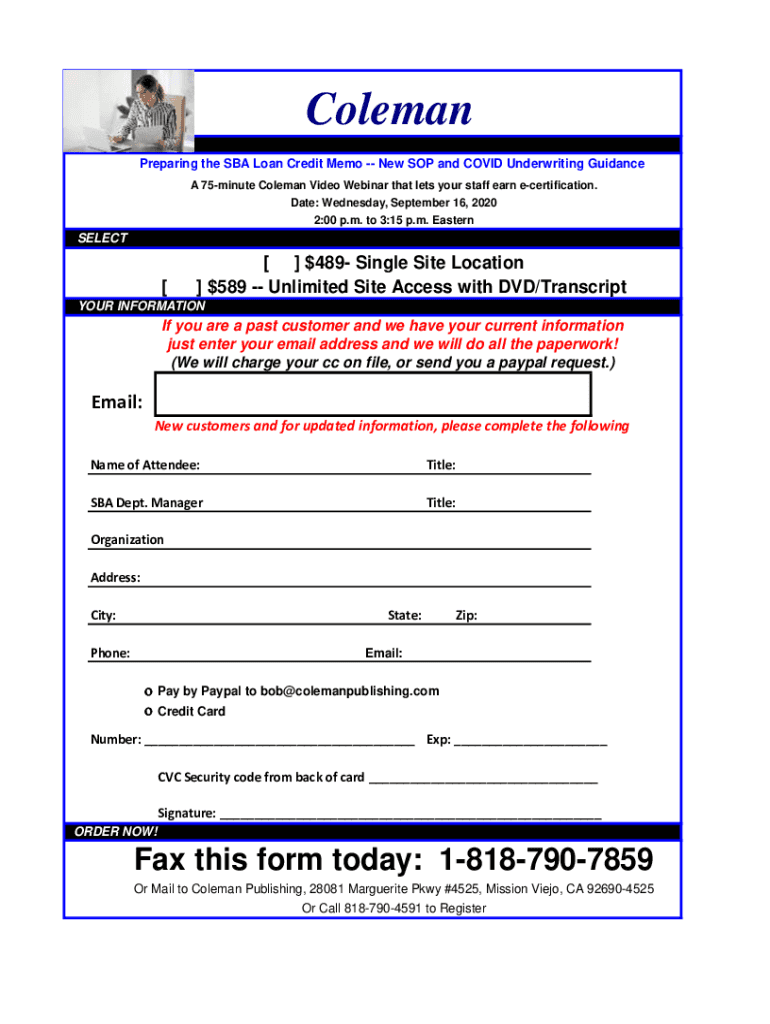

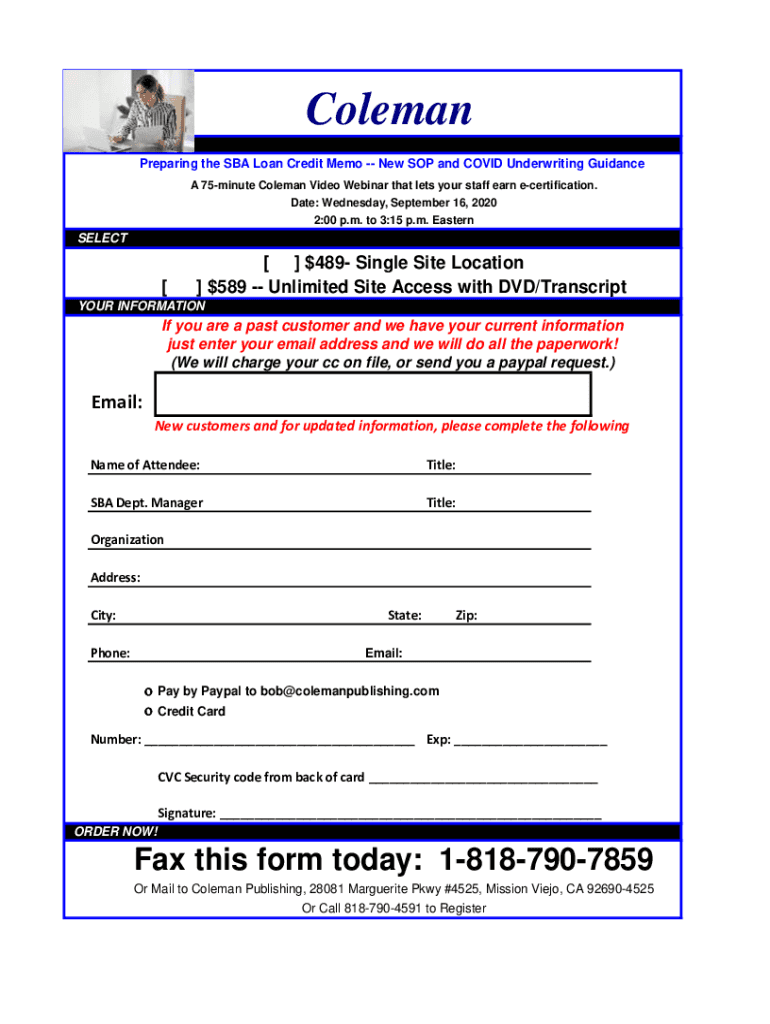

Coleman Preparing the SBA Loan Credit Memo New SOP and COVID-19 Underwriting Guidance A 75minute Coleman Video Webinar that lets your staff earn certification. Date: Wednesday, September 16, 2020

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form small-business paycheck loan

Edit your form small-business paycheck loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form small-business paycheck loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form small-business paycheck loan online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form small-business paycheck loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form small-business paycheck loan

How to fill out form small-business paycheck loan

01

Start by gathering all the necessary information and documents required to fill out the form. This may include your business tax ID, payroll records, bank statements, and financial statements.

02

Read and understand the instructions provided with the form. Pay attention to any specific requirements or additional documentation that may be needed.

03

Begin by providing your basic business information such as your legal name, address, and contact details.

04

Fill in the sections related to your business's payroll information, such as the number of employees, their names, positions, salaries, and hours worked.

05

Provide all the required financial information, including your business's revenue, expenses, and any outstanding debts.

06

Review your completed form to ensure accuracy and completeness. Make sure to double-check all the provided information before submitting the form.

07

Submit the filled-out form according to the specified instructions. This may involve mailing a physical copy or submitting it electronically through a designated portal.

08

Keep a copy of the form and any supporting documents for your records.

09

Follow up with the loan administering authority to track the progress of your application and address any questions or concerns that may arise during the review process.

10

If approved, make sure to adhere to any terms and conditions associated with the loan, such as using the funds for eligible payroll expenses and providing necessary reporting as requested.

Who needs form small-business paycheck loan?

01

Small businesses that are experiencing financial difficulties or disruptions due to unforeseen circumstances, such as the COVID-19 pandemic, may need to fill out a small-business paycheck loan form.

02

Companies that need financial support to maintain their workforce, cover payroll expenses, or meet other ongoing operational needs may find the small-business paycheck loan program beneficial.

03

Businesses that have suffered a significant reduction in revenue or faced challenges in meeting financial obligations due to economic uncertainties may also be eligible for the small-business paycheck loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form small-business paycheck loan?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your form small-business paycheck loan to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit form small-business paycheck loan on an Android device?

You can make any changes to PDF files, such as form small-business paycheck loan, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete form small-business paycheck loan on an Android device?

On Android, use the pdfFiller mobile app to finish your form small-business paycheck loan. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is form small-business paycheck loan?

Form small-business paycheck loan is a loan program designed to help small businesses cover payroll and other expenses during the COVID-19 pandemic.

Who is required to file form small-business paycheck loan?

Small business owners who have employees and are experiencing financial hardship due to the COVID-19 pandemic are required to file form small-business paycheck loan.

How to fill out form small-business paycheck loan?

Form small-business paycheck loan can be filled out online through the Small Business Administration's website or through an approved lender.

What is the purpose of form small-business paycheck loan?

The purpose of form small-business paycheck loan is to provide financial assistance to small businesses to help them retain employees and cover essential expenses during the COVID-19 pandemic.

What information must be reported on form small-business paycheck loan?

Information such as business name, address, number of employees, payroll costs, and other financial information must be reported on form small-business paycheck loan.

Fill out your form small-business paycheck loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Small-Business Paycheck Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.