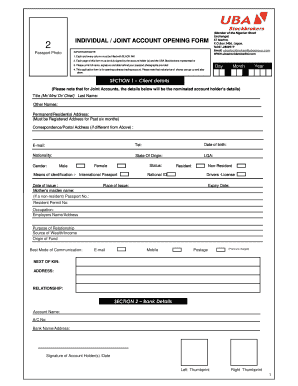

Get the free business account application form

Show details

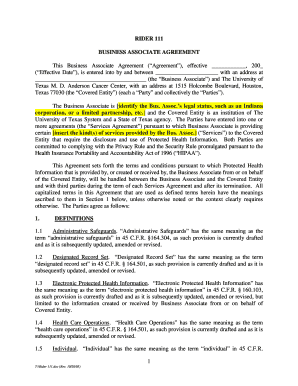

New account opening form BUSINESS OR ASSOCIATION Inquiry CODE: BUSINESS NOTE: Please provide a completed form to one of our bankers with your business documents at any of our banking centers. Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business account application form

Edit your business account application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business account application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business account application form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business account application form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

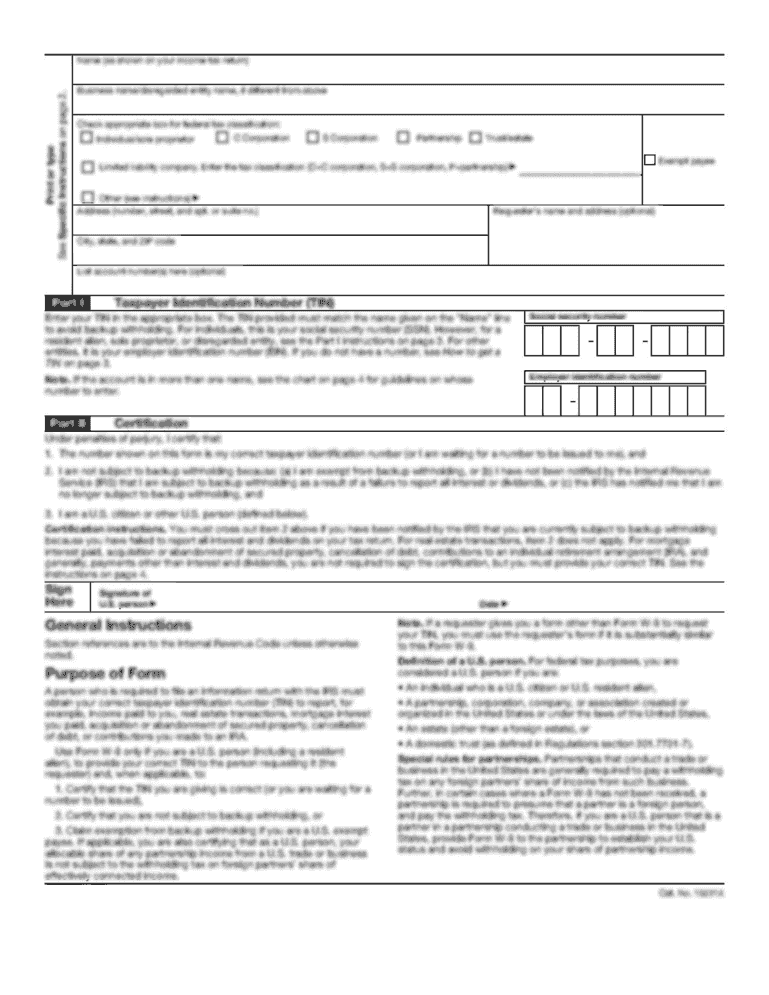

How to fill out business account application form

How to fill out Jefferson Bank B6010

01

Obtain the Jefferson Bank B6010 form from their website or branch.

02

Fill out the date at the top of the form.

03

Enter your personal information, including your name, address, and contact details.

04

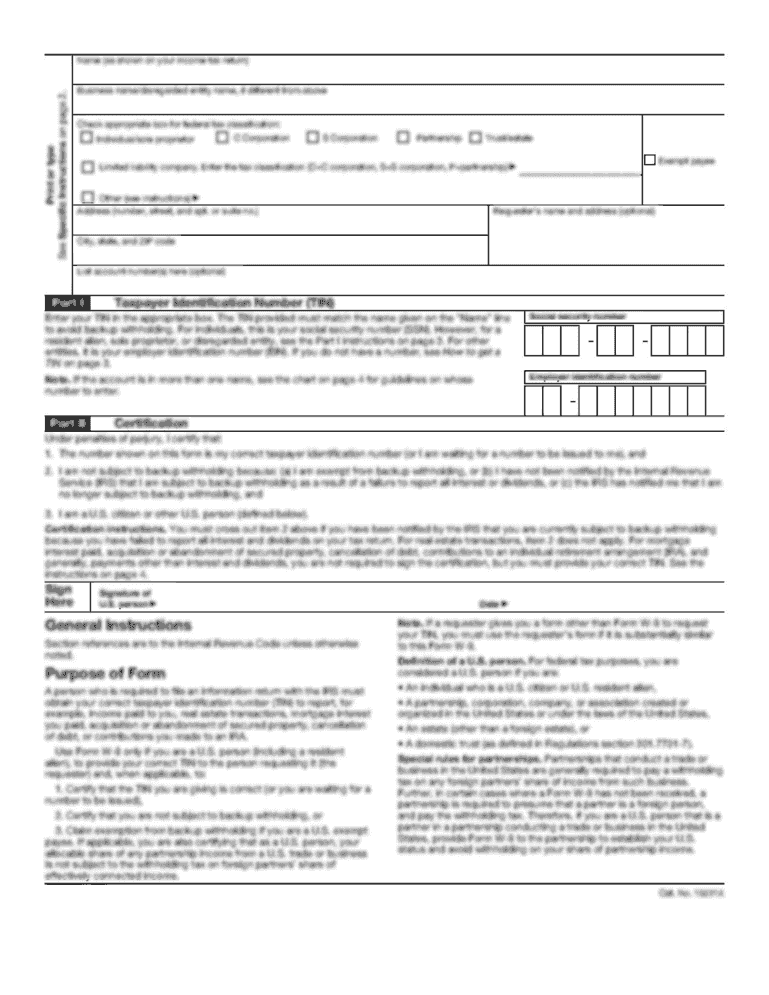

Provide your Social Security number or Tax Identification Number.

05

Input information regarding your employment and income.

06

Detail any assets you may have, including bank accounts and property.

07

If applicable, disclose any liabilities, such as loans or credit card debt.

08

Review all entered information for accuracy.

09

Sign and date the form at the bottom.

10

Submit the completed form to the bank either in person or online.

Who needs Jefferson Bank B6010?

01

Individuals seeking a loan or credit from Jefferson Bank.

02

Customers wanting to establish a banking relationship with Jefferson Bank.

03

Those applying for financial assistance or services offered by Jefferson Bank.

Fill

form

: Try Risk Free

People Also Ask about

What is the benefits of business account?

It can keep you legally compliant, provide some financial security and help you appear more professional to customers and vendors. Plus, having one account for the sole purpose of collecting from customers and paying your vendors makes it easier to log transactions and manage your business.

What is a business account?

A business bank account is a bank account that's used only for business transactions rather than personal finances. It can be opened in the name of the business, allowing payments to be made and received using the business's name. Business bank accounts operate in a similar manner to personal bank accounts.

What is the difference between a business account and a regular account?

A business bank account allows you to carry out almost all the same transactions as a personal account (deposits, withdrawals, transfers, line of credit, etc.), but since it is in the name of the business, it can have several signatories.

What is an account application form?

Account Opening Application Form means the application form/questionnaire completed by the Client in order to apply for the Company's Services under this Agreement and a Client Account, via which form/questionnaire the Company will obtain amongst other things information for the Client's identification and due

How does business account work?

Business bank accounts work just like personal checking and savings accounts, but they are specifically designed for you to use for business transactions. You can connect your checking account to your online payment system so that when clients pay you or make a purchase, the funds get deposited into your bank account.

What does business account mean?

A business account is a bank account for a small business. Like your personal bank account, these accounts allow companies to pay bills, purchase assets and inventory, and save for an emergency expense.

How do I open a business account?

Collect the required Know Your Customer (KYC) documents that are required for opening the account. The bank will process the account opening formalities and open the start-up Business Account. Once the Business Account is opened, the start-up can take benefit of the other facilities offered by the bank.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute business account application form online?

pdfFiller has made it easy to fill out and sign business account application form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in business account application form without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your business account application form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my business account application form in Gmail?

Create your eSignature using pdfFiller and then eSign your business account application form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is Jefferson Bank B6010?

Jefferson Bank B6010 is a specific form or report used by Jefferson Bank for regulatory or internal accounting purposes.

Who is required to file Jefferson Bank B6010?

Typically, businesses or individuals who have transactions or accounts with Jefferson Bank that meet certain thresholds may be required to file Jefferson Bank B6010.

How to fill out Jefferson Bank B6010?

To fill out Jefferson Bank B6010, you would need to provide required information such as account details, transaction amounts, and any other relevant data specified on the form.

What is the purpose of Jefferson Bank B6010?

The purpose of Jefferson Bank B6010 is to ensure compliance with financial regulations and to keep accurate records of transactions for both the bank and its clients.

What information must be reported on Jefferson Bank B6010?

Information that must be reported on Jefferson Bank B6010 typically includes account numbers, transaction dates, amounts, and the identities of the individuals or entities involved.

Fill out your business account application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Account Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.