Get the free MUNICIPAL TAX PRE-AUTHORIZED DEBIT AGREEMENT

Show details

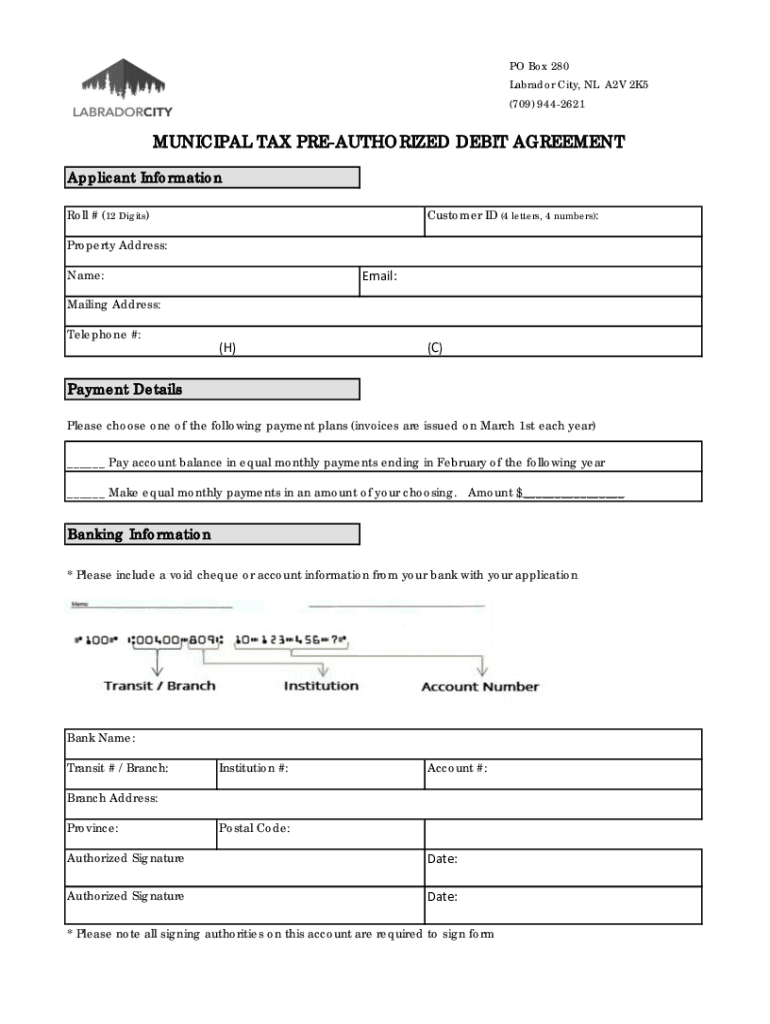

PO Box 280 Labrador City, NL A2V 2K5 (709) 9442621MUNICIPAL TAX PREAUTHORIZED DEBIT AGREEMENT Applicant Information Roll # (12 Digits)Customer ID (4 letters, 4 numbers):Property Address: Name:Email:Mailing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign municipal tax pre-authorized debit

Edit your municipal tax pre-authorized debit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your municipal tax pre-authorized debit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit municipal tax pre-authorized debit online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit municipal tax pre-authorized debit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out municipal tax pre-authorized debit

How to fill out municipal tax pre-authorized debit

01

To fill out a municipal tax pre-authorized debit form, follow these steps:

02

Obtain the pre-authorized debit form from your municipality or download it from their website.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide your financial institution details, such as the bank name, branch address, and transit and account numbers.

05

Specify the tax amount and frequency of the payments you wish to authorize.

06

Sign and date the form.

07

Submit the completed form to your municipality's tax department. You may need to provide additional documents, such as a void cheque, to verify your bank account details.

08

Once your form is processed and approved, your municipal taxes will be automatically deducted from your bank account on the specified payment dates.

Who needs municipal tax pre-authorized debit?

01

Municipal tax pre-authorized debit is beneficial for individuals who:

02

- Prefer the convenience of automatic payment without the need for manual transactions.

03

- Want to avoid late or missed payments by ensuring timely deductions.

04

- Have difficulty remembering payment due dates or managing their tax payments.

05

- Seek to streamline their financial management by automating tax payments.

06

However, eligibility and availability of this service may vary depending on the municipality. It's recommended to check with your local tax department or municipal website for specific information regarding the availability of municipal tax pre-authorized debit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my municipal tax pre-authorized debit in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your municipal tax pre-authorized debit and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out municipal tax pre-authorized debit using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign municipal tax pre-authorized debit and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete municipal tax pre-authorized debit on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your municipal tax pre-authorized debit by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is municipal tax pre-authorized debit?

Municipal tax pre-authorized debit is a payment method where taxpayers authorize their municipal government to automatically withdraw funds from their bank account to pay property taxes.

Who is required to file municipal tax pre-authorized debit?

Property owners who wish to streamline their property tax payments and avoid potential penalties for late payments are required to file municipal tax pre-authorized debit.

How to fill out municipal tax pre-authorized debit?

To fill out municipal tax pre-authorized debit, property owners must contact their municipal government or tax office to set up the automatic payment authorization and provide their banking information.

What is the purpose of municipal tax pre-authorized debit?

The purpose of municipal tax pre-authorized debit is to simplify the property tax payment process for taxpayers and ensure timely payments to the municipal government.

What information must be reported on municipal tax pre-authorized debit?

The information required for municipal tax pre-authorized debit includes the taxpayer's bank account information, property tax account details, and authorization for automatic withdrawals.

Fill out your municipal tax pre-authorized debit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Municipal Tax Pre-Authorized Debit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.