Get the free Donations - Donate to NMCRS - Navy-Marine Corps Relief ...Donation Request Letter fo...

Show details

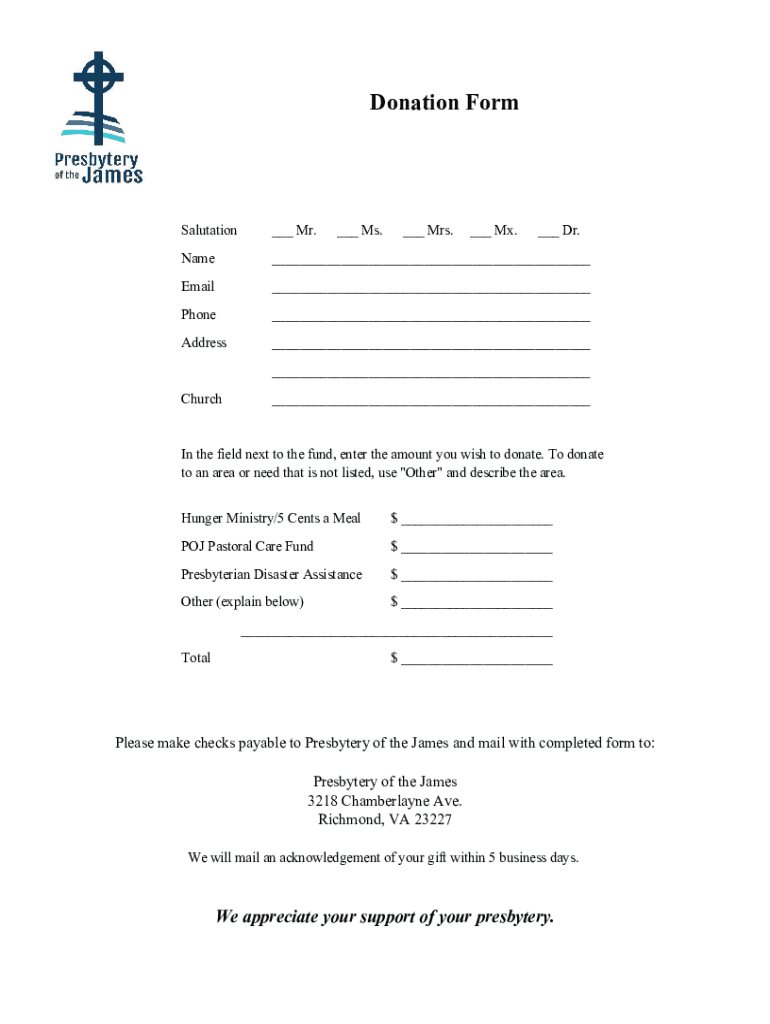

Donation Formalization Mr. Ms. Mrs. MX. Dr. Name Email Phone Address Church In the field next to the fund, enter the amount you wish to donate. To donate to an area or need that is not listed, use

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donations - donate to

Edit your donations - donate to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donations - donate to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donations - donate to online

To use the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit donations - donate to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donations - donate to

How to fill out donations - donate to

01

Research organizations or charities that accept donations online or in person.

02

Choose the organization you want to donate to based on your personal preferences or causes you want to support.

03

Visit the organization's website or contact them directly to find out the specific instructions for making a donation.

04

Follow the instructions provided by the organization to fill out the donation form, which may include providing personal information, selecting the amount to donate, and choosing the payment method.

05

Double-check the information you have entered before submitting the donation form.

06

Complete the payment process according to the chosen payment method.

07

Keep a record of the donation for your own records and for any potential tax deductions.

Who needs donations - donate to?

01

Various individuals, communities, and organizations may need donations to support their causes or provide assistance to those in need. This can include:

02

- Nonprofit organizations working towards a specific mission or social cause.

03

- Charities supporting disadvantaged groups such as the homeless, children, or refugees.

04

- Hospitals and medical institutions in need of supplies and resources.

05

- Animal shelters and rescue organizations caring for abandoned or injured animals.

06

- Research institutions and universities conducting studies in various fields.

07

- Disaster relief organizations assisting in natural or man-made disasters.

08

- Schools and education programs in need of funding for resources and scholarships.

09

- Local community initiatives and projects aimed at improving the quality of life.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find donations - donate to?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific donations - donate to and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the donations - donate to electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your donations - donate to in minutes.

How do I fill out donations - donate to using my mobile device?

Use the pdfFiller mobile app to fill out and sign donations - donate to on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is donations - donate to?

Donations are funds or goods given to a charity, organization, or individual to support a cause or project.

Who is required to file donations - donate to?

Individuals and organizations who receive donations are required to report them to the appropriate tax authorities.

How to fill out donations - donate to?

Donations can be reported on a tax form like the IRS Form 990 for organizations or as part of an individual's tax return.

What is the purpose of donations - donate to?

The purpose of donations is to provide financial support to charitable causes, individuals in need, or organizations that benefit the community.

What information must be reported on donations - donate to?

Donations must be reported with details such as the amount, donor information, date received, and the purpose of the donation.

Fill out your donations - donate to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donations - Donate To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.