Get the free Offshore Trusts Can Offer Asset ProtectionWolters Kluwer

Show details

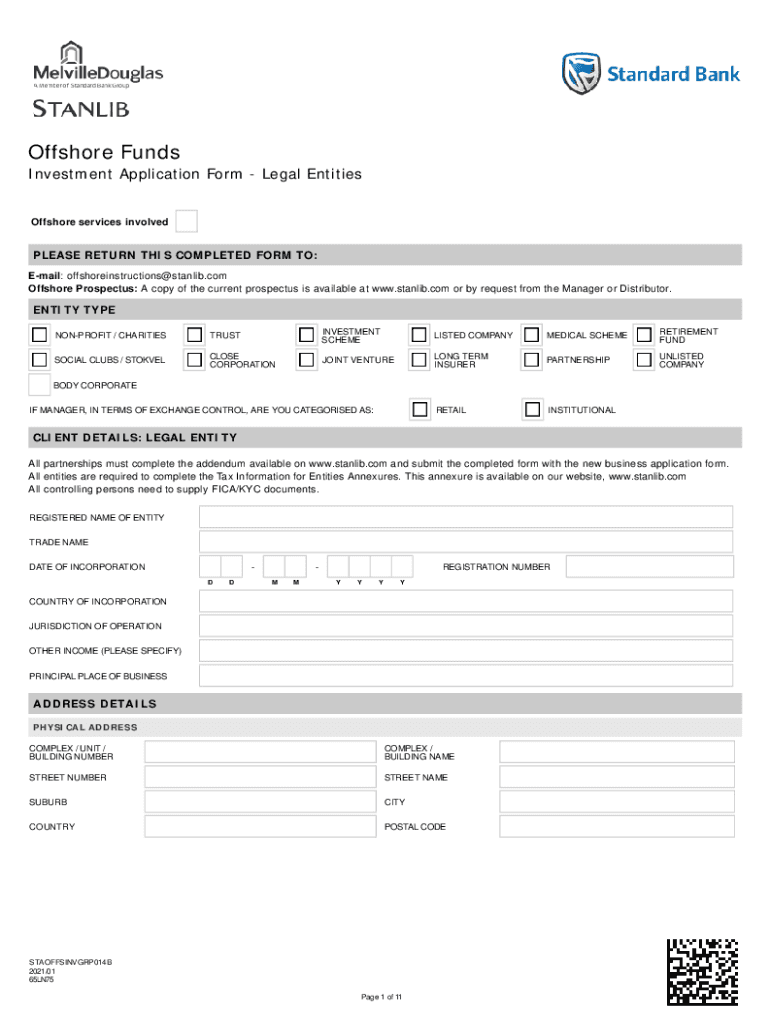

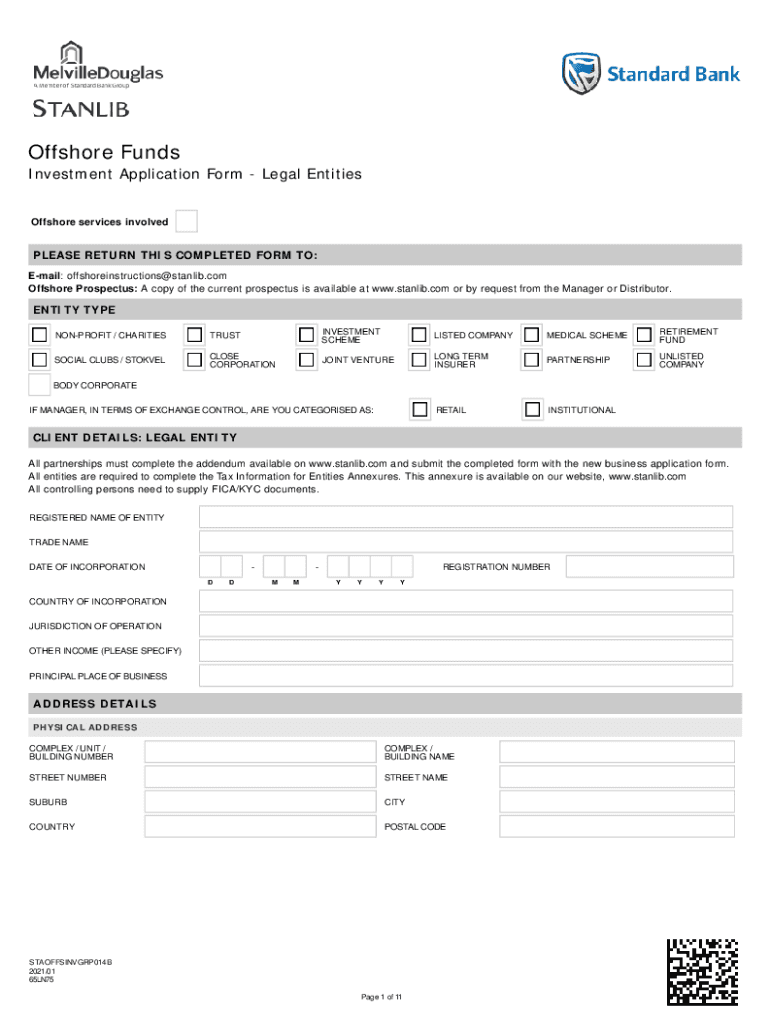

Offshore Funds Investment Application Form Legal Entities. Offshore services involvedPLEASE RETURN THIS COMPLETED FORM TO: Email: offshore instructions stanlib.com Offshore Prospectus: A copy of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offshore trusts can offer

Edit your offshore trusts can offer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offshore trusts can offer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offshore trusts can offer online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit offshore trusts can offer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offshore trusts can offer

How to fill out offshore trusts can offer

01

Choose a reliable offshore jurisdiction: Research and identify a jurisdiction that offers favorable tax and legal regulations for setting up offshore trusts.

02

Seek professional advice: Consult with an experienced offshore trust attorney who can guide you through the process and ensure compliance with all legal requirements.

03

Determine the type of trust: Decide on the specific type of offshore trust that suits your needs, such as discretionary trusts, asset protection trusts, or charitable trusts.

04

Settle the trust: Transfer your assets or funds into the offshore trust, following the guidelines provided by the jurisdiction and under the supervision of your attorney.

05

Appoint a trustee: Select a trustworthy trustee who will manage the trust, making investment decisions and fulfilling fiduciary duties.

06

Set beneficiaries and terms: Clearly define the beneficiaries of the trust and the terms and conditions under which they can receive distributions or access the trust assets.

07

Maintain compliance: Adhere to the ongoing reporting and compliance requirements of the offshore jurisdiction, such as filing annual tax returns and submitting financial statements.

08

Regularly review and update the trust: Monitor the performance of the trust and periodically review its structure to ensure it continues to meet your objectives and complies with any changes in laws or regulations.

Who needs offshore trusts can offer?

01

High-net-worth individuals: Offshore trusts can offer wealth preservation benefits, allowing individuals to protect and manage their assets in a tax-efficient manner.

02

Business owners: Offshore trusts can be used for asset protection and succession planning purposes, enabling business owners to safeguard their business interests and secure the financial future of their beneficiaries.

03

Individuals seeking privacy: Offshore trusts can provide an additional layer of privacy, as the details of the trust and its beneficiaries are typically not publicly disclosed.

04

International investors: Offshore trusts can facilitate cross-border investments and help optimize tax planning strategies for individuals with global investment portfolios.

05

Philanthropists: Offshore charitable trusts can be established to support philanthropic causes while providing tax benefits for the donors.

06

Individuals residing in unstable jurisdictions: Offshore trusts can offer asset protection from political instability, economic uncertainties, or potential legal claims in their home countries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my offshore trusts can offer in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your offshore trusts can offer and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit offshore trusts can offer straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing offshore trusts can offer, you can start right away.

Can I edit offshore trusts can offer on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign offshore trusts can offer. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is offshore trusts can offer?

Offshore trusts can offer asset protection, estate planning, confidentiality, and tax benefits.

Who is required to file offshore trusts can offer?

Individuals or entities who have established offshore trusts are required to file.

How to fill out offshore trusts can offer?

To fill out offshore trusts, one must provide details about the trust assets, beneficiaries, and trustees.

What is the purpose of offshore trusts can offer?

The purpose of offshore trusts is to protect assets, plan for inheritance, maintain privacy, and reduce tax liability.

What information must be reported on offshore trusts can offer?

Information such as trust assets, income, beneficiaries, and trustees must be reported.

Fill out your offshore trusts can offer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offshore Trusts Can Offer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.