Get the free Mortgages By Miles 1031 W Center St Ste 202 Orem, UT Mortgage ...

Show details

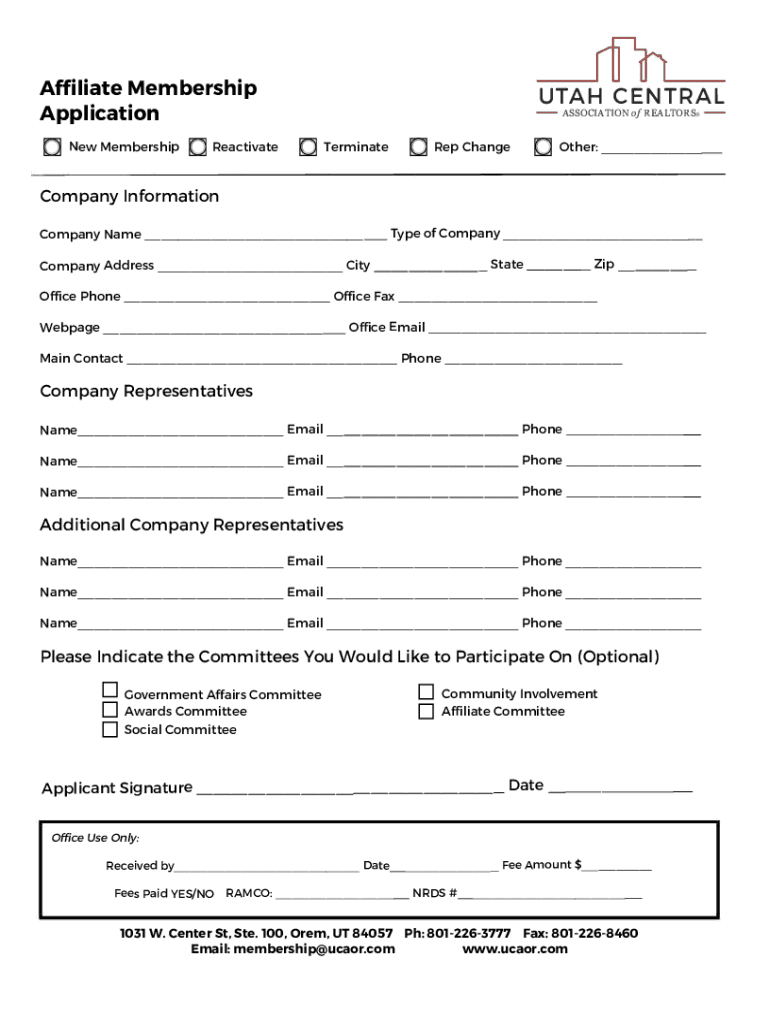

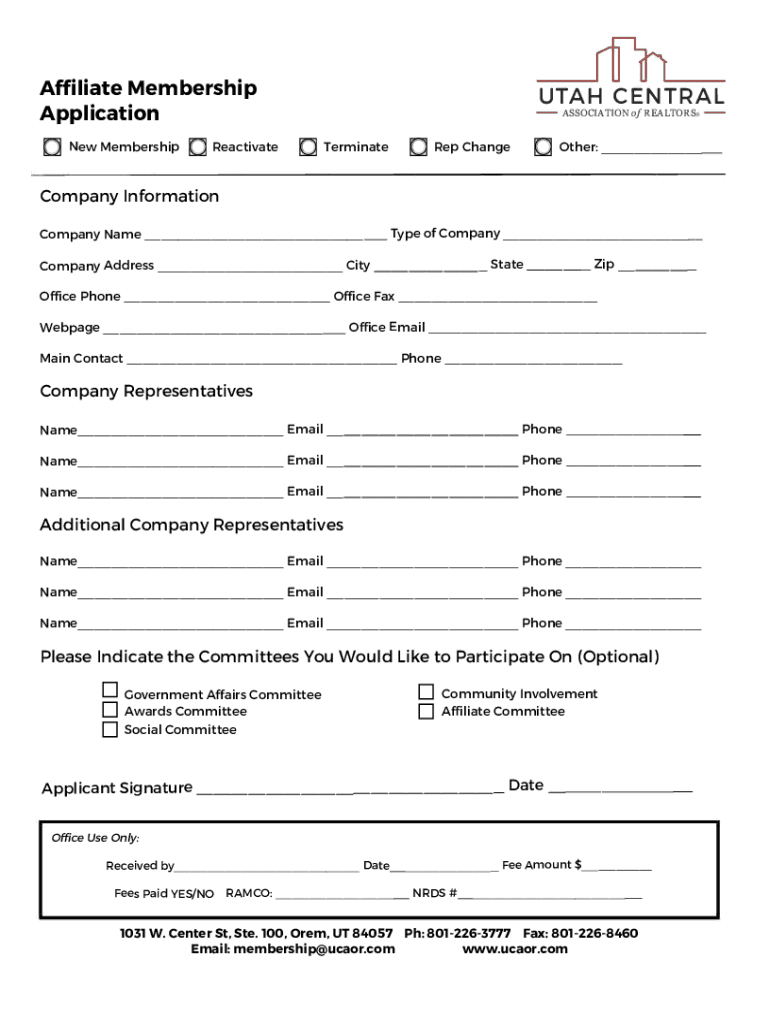

1031 W. Center St. Orem, UT 84057 Phone 8012263777 FAX 8012268460 www.ucaor.comDear Interested Business, At the Utah Central Association of REALTORS we have a marketing opportunity for companies and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgages by miles 1031

Edit your mortgages by miles 1031 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgages by miles 1031 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgages by miles 1031 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgages by miles 1031. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgages by miles 1031

How to fill out mortgages by miles 1031

01

To fill out mortgages by miles 1031, follow these steps:

02

Gather all necessary information such as personal and financial details.

03

Research and compare various mortgage options available in the market.

04

Choose the best mortgage option that suits your needs and affordability.

05

Complete the mortgage application form accurately and truthfully.

06

Provide all required supporting documents, such as income proof, bank statements, etc.

07

Submit the filled out application form along with the supporting documents to the mortgage lender.

08

Await the lender's response and follow any additional instructions provided.

09

If approved, carefully review the mortgage terms and conditions.

10

Sign the mortgage agreement and fulfill any requirements, such as paying closing costs or down payment.

11

Keep track of the mortgage repayment schedule and make timely payments to avoid any penalties or issues.

Who needs mortgages by miles 1031?

01

Mortgages by miles 1031 is suitable for individuals or businesses who are in need of mortgage financing for real estate investments.

02

It can be beneficial for property investors looking to defer capital gains taxes by utilizing a 1031 exchange.

03

Additionally, individuals or businesses looking to purchase new properties while selling existing ones can benefit from mortgages by miles 1031 to simplify the financing process.

04

By utilizing this type of mortgage, they can potentially save on taxes and continue to grow their real estate portfolio.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mortgages by miles 1031 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your mortgages by miles 1031 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for signing my mortgages by miles 1031 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your mortgages by miles 1031 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the mortgages by miles 1031 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign mortgages by miles 1031 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is mortgages by miles 1031?

Mortgages by miles 1031 is a tax form used for reporting like-kind exchanges of real estate under section 1031 of the Internal Revenue Code.

Who is required to file mortgages by miles 1031?

Taxpayers who engage in like-kind exchanges of real estate must file mortgages by miles 1031 form.

How to fill out mortgages by miles 1031?

To fill out mortgages by miles 1031, taxpayers need to provide details of the properties involved in the like-kind exchange and calculate any gain or loss.

What is the purpose of mortgages by miles 1031?

The purpose of mortgages by miles 1031 is to report like-kind exchanges of real estate and defer the recognition of capital gains taxes.

What information must be reported on mortgages by miles 1031?

Taxpayers must report details of the properties exchanged, their values, any boot received, and information about any mortgages or debt on the properties.

Fill out your mortgages by miles 1031 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgages By Miles 1031 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.