GA Application for Cobb County Homestead Exemptions 2013 free printable template

Show details

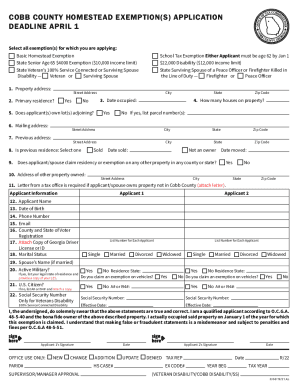

R5/13 APPLICATION FOR COBB COUNTY HOMESTEAD EXEMPTIONS SELECT TYPE OF EXEMPTION(S) Cobb County Basic Homestead Exemption State Senior Age 65 Cobb County School Tax (Age 62) Exemption State Senior

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA Application for Cobb County Homestead Exemptions

Edit your GA Application for Cobb County Homestead Exemptions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA Application for Cobb County Homestead Exemptions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA Application for Cobb County Homestead Exemptions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit GA Application for Cobb County Homestead Exemptions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Application for Cobb County Homestead Exemptions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA Application for Cobb County Homestead Exemptions

How to fill out GA Application for Cobb County Homestead Exemptions

01

Gather necessary documents, including proof of ownership, income statements, and other supporting information.

02

Visit the Cobb County Tax Assessor's website to download the Homestead Exemption application form or pick one up at the office.

03

Complete the application form thoroughly, providing all requested information accurately.

04

Attach any required documents that support your application, such as proof of residency and income.

05

Review the completed application for accuracy before submission.

06

Submit the application form and attached documents to the Cobb County Tax Assessor's office, either in person or via mail.

07

Keep a copy of the submitted application and any supporting documents for your records.

08

Follow up with the Tax Assessor’s office if you don’t receive confirmation of your application status within a few weeks.

Who needs GA Application for Cobb County Homestead Exemptions?

01

Homeowners in Cobb County who are seeking property tax relief through exemptions available for primary residences.

02

Individuals who meet specific criteria such as age, income level, or disability status may also need the application to qualify for specific exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How much is the homestead exemption in Cobb County?

Cobb County Basic Homestead This is a $10,000 exemption in the county general and school general tax categories.

How much does a homestead exemption save you in Fulton County?

These Homestead Exemptions apply to the Fulton County portion of your property taxes anywhere in Fulton county, with no income or age limits. Fulton Schools Basic Exemption $2,000 Plus 3% Floating Homestead.

How much is Cobb County homestead exemption?

Cobb County Basic Homestead This is a $10,000 exemption in the county general and school general tax categories.

How much do you save if you homestead in Florida?

The Florida homestead exemption is a property tax break for eligible homeowners. It can reduce the taxable value on your primary home as much as $50,000, saving you approximately $750 per year. Additionally, your assessed value cannot increase more than 3 percent annually once you've been granted a homestead exemption.

What is needed for homestead exemption in GA?

To be granted a homestead exemption: A person must actually occupy the home, and the home is considered their legal residence for all purposes. Persons that are away from their home because of health reasons will not be denied homestead exemption.

How do I file for homestead exemption in Cobb County?

An application for homestead may be made with the county tax office at any time during the year subsequent to the property becoming the primary residence, up to April 1st of the first year for which the exemption is sought.

What is the floating homestead exemption in Cobb County?

The Floating Homestead Exemption increases each time the value of a homestead is increased so that the owner does not pay a higher County General Fund tax solely as a result of a reassessment. Over time this can amount to a significant exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my GA Application for Cobb County Homestead Exemptions in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your GA Application for Cobb County Homestead Exemptions along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I fill out the GA Application for Cobb County Homestead Exemptions form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign GA Application for Cobb County Homestead Exemptions and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete GA Application for Cobb County Homestead Exemptions on an Android device?

Use the pdfFiller app for Android to finish your GA Application for Cobb County Homestead Exemptions. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is GA Application for Cobb County Homestead Exemptions?

The GA Application for Cobb County Homestead Exemptions is a form used by property owners in Cobb County, Georgia, to apply for homestead exemptions that reduce property taxes.

Who is required to file GA Application for Cobb County Homestead Exemptions?

Property owners in Cobb County who occupy their property as their primary residence and wish to qualify for homestead exemptions are required to file the application.

How to fill out GA Application for Cobb County Homestead Exemptions?

To fill out the application, property owners should provide their personal information, details of the property, and any required income or ownership documentation as specified in the application form.

What is the purpose of GA Application for Cobb County Homestead Exemptions?

The purpose of the application is to determine eligibility for property tax relief through homestead exemptions available for qualifying homeowners in Cobb County.

What information must be reported on GA Application for Cobb County Homestead Exemptions?

The application requires information such as the property owner's name, address, date of birth, social security number, and details about the property being claimed for the homestead exemption.

Fill out your GA Application for Cobb County Homestead Exemptions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA Application For Cobb County Homestead Exemptions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.