AL Form 40ES 2011 free printable template

Show details

2 First payment. 3 Second payment. 4 Third payment. 5 Fourth payment. 6 Total. ENTER THIS AMOUNT ON THE PROPER LINE OF YOUR 2011 ALABAMA INDIVIDUAL INCOME TAX RETURN FORM 40 OR FORM 40NR. NOTE The Alabama Department of Revenue does not send notices of amounts paid on estimated tax. Therefore it is important that you maintain this record. Form 40ES Instructions Who Must Pay Estimated Tax If you owe additional tax for 2010 you may have to pay estim...

pdfFiller is not affiliated with any government organization

Instructions and Help about AL Form 40ES

How to edit AL Form 40ES

How to fill out AL Form 40ES

Instructions and Help about AL Form 40ES

How to edit AL Form 40ES

To edit AL Form 40ES, access the form through a PDF editing platform like pdfFiller. Use the editing tools to input necessary information accurately. Ensure that all changes adhere to the guidelines set by the Alabama Department of Revenue to maintain compliance.

How to fill out AL Form 40ES

Filling out AL Form 40ES requires careful attention to detail. Begin by gathering your financial records, ensuring you have all necessary information at hand. Follow these steps:

01

Download the AL Form 40ES from the appropriate source.

02

Enter your personal information in the required fields, including your name, address, and Social Security number.

03

Calculate your estimated tax liability for the year based on your expected income.

04

Sign and date the completed form before submission.

About AL Form 40ES 2011 previous version

What is AL Form 40ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AL Form 40ES 2011 previous version

What is AL Form 40ES?

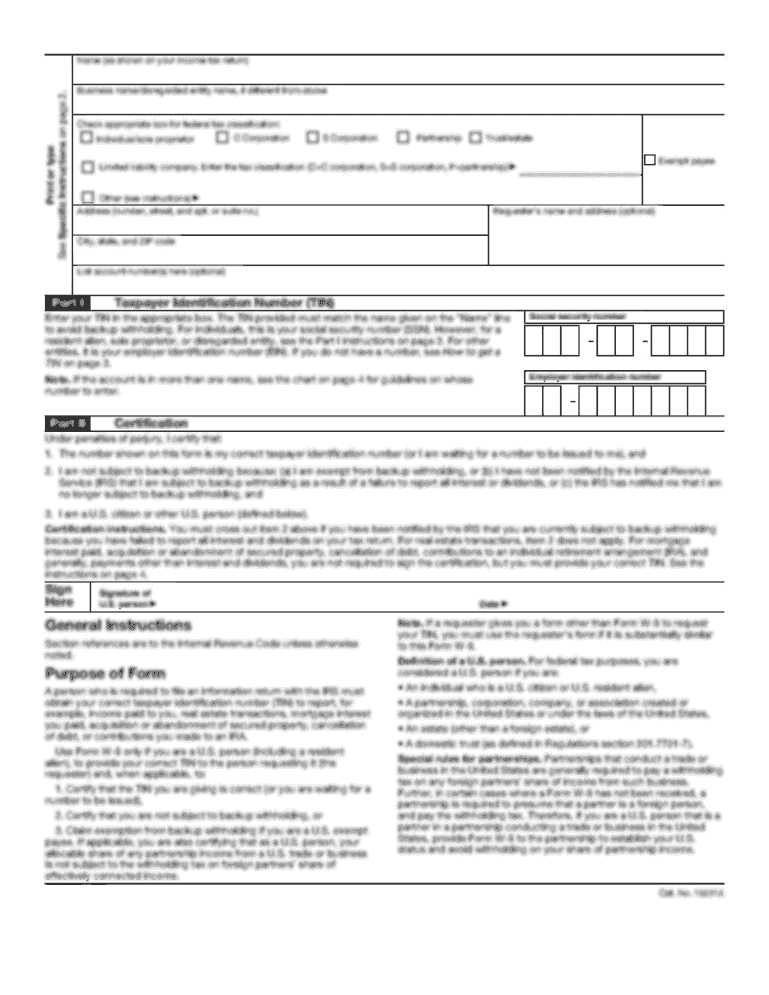

AL Form 40ES, also known as the Estimated Tax Payment Form, is used by Alabama residents to report and pay estimated income taxes. This form is crucial for individuals who expect to owe a certain amount in taxes and wish to make periodic payments throughout the year.

What is the purpose of this form?

The purpose of AL Form 40ES is to help taxpayers manage their tax liabilities by allowing them to make estimated tax payments throughout the year. This proactive approach can prevent underpayment penalties and reduce the burden of a large tax bill during filing season.

Who needs the form?

Taxpayers who expect to owe $500 or more in state income tax when filing their return must complete AL Form 40ES. This includes self-employed individuals, freelancers, or anyone with significant non-withheld income.

When am I exempt from filling out this form?

You are exempt from filling out AL Form 40ES if you had no tax liability in the previous year and you were a resident of Alabama for the entire year. Additionally, if your current year's tax liability is expected to be less than $100, you may not need to submit the form.

Components of the form

AL Form 40ES includes sections for personal information, estimated income for the current year, and calculations for estimated tax payments. Additionally, there are areas to delineate quarterly payment amounts and provide signatures for verification.

What are the penalties for not issuing the form?

Failing to issue AL Form 40ES or making inadequate estimated payments can lead to penalties. The Alabama Department of Revenue may impose a penalty of 10% on the amount due if estimated payments are not made or if they are underpaid during the tax year.

What information do you need when you file the form?

When filing AL Form 40ES, gather your previous year’s tax returns, current income projections, and any applicable deductions or credits. Accurate income estimates are essential for calculating your estimated tax liability.

Is the form accompanied by other forms?

AL Form 40ES is typically filed independently, but taxpayers should also maintain records of any federal estimated tax forms submitted, as well as receipts or documentation for any payments made to ensure accurate reporting.

Where do I send the form?

Once completed, AL Form 40ES should be mailed to the Alabama Department of Revenue. The specific mailing address may vary based on whether you are making a payment, so it is always advisable to check the latest guidance on the Alabama Department of Revenue's official website.

See what our users say