Get the free Beverage Tax Fast-Food Restaurant Observation Form

Show details

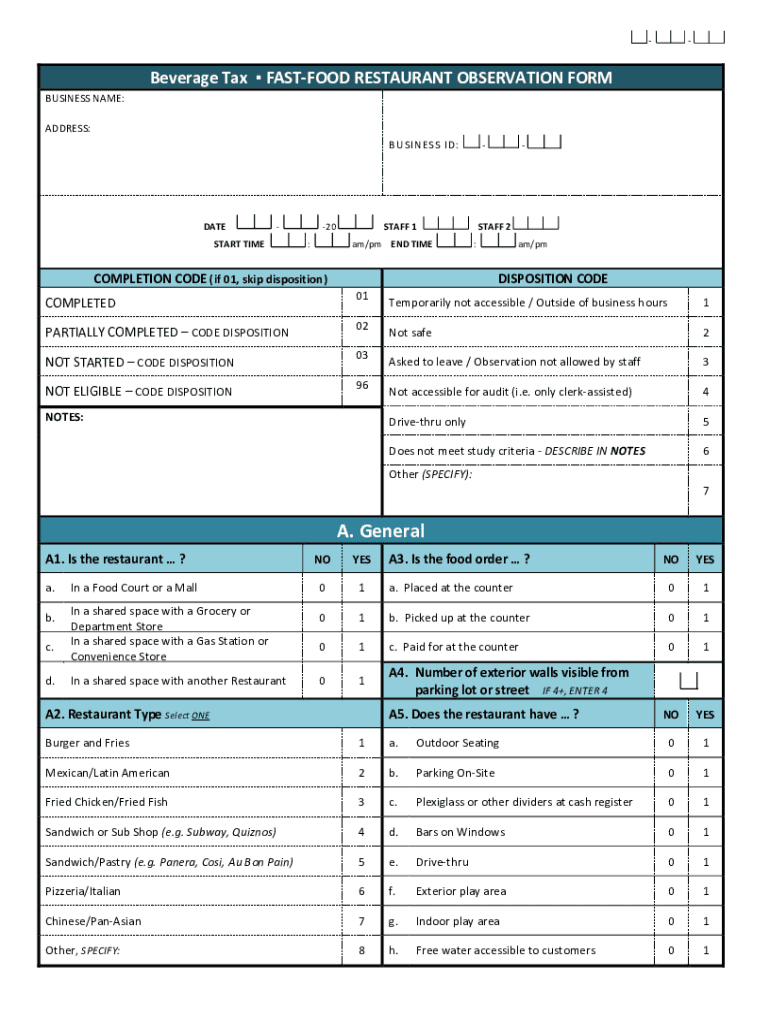

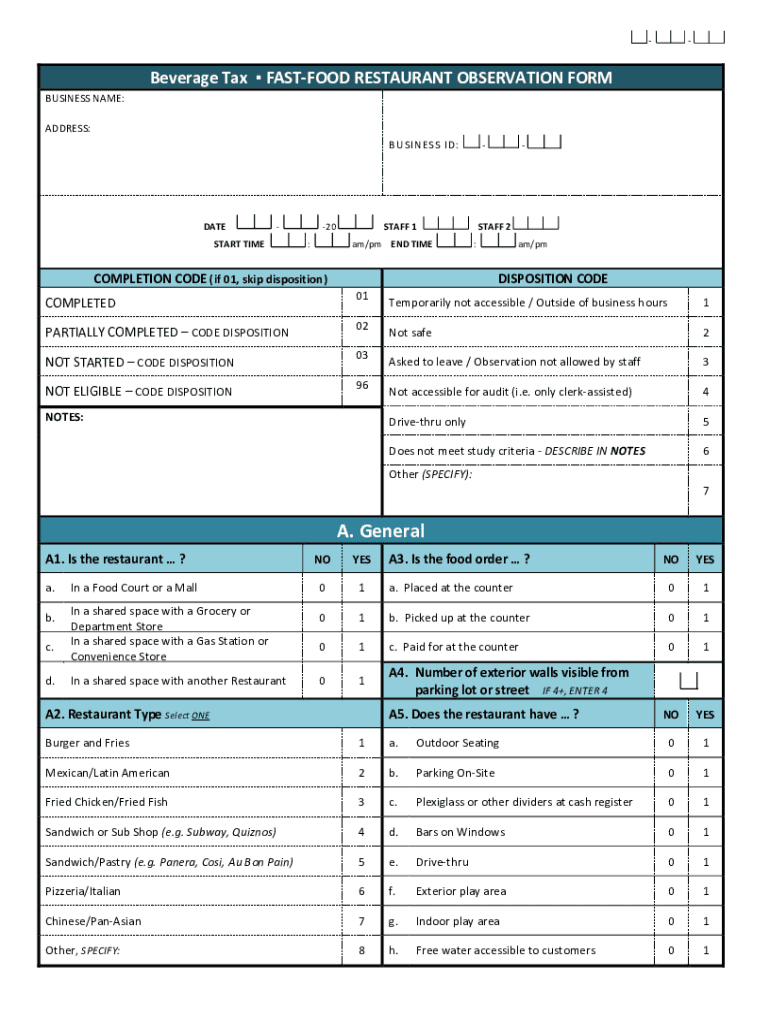

Beverage Tax EASTWOOD RESTAURANT OBSERVATION FORM BUSINESS NAME: ADDRESS: BUSINESS ID:RESTART TIME20 :STAFF 1 am/pm END TIMESTAMP 2 :COMPLETION CODE (if 01, skip disposition)am/disposition CODECOMPLETED01PARTIALLY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beverage tax fast-food restaurant

Edit your beverage tax fast-food restaurant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beverage tax fast-food restaurant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beverage tax fast-food restaurant online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit beverage tax fast-food restaurant. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beverage tax fast-food restaurant

How to fill out beverage tax fast-food restaurant

01

Start by gathering all necessary information such as the type and quantity of beverages sold at the fast-food restaurant.

02

Determine the applicable beverage tax rate based on the regulations and laws in the specific jurisdiction where the restaurant operates.

03

Calculate the total amount of beverage tax owed by multiplying the quantity of each type of beverage by its corresponding tax rate.

04

Keep accurate records of the beverage sales and taxes collected, as these may be required for reporting purposes.

05

Ensure that the beverage tax is included in the final price charged to customers and clearly indicated on receipts or invoices.

06

Stay updated with any changes or updates to the beverage tax laws to ensure compliance.

07

Regularly review and reconcile the beverage tax records to ensure accuracy and identify any discrepancies.

08

File any necessary beverage tax reports or returns within the specified deadlines, providing all required information.

09

Consult with tax professionals or experts if needed to ensure proper understanding and compliance with the beverage tax regulations.

Who needs beverage tax fast-food restaurant?

01

Fast-food restaurants that sell beverages are the ones who need to comply with the beverage tax regulations.

02

This includes both large chain restaurants and small independent fast-food establishments.

03

The beverage tax may apply to specific jurisdictions or locations, so it is important for fast-food restaurants operating in those areas to understand and fulfill their obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beverage tax fast-food restaurant directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your beverage tax fast-food restaurant as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute beverage tax fast-food restaurant online?

Filling out and eSigning beverage tax fast-food restaurant is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit beverage tax fast-food restaurant straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing beverage tax fast-food restaurant right away.

What is beverage tax fast-food restaurant?

Beverage tax at a fast-food restaurant is a tax imposed on beverages sold by fast-food establishments.

Who is required to file beverage tax fast-food restaurant?

Fast-food restaurants are required to file and pay beverage tax.

How to fill out beverage tax fast-food restaurant?

To fill out beverage tax at a fast-food restaurant, the establishment needs to report all beverage sales and calculate the tax owed.

What is the purpose of beverage tax fast-food restaurant?

The purpose of beverage tax at a fast-food restaurant is to generate revenue for the government and discourage excessive consumption of sugary drinks.

What information must be reported on beverage tax fast-food restaurant?

The information that must be reported includes total beverage sales, types of beverages sold, and the amount of tax owed.

Fill out your beverage tax fast-food restaurant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beverage Tax Fast-Food Restaurant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.