Get the free Request a SEPA creditor ID from your bank : Stripe: Help & Support

Show details

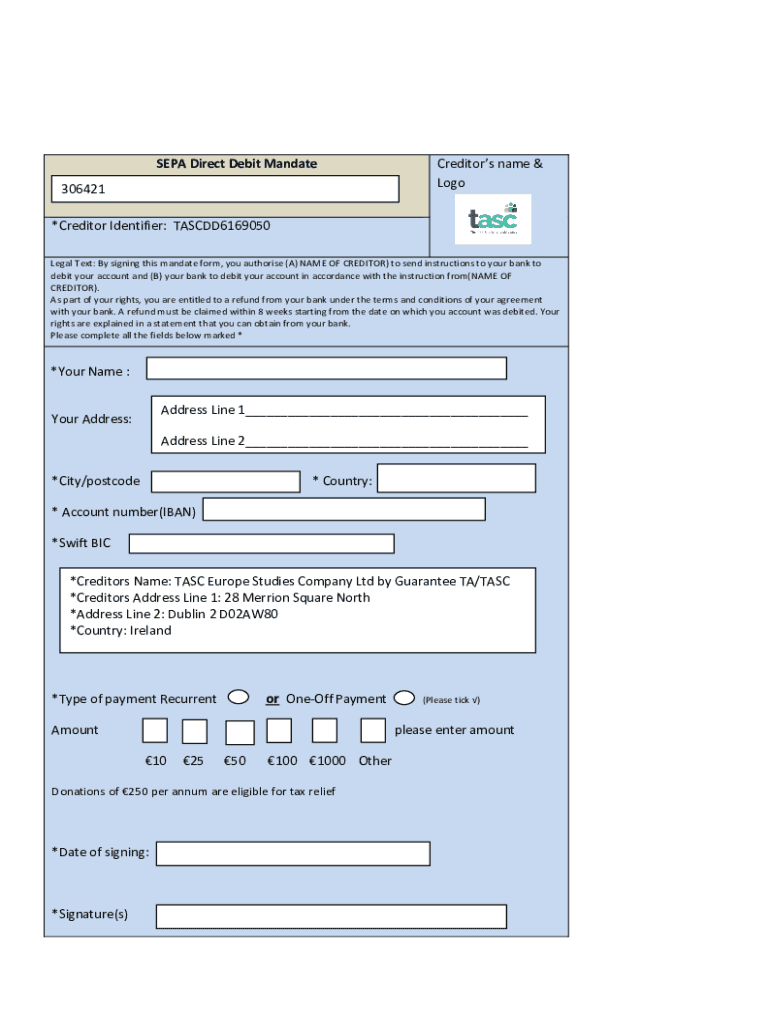

SEPA Direct Debit Mandate 306421Creditors name & Logo×Creditor Identifier: TASCDD6169050 Legal Text: By signing this mandate form, you authorize (A) NAME OF CREDITOR) to send instructions to your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request a sepa creditor

Edit your request a sepa creditor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request a sepa creditor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit request a sepa creditor online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit request a sepa creditor. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request a sepa creditor

How to fill out request a sepa creditor

01

To fill out a request for a SEPA creditor, follow these steps:

02

Gather all necessary information about the creditor, including their name, address, and bank account details.

03

Access your online banking platform or visit your bank branch in person.

04

Navigate to the SEPA payments section or ask a bank representative for assistance.

05

Choose the option to request a SEPA creditor.

06

Fill in the required information, such as the creditor's name, address, bank account number, and BIC (Bank Identifier Code).

07

Double-check the entered information for accuracy.

08

Confirm the request and submit it.

09

Wait for the confirmation from your bank regarding the successful processing of the SEPA creditor request.

Who needs request a sepa creditor?

01

Anyone who wishes to make payments to a SEPA creditor needs to request a SEPA creditor. This is particularly useful for individuals or businesses who frequently make cross-border money transfers within the SEPA (Single Euro Payments Area) zone.

02

SEPA creditors are commonly used for various purposes, including salary payments, bill payments, supplier payments, and other financial transactions.

03

Additionally, organizations that handle payments on behalf of others, such as payment service providers or financial institutions, may also need to request a SEPA creditor for administrative purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify request a sepa creditor without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your request a sepa creditor into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find request a sepa creditor?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific request a sepa creditor and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit request a sepa creditor on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign request a sepa creditor on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is request a sepa creditor?

Request a SEPA creditor is a form that allows a creditor to request the creation of a SEPA (Single Euro Payments Area) direct debit.

Who is required to file request a sepa creditor?

Any creditor who wants to set up a SEPA direct debit must file a request a SEPA creditor form.

How to fill out request a sepa creditor?

To fill out a request a SEPA creditor form, the creditor needs to provide their details, the debtor's details, and the mandate reference number.

What is the purpose of request a sepa creditor?

The purpose of the request a SEPA creditor form is to initiate the process of setting up a SEPA direct debit between a creditor and a debtor.

What information must be reported on request a sepa creditor?

The request a SEPA creditor form must include the creditor's information, debtor's information, and the mandate reference number.

Fill out your request a sepa creditor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request A Sepa Creditor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.