Get the free C140392 - Forensic Accounting Services RFP - Revised 2.18.21

Show details

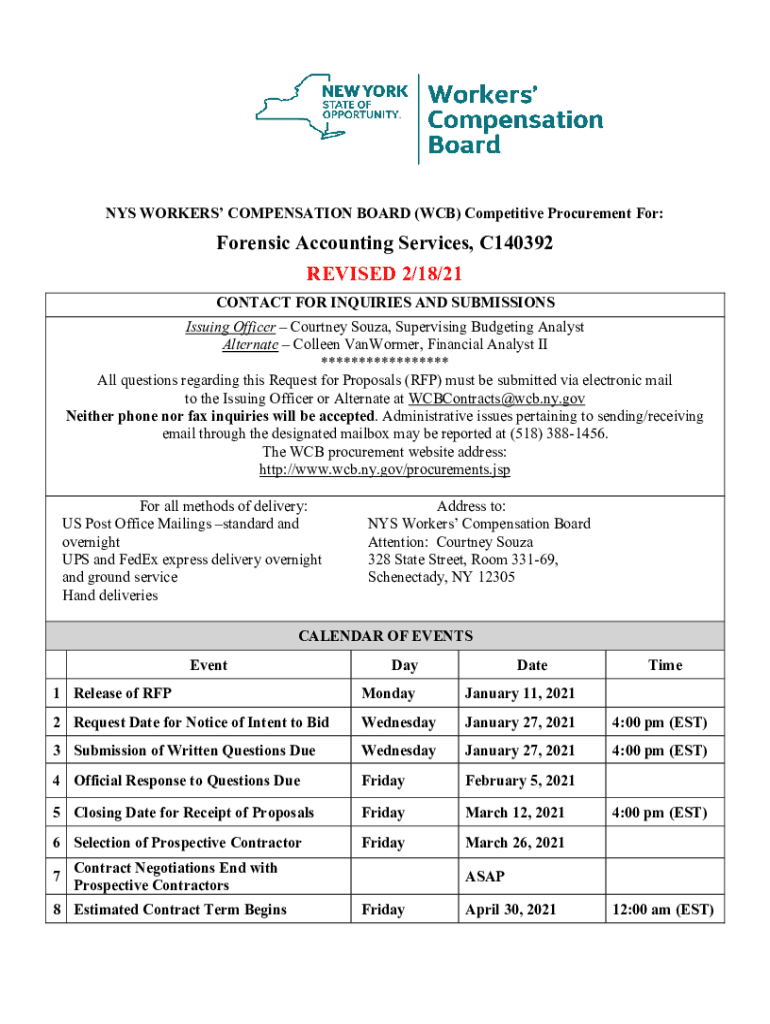

NYS WORKERS COMPENSATION BOARD (WEB) Competitive Procurement For:Forensic Accounting Services, C140392 REVISED 2/18/21 CONTACT FOR INQUIRIES AND SUBMISSIONS Issuing Officer Courtney Souza, Supervising

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign c140392 - forensic accounting

Edit your c140392 - forensic accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c140392 - forensic accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing c140392 - forensic accounting online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit c140392 - forensic accounting. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out c140392 - forensic accounting

How to fill out c140392 - forensic accounting

01

Start by gathering all relevant financial documents and records related to the case, such as bank statements, invoices, receipts, and tax returns.

02

Review and analyze the financial documents to identify any inconsistencies, anomalies, or potential fraudulent activities.

03

Conduct interviews with key individuals involved in the case, such as company employees, clients, and suppliers, to gather additional information and insights.

04

Utilize forensic accounting techniques and tools, such as data analysis software and financial modeling, to uncover hidden patterns or irregularities in the financial data.

05

Prepare detailed reports and findings based on the analysis, documenting any evidence of fraud, misappropriation of funds, or other financial wrongdoings.

06

Present the findings and reports to relevant parties, such as law enforcement agencies, lawyers, or court officials, for further investigation or legal action.

07

Work closely with legal professionals throughout the process, providing expert advice and testimony when necessary.

Who needs c140392 - forensic accounting?

01

Businesses or organizations facing financial disputes or suspected financial fraud, seeking to uncover and gather evidence for litigation purposes.

02

Individuals or companies involved in divorce or inheritance disputes, requiring an objective analysis of financial records to ensure fair distribution of assets.

03

Law enforcement agencies investigating financial crimes, such as money laundering, embezzlement, or corporate fraud.

04

Bankruptcy trustees or receiverships dealing with financial distress or insolvency cases, needing to assess the accuracy of financial reporting or uncover hidden assets.

05

Insurance companies investigating potential fraudulent claims, aiming to verify the legitimacy of the claim and gather evidence.

06

Auditors or internal investigators looking to detect and prevent financial irregularities within an organization.

07

Attorneys representing clients involved in complex financial litigation or disputes, requiring expert analysis and support.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send c140392 - forensic accounting for eSignature?

To distribute your c140392 - forensic accounting, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get c140392 - forensic accounting?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the c140392 - forensic accounting in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute c140392 - forensic accounting online?

Completing and signing c140392 - forensic accounting online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is c140392 - forensic accounting?

c140392 - forensic accounting is a specialized accounting practice that involves investigating financial records to identify fraud or other illegal activities.

Who is required to file c140392 - forensic accounting?

C140392 - forensic accounting is typically required to be filed by companies or individuals who suspect that financial fraud or misconduct has occurred within their organization.

How to fill out c140392 - forensic accounting?

To fill out c140392 - forensic accounting, one must gather financial records, conduct interviews with relevant parties, analyze data, and document findings in a report.

What is the purpose of c140392 - forensic accounting?

The purpose of c140392 - forensic accounting is to uncover financial crimes, detect fraudulent activities, and provide evidence for legal proceedings.

What information must be reported on c140392 - forensic accounting?

Information reported on c140392 - forensic accounting may include financial transactions, discrepancies in records, suspicious activities, and analysis of financial documents.

Fill out your c140392 - forensic accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

c140392 - Forensic Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.