Get the free Petty CashFinancial Accounting - Lumen Learning

Show details

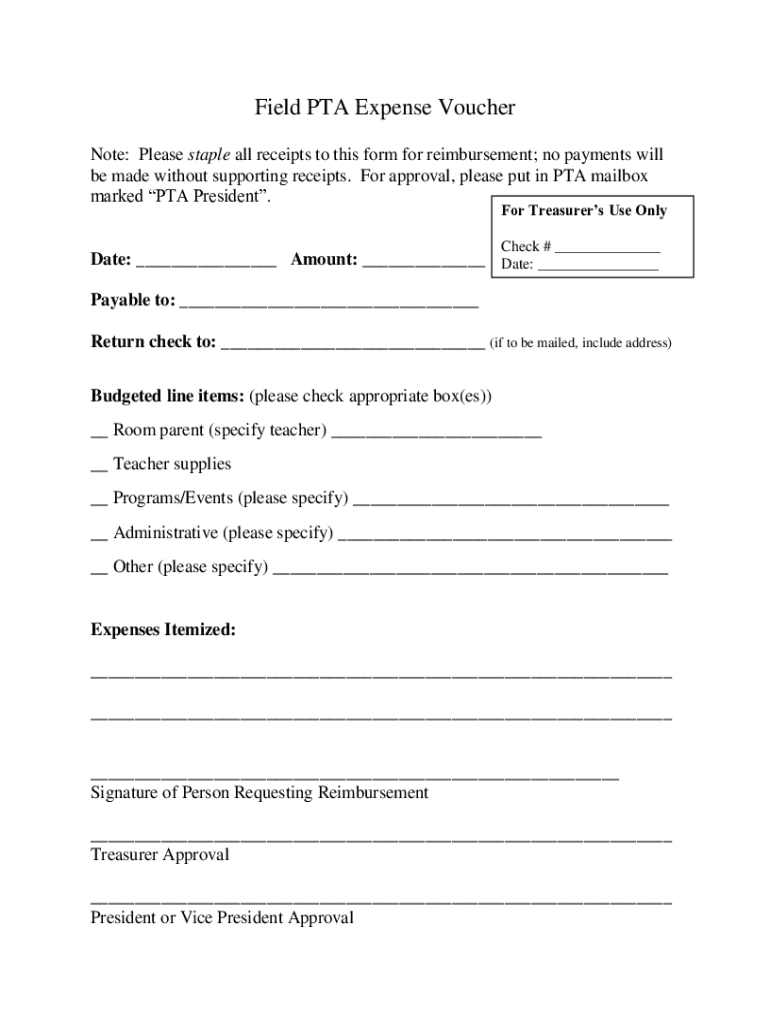

Field PTA Expense Voucher Note: Please staple all receipts to this form for reimbursement; no payments will be made without supporting receipts. For approval, please put in PTA mailbox marked PTA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petty cashfinancial accounting

Edit your petty cashfinancial accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petty cashfinancial accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petty cashfinancial accounting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit petty cashfinancial accounting. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petty cashfinancial accounting

How to fill out petty cashfinancial accounting

01

Start by gathering all the necessary documents and forms required for petty cash accounting, such as a petty cash voucher template.

02

Determine the appropriate amount of money to be allocated for the petty cash fund.

03

Designate a custodian who will be responsible for managing the petty cash fund.

04

Create a petty cash log to keep track of all transactions made from the fund.

05

Whenever a petty cash expense is incurred, fill out a petty cash voucher, providing details about the expenditure.

06

Ensure that the petty cash voucher is properly approved and signed by the appropriate authority.

07

Keep all petty cash vouchers and receipts as supporting documents for future reference.

08

Regularly reconcile the petty cash fund by comparing the remaining cash balance with the total value of petty cash vouchers issued.

09

Prepare periodic financial reports to account for petty cash transactions and provide an overview of expenses.

10

Finally, close the accounting period by replenishing the petty cash fund and making necessary adjustments.

Who needs petty cashfinancial accounting?

01

Petty cash financial accounting is needed by organizations or businesses that handle small cash transactions frequently.

02

It is particularly useful for businesses that make daily or frequent cash purchases, such as retail stores, restaurants, and small service providers.

03

Additionally, any organization that requires reimbursement for small expenses, such as office supplies or travel costs, can benefit from implementing petty cash financial accounting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit petty cashfinancial accounting straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing petty cashfinancial accounting.

How do I fill out petty cashfinancial accounting using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign petty cashfinancial accounting and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete petty cashfinancial accounting on an Android device?

Complete petty cashfinancial accounting and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is petty cash financial accounting?

Petty cash financial accounting refers to the process of managing and recording small amounts of cash that are kept on hand for minor expenses. It involves tracking the receipt and disbursement of petty cash to ensure accurate financial records.

Who is required to file petty cash financial accounting?

Organizations or businesses that use petty cash for day-to-day transactions are required to file petty cash financial accounting. This includes small businesses, non-profits, and any entity that maintains a petty cash fund.

How to fill out petty cash financial accounting?

To fill out petty cash financial accounting, start by recording each transaction in a petty cash log. Include the date, amount, purpose of the expense, and the individual who received the funds. At the end of a defined period, reconcile the petty cash balance with the records to ensure accuracy.

What is the purpose of petty cash financial accounting?

The purpose of petty cash financial accounting is to provide a systematic way to track small cash expenditures. It helps in maintaining accurate financial records, controlling spending, and simplifying the reimbursement process for minor expenses.

What information must be reported on petty cash financial accounting?

Information that must be reported includes the date of each transaction, amount disbursed, purpose of the expenditure, the name of the person receiving the cash, and the remaining balance in the petty cash fund.

Fill out your petty cashfinancial accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petty Cashfinancial Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.