DC D-40P 2020 free printable template

Show details

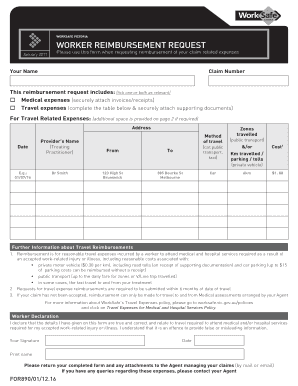

D40P PAYMENT VOUCHER

See instructions on backbench

Detachatatperforation

perforation and mail the voucher,

voucher, with payment attached,

attached, tooth

office

OFCE

OfceofofTax

Tax and

revenue,

Revenue,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DC D-40P

Edit your DC D-40P form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DC D-40P form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DC D-40P online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit DC D-40P. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DC D-40P Form Versions

Version

Form Popularity

Fillable & printabley

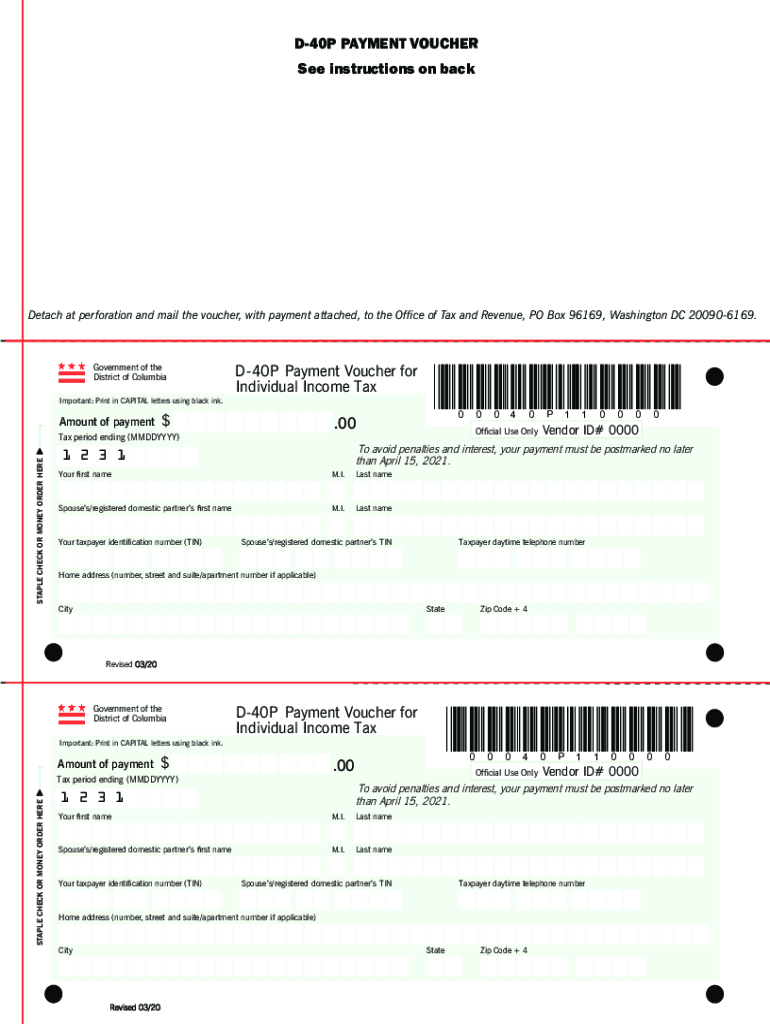

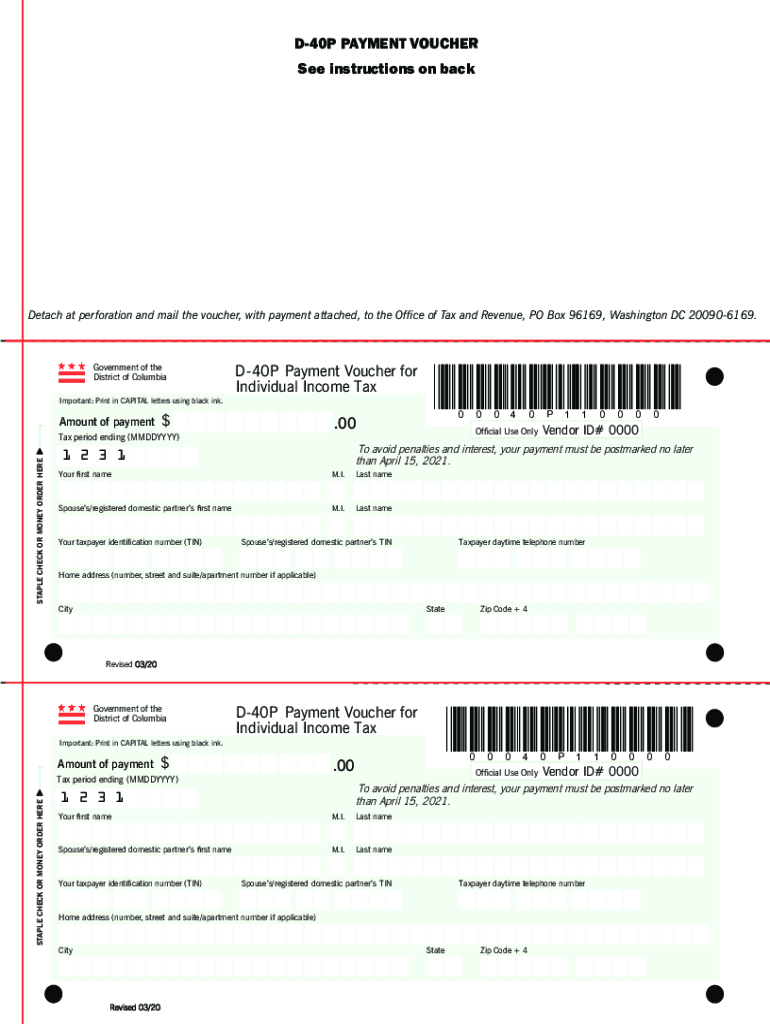

How to fill out DC D-40P

How to fill out DC D-40P

01

Gather all necessary financial documents including W-2s, 1099s, and any other income statements.

02

Download the DC D-40P form from the DC Office of Tax and Revenue website.

03

Fill in your personal information including your name, address, and Social Security number at the top of the form.

04

Report your total income from all sources as directed in the income section of the form.

05

Claim any applicable deductions and credits available to you.

06

Calculate your tax liability based on your income and applicable tax rates.

07

Review the form for accuracy before submitting it.

08

Submit the completed DC D-40P form by the deadline, either electronically or via mail.

Who needs DC D-40P?

01

Anyone who is a resident of the District of Columbia and earns income must file the DC D-40P tax form.

02

Individuals who have income from self-employment, investments, or other sources beyond regular employment.

03

Residents who are required to pay additional taxes or receive refunds for overpayment of taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is a D-40B form?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

Can I file a DC extension online?

You have the following options to file a D.C. tax extension: Pay all or some of your Washington, D.C. income taxes online by submitting Form FR-127 via: MyTax. DC. Paying your D.C. taxes online on time will be considered a D.C. tax extension and you do not have to mail in Form FR-127.

Can DC form D-40B be filed electronically?

Electronic Filing Mandate - Washington D.C. does not mandate e-filing of returns. The DC D-40B Nonresident Request for Refund is not e-fileable.

What is D-40B form?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

What is form D 40E?

The Form D-40E, District of Columbia (DC) Individual Income Tax Declaration for Electronic Filing, is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO).

How do I fill out a payment voucher?

0:27 1:20 How to fill out a Payment Voucher - YouTube YouTube Start of suggested clip End of suggested clip Amount. As for your check please remember that the legal line on the check is the only amount theMoreAmount. As for your check please remember that the legal line on the check is the only amount the bank will accept. So make sure the amount is correct on the legal line.

What is d40 tax form?

If you need to change or amend an accepted Washington, D.C. State Income Tax Return for the current or previous Tax Year you need to complete Form D-40. Form D-40 is used for the Tax Return and Tax Amendment.

Do I have to pay quarterly taxes in DC?

DC residents must pay estimated taxes on any wages they earn outside the District, unless their employer pays DC withholding taxes. Make your four (4) quarterly estimated payments with vouchers from the Form D-40ES booklet.

Can I pay DC taxes in installments?

DC. District law requires that taxpayers pay their tax in full when filing a return. However, if a taxpayer cannot pay in full, the Office of Tax and Revenue (OTR) may allow them to pay in installments. Taxpayers may request an installment agreement from the Collection Division representative assigned to their case.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get DC D-40P?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the DC D-40P in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit DC D-40P on an iOS device?

Create, modify, and share DC D-40P using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete DC D-40P on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your DC D-40P by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is DC D-40P?

DC D-40P is a tax form used by residents of the District of Columbia to report personal income tax for the tax year.

Who is required to file DC D-40P?

Residents of the District of Columbia who meet the income threshold set by the DC Office of Tax and Revenue are required to file DC D-40P.

How to fill out DC D-40P?

To fill out DC D-40P, individuals need to provide personal information, report income, claim any deductions or credits, and calculate the tax owed or refund due.

What is the purpose of DC D-40P?

The purpose of DC D-40P is to collect personal income tax from residents of the District of Columbia to fund public services and infrastructure.

What information must be reported on DC D-40P?

DC D-40P requires reporting of personal identification information, income earned, tax credits, deductions claimed, and any taxes owed or refunds expected.

Fill out your DC D-40P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DC D-40p is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.