Get the free Contact Creative Tax Reliefs for specialist help and advice

Show details

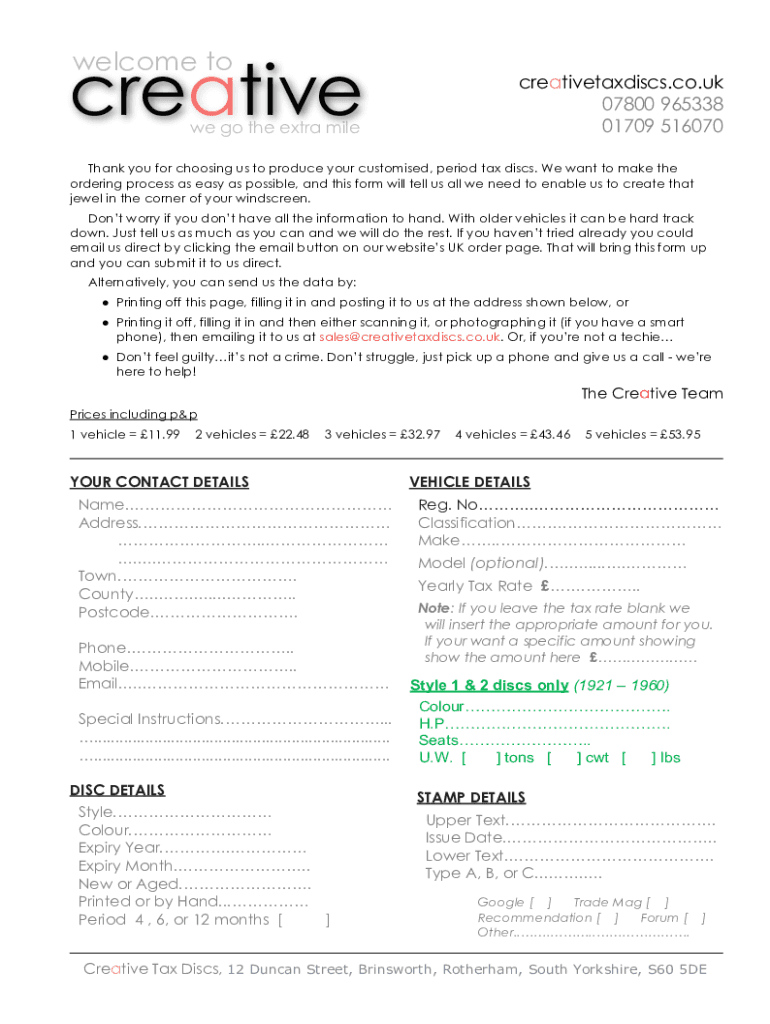

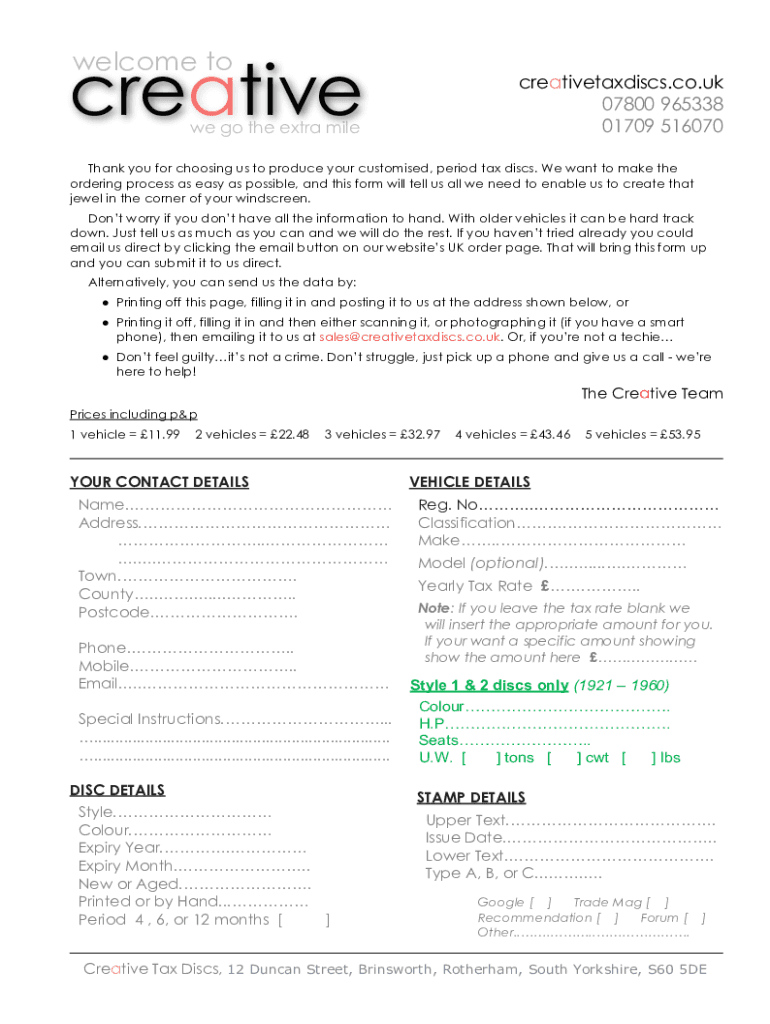

Welcome tocreativecreativetaxdiscs.co.UK

07800 965338

01709 516070we go the extra methane you for choosing us to produce your customized, period tax discs. We want to make the

ordering process as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contact creative tax reliefs

Edit your contact creative tax reliefs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contact creative tax reliefs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contact creative tax reliefs online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit contact creative tax reliefs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contact creative tax reliefs

How to fill out contact creative tax reliefs

01

Gather all the necessary information and documents related to the creative project for which you are claiming tax reliefs.

02

Ensure that you meet the eligibility criteria for claiming creative tax reliefs. For example, you may need to be a UK taxpayer or meet specific requirements for the category of relief you are applying for.

03

Complete the appropriate forms or online application for claiming creative tax reliefs. Provide accurate and detailed information about the project, including its title, description, budget, expenses, and any relevant supporting evidence.

04

Include any additional documents or certificates required to support your claim, such as cultural test certificates or relevant clearances.

05

Double-check your completed forms and supporting documents for accuracy and completeness.

06

Submit your completed application for creative tax reliefs to the appropriate authority or government department. Follow any specific submission instructions provided.

07

Keep copies of all submitted documents and keep track of your application's progress. Make note of any reference numbers or communication from the tax authority.

08

If necessary, respond promptly to any requests for further information or clarification from the tax authority regarding your claim.

09

Await a decision on your creative tax reliefs application. This may take some time, and you may receive communication or require additional steps during the assessment process.

10

Upon approval, ensure that you comply with any ongoing obligations or reporting requirements associated with the tax reliefs received.

11

Seek professional advice or consult relevant resources if you have any doubts or questions during the application process.

Who needs contact creative tax reliefs?

01

Contact creative tax reliefs are beneficial for individuals or businesses involved in creative activities in the UK.

02

Artists, musicians, writers, filmmakers, and performers who engage in qualifying creative projects may be eligible for creative tax reliefs.

03

Production companies, studios, or organizations involved in the development, production, or distribution of creative content may also qualify for these reliefs.

04

Startups or companies investing in the creative sector can leverage creative tax reliefs to offset their costs and support innovation.

05

Individuals or businesses in the UK aiming to promote cultural heritage, diversity, or art-related events may also benefit from creative tax reliefs.

06

It is advisable to consult with a tax professional or relevant authorities to determine your eligibility and specific requirements for claiming contact creative tax reliefs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my contact creative tax reliefs in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your contact creative tax reliefs and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send contact creative tax reliefs for eSignature?

contact creative tax reliefs is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in contact creative tax reliefs without leaving Chrome?

contact creative tax reliefs can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is contact creative tax reliefs?

Contact creative tax reliefs are tax incentives designed to encourage companies to invest in creative industries such as film, television, and video games.

Who is required to file contact creative tax reliefs?

Companies that are involved in creative industries and meet certain criteria are required to file contact creative tax reliefs.

How to fill out contact creative tax reliefs?

Contact creative tax reliefs can be filled out online through the designated government portal or by using specific forms provided by the tax authorities.

What is the purpose of contact creative tax reliefs?

The purpose of contact creative tax reliefs is to incentivize companies to invest in creative industries, stimulate economic growth, and create job opportunities.

What information must be reported on contact creative tax reliefs?

Companies must report detailed information about their investment in creative projects, expenses incurred, and revenue generated.

Fill out your contact creative tax reliefs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contact Creative Tax Reliefs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.