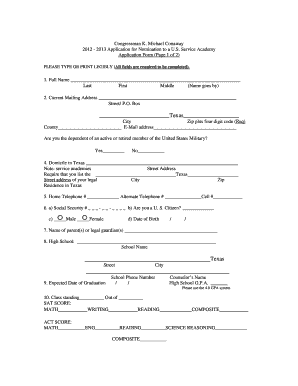

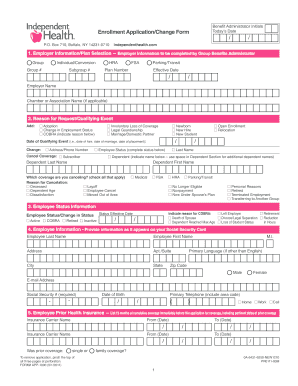

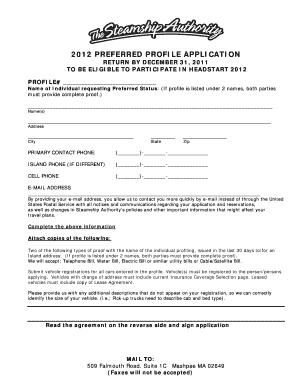

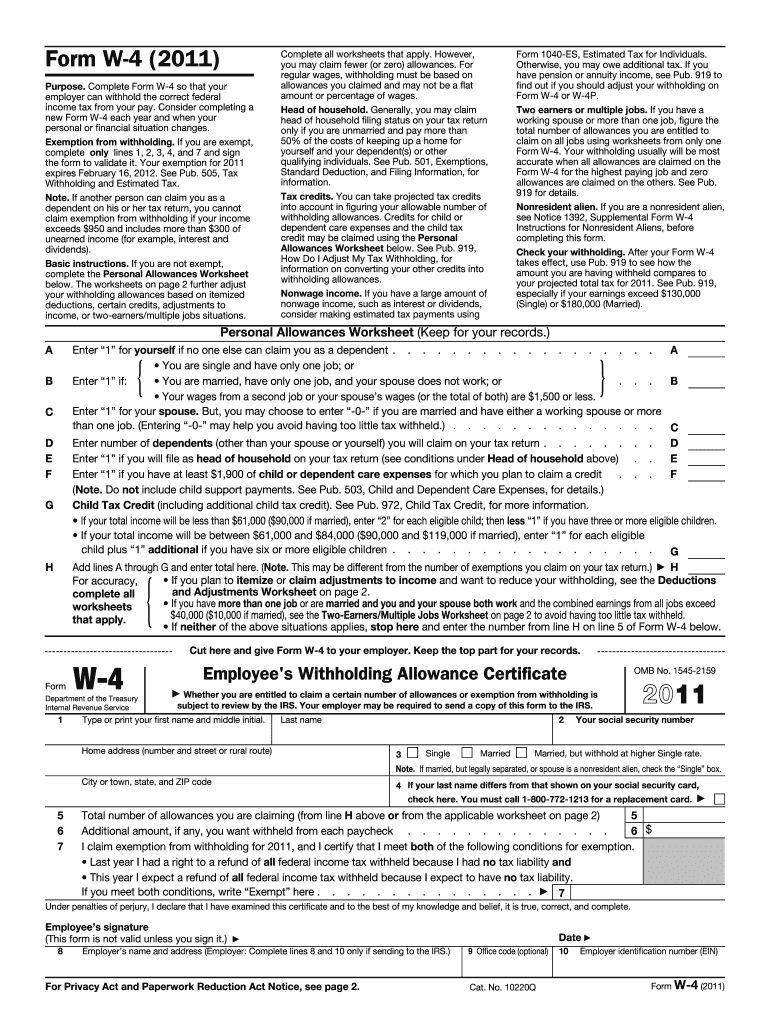

IRS W-4 2011 free printable template

Instructions and Help about IRS W-4

How to edit IRS W-4

How to fill out IRS W-4

About IRS W-4 2021 previous version

What is IRS W-4?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-4

What should I do if I find an error on my submitted IRS W-4?

If you discover an error on your submitted IRS W-4, you should complete a new W-4 with the correct information and submit it to your employer as soon as possible. Ensure to include a note explaining the reason for the change to avoid confusion.

How can I track the status of my submitted IRS W-4?

To track the status of your submitted IRS W-4, you can contact your employer's payroll department. They should have records of your submission and can confirm whether it has been processed. Unfortunately, the IRS does not provide tracking for W-4 forms.

Are electronic signatures accepted for submitting an IRS W-4?

Yes, electronic signatures are generally accepted when submitting an IRS W-4 as long as your employer's payroll system supports it. However, it's advisable to confirm with your employer regarding their specific policies on electronic submissions.

What should I do if my IRS W-4 gets rejected?

If your IRS W-4 is rejected, first check for common rejection codes or issues, such as missing signatures or incorrect information. After addressing the issues, you can resubmit the corrected form, making sure to keep copies for your records.

How long should I retain a copy of my IRS W-4?

It's recommended to retain a copy of your IRS W-4 for at least four years after filing, as this period aligns with the IRS's record retention guidelines. Keeping a record can assist in case of audits or discrepancies in taxation.

See what our users say