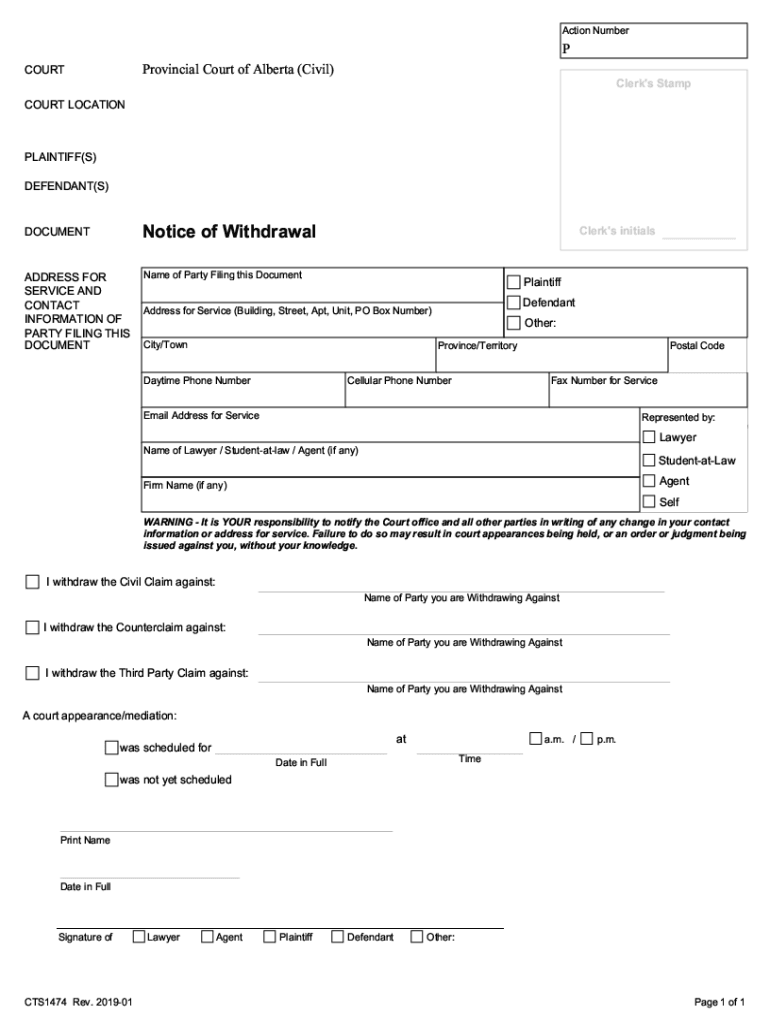

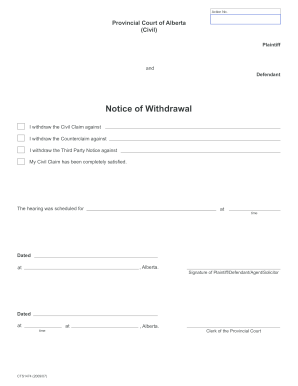

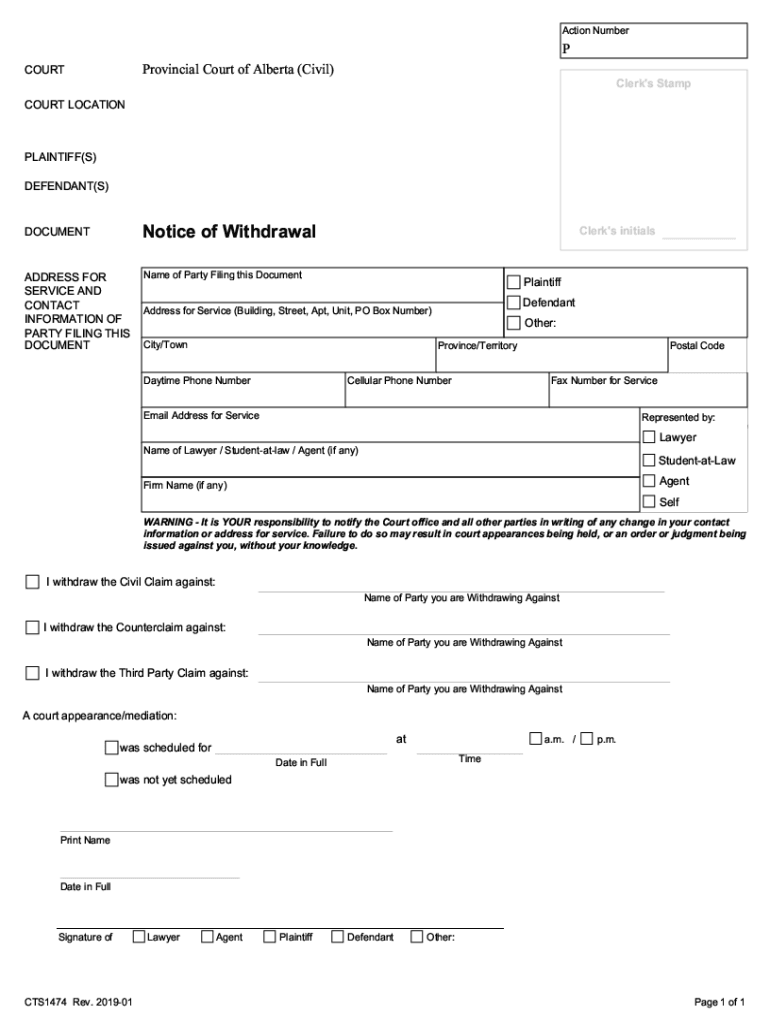

Canada CTS1474 2019-2025 free printable template

Get, Create, Make and Sign cts1474

Editing cts1474 online

Uncompromising security for your PDF editing and eSignature needs

Canada CTS1474 Form Versions

How to fill out cts1474

How to fill out Canada CTS1474

Who needs Canada CTS1474?

Instructions and Help about cts1474

Hi and welcome to another IRS forms video Today were tackling IRS Form 12277 Application for Withdrawal of Federal Tax Lien Getting the IRS to withdraw a lien can BEA huge benefit for your clients Lets take a look at what that takes anyhow you can use Form 12277 to make it happen Tip 1 How to Resolve IRS Liens and When house Form 12277 When a taxpayer lets their tax debt go unaddressed for too long the IRS will respond by placing a lien on their assets By issuing a lien the IRS is asserting legal claim to a taxpayers' property as a security against the tax debt That claim if left unchecked will end with the IRS seizing the taxpayers assets bank accounts valuables real assets with equityinan attempt to fulfill the outstanding tax debt The IRS liens can be resolved in two differentwaysrelease and withdrawal A lien release gets rid of most of the immediate effects of a lien Because the IRS no longer has any interesting the assets your client may sell or transfer their assets at will The IRS will release a lien 30 days after the tax debt has either been satisfied through an installment agreement or Offer in Compromise A lien will also automatically be released30 days after the collections statute expiration date or if the tax debt is discharge din bankruptcy A lien release however does not erase allow the effects of a lien The lien will remain on the taxpayers credit history unless the IRS withdraws the lien A withdrawal allows the lien to be removed from the clients credit history as if it had never been issued IRS Form 12277 is the form you will use to request that withdrawal Tip 2 Reasons for Lien WithdrawalGetting a lien withdrawn is obviously the preferable option so how do you know if your client qualifies to have their lien withdrawn Line 11 of Form 12277 lists four reasons the IRS will consider withdrawing the lien Reason #1- The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures The IRS will withdraw the lien if the tax that eventually prompted the lien was assessed in error or if the lien was filed without giving the taxpayer proper notice This is extremely rare as the IRS has multiplefail-safes in place to avoid these kinds of mistakes However mistakes do still happen and theirs will withdraw the lien if you can prove it #2- The taxpayer entered into an installment agreement to satisfy the liability for which the lien was imposed and the agreement did not provide for a Notice of Federal Tax Lien to be filed This is the most common method of getting alien withdrawn The IRS Fresh Start Program allows the IRS to withdraw a lien if the taxpayer has entered into a Direct Debit Installment Agreement In order to qualify for withdrawal the taxpayer must have filed all required tax returns for the last three years and must be current with any estimated tax payments #3- Withdrawal will facilitate the collection of the tax Because a tax lien is so detrimental to taxpayers credit it will often affect their...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cts1474 in Chrome?

Can I sign the cts1474 electronically in Chrome?

How can I fill out cts1474 on an iOS device?

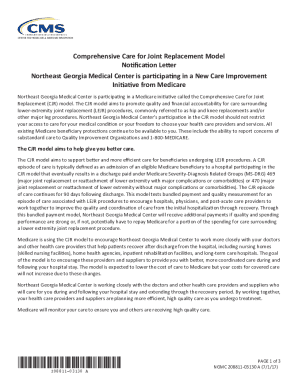

What is Canada CTS1474?

Who is required to file Canada CTS1474?

How to fill out Canada CTS1474?

What is the purpose of Canada CTS1474?

What information must be reported on Canada CTS1474?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.