Get the free COMMERCIAL BOND APPLICATION - cbalaw

Show details

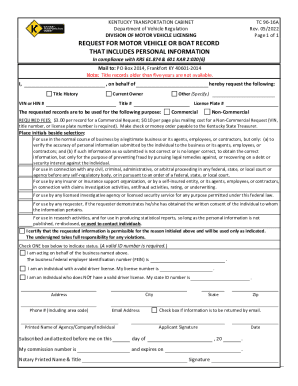

DES MOINES OFFICE 2100 FLEUR DRIVE DES MOINES, IOWA 50321-1158 (515) 243-8171 FAX (515) 243-3854 AUSTIN OFFICE P.O. BOX 26720 AUSTIN, TEXAS 78755-0720 (512) 343-9033 FAX (512) 343-8363 Bond No. COMMERCIAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial bond application

Edit your commercial bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial bond application online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit commercial bond application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial bond application

How to fill out a commercial bond application:

01

Start by gathering all the necessary information: In order to fill out a commercial bond application, you'll need to have certain details on hand. This includes the name of the company or individual applying for the bond, their contact information, and the type of bond they are seeking.

02

Choose the appropriate bond type: Commercial bonds come in various forms, including license bonds, contract bonds, and more. It's important to select the correct bond type that aligns with your specific needs. Each bond type may have unique requirements, so make sure to research and understand what is necessary for your particular situation.

03

Provide background information: The application will typically require you to provide background information about the company or individual seeking the bond. This may include details about their business history, financial statements, and any relevant licenses or permits.

04

Submit supporting documentation: Depending on the type of commercial bond, you may need to submit additional supporting documentation. This can include copies of contracts, financial records, or any other documents that demonstrate the company's stability and ability to fulfill their obligations.

05

Pay the required fees: Commercial bonds often come with a fee that needs to be paid. Make sure to include the payment information along with your application. The fee amount may vary depending on the bond type and the coverage needed.

06

Review and double-check the application: Before finalizing the application, take the time to thoroughly review and verify all the information provided. Ensure that all the details are accurate and complete. This will help prevent any delays or complications further down the line.

07

Submit the application: Once you are confident that all the necessary information is included and accurate, submit the application to the appropriate bonding agency or institution. Follow any specific instructions provided, such as submitting it electronically or mailing a physical copy.

Who needs a commercial bond application:

01

Construction professionals: Contractors, builders, and other construction-related professionals often require commercial bonds as part of their licensing and permit requirements. These bonds provide financial protection for clients and ensure that projects are completed as agreed upon.

02

Businesses providing services to the government: Companies that provide services to the government, such as janitorial services or transportation, may need commercial bonds. These bonds act as a guarantee that the contracted services will be fulfilled as per the agreement.

03

Retailers or wholesalers: Retailers or wholesalers who need to collect sales tax may be required to obtain a commercial bond. This bond protects the governing agency against any financial losses resulting from unpaid or mishandled taxes.

04

Mortgage brokers and lenders: Professionals in the mortgage industry may be required to secure a commercial bond. This bond ensures compliance with industry regulations and protects clients against financial harm caused by fraudulent or unethical practices.

05

Auto dealerships: Auto dealerships often need commercial bonds to demonstrate their financial responsibility and compliance with industry regulations. These bonds protect buyers against fraudulent practices or failure to fulfill obligations outlined in the purchase agreement.

06

Notaries public: Notaries public may need to obtain a commercial bond as part of their licensing requirements. This bond offers financial protection to clients in case of errors or misconduct during the notarization process.

07

Alcohol or tobacco license holders: Businesses that hold licenses for selling alcohol or tobacco products may be required to obtain commercial bonds. These bonds help regulate the industry and protect consumers from any potential violations or unlawful actions.

Remember, the specific requirements for a commercial bond application may vary depending on the industry, location, and governing regulations. It's always best to consult with the appropriate authorities or a licensed bonding agency to ensure you have the most up-to-date information and to clarify any questions or concerns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete commercial bond application online?

pdfFiller has made it easy to fill out and sign commercial bond application. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in commercial bond application without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your commercial bond application, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out commercial bond application using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign commercial bond application and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is commercial bond application?

Commercial bond application is a formal request submitted to obtain a commercial bond, which is a type of surety bond that guarantees the performance or fulfillment of a contract.

Who is required to file commercial bond application?

Any individual or business entity that needs to obtain a commercial bond as a requirement for a specific business transaction or activity.

How to fill out commercial bond application?

To fill out a commercial bond application, one typically needs to provide personal or business information, details of the bond required, financial information, and any other relevant details requested by the bonding company.

What is the purpose of commercial bond application?

The purpose of a commercial bond application is to secure a bond to guarantee the performance of a contract or compliance with regulations, protecting the parties involved in the transaction.

What information must be reported on commercial bond application?

Information such as personal/business details, bond amount, financial statements, credit history, project details, and any other relevant information as required by the bonding company.

Fill out your commercial bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.