Get the free Indian Depository Receipt A gateway to overseas entities ...

Show details

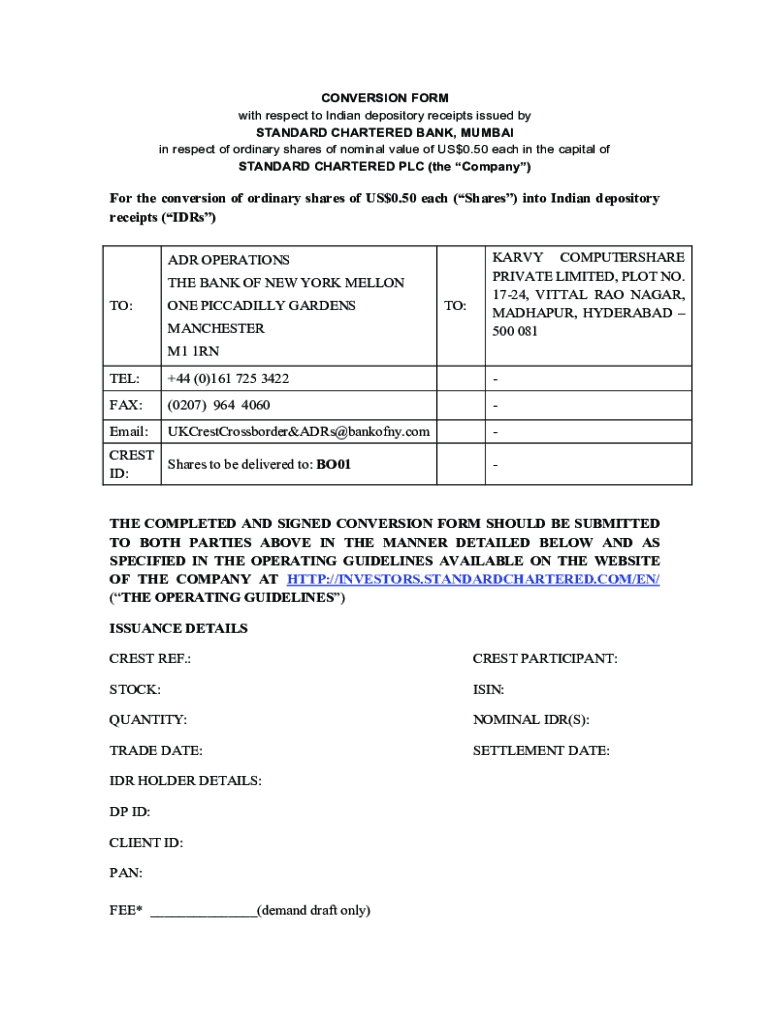

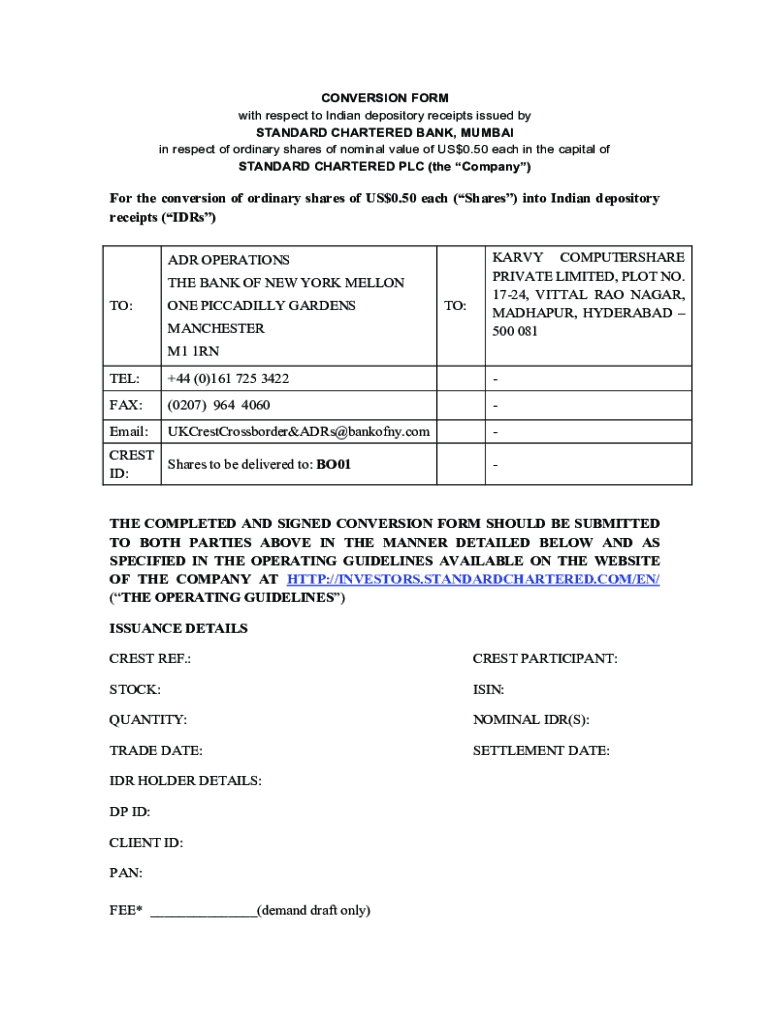

CONVERSION FORM

with respect to Indian depository receipts issued by

STANDARD CHARTERED BANK, MUMBAI

in respect of ordinary shares of nominal value of US$0.50 each in the capital of

STANDARD CHARTERED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indian depository receipt a

Edit your indian depository receipt a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indian depository receipt a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indian depository receipt a online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit indian depository receipt a. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indian depository receipt a

How to fill out indian depository receipt a

01

To fill out an Indian Depository Receipt (IDR) application, follow these steps:

02

Obtain the IDR application form from the designated bank or financial institution.

03

Provide your personal information such as name, contact details, and address.

04

Provide your bank account details for fund transfers.

05

Specify the number of IDRs you want to purchase and the desired price.

06

Attach the necessary documents including proof of identity, proof of address, and PAN card.

07

Review the completed form and ensure all information is accurate.

08

Submit the filled-out application form along with the required documents to the designated bank or financial institution.

09

Pay the prescribed fees for processing the IDR application.

10

Wait for the approval and allotment of IDRs, which will be credited to your demat account.

11

Monitor the status of your application and contact the bank or financial institution if any further actions are required.

Who needs indian depository receipt a?

01

Indian Depository Receipts (IDRs) are typically needed by individuals or institutional investors who want to invest in Indian companies listed on foreign exchanges.

02

IDRs provide an avenue for foreign investors to invest in Indian securities without the need to hold shares directly on Indian stock exchanges.

03

They are especially relevant for foreign investors who are interested in Indian companies or sectors but may not have direct access to Indian stock markets.

04

IDRs allow investors to diversify their portfolios by gaining exposure to Indian companies and participating in the Indian economy's growth potential.

05

Additionally, Indian companies can benefit from IDR issuances as it expands their investor base and facilitates capital raising from global investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my indian depository receipt a in Gmail?

indian depository receipt a and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send indian depository receipt a for eSignature?

Once your indian depository receipt a is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out indian depository receipt a using my mobile device?

Use the pdfFiller mobile app to fill out and sign indian depository receipt a on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is indian depository receipt a?

Indian Depository Receipt (IDR) is a financial instrument that allows foreign companies to raise funds from the Indian capital market without seeking for an IPO in India.

Who is required to file indian depository receipt a?

Foreign companies looking to raise funds from the Indian capital market are required to file for Indian Depository Receipt (IDR).

How to fill out indian depository receipt a?

To fill out an Indian Depository Receipt (IDR), foreign companies must follow the regulations set by SEBI and the Indian Stock Exchange. It involves providing detailed information about the company and the purpose of raising funds.

What is the purpose of indian depository receipt a?

The purpose of Indian Depository Receipt (IDR) is to allow foreign companies to tap into the Indian capital market for fundraising without going through the process of an IPO in India.

What information must be reported on indian depository receipt a?

Information such as company details, financial statements, purpose of raising funds, and compliance with SEBI regulations must be reported on Indian Depository Receipt (IDR).

Fill out your indian depository receipt a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indian Depository Receipt A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.