Get the free Department of Revenue or call 360-705-6203 - dor wa

Show details

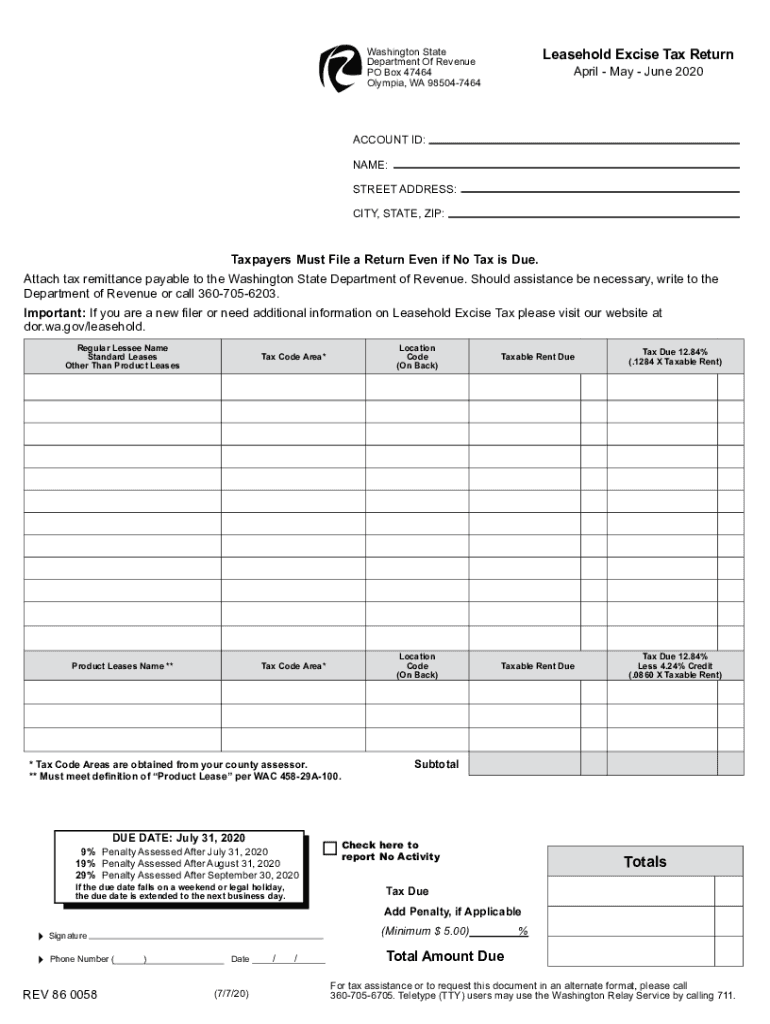

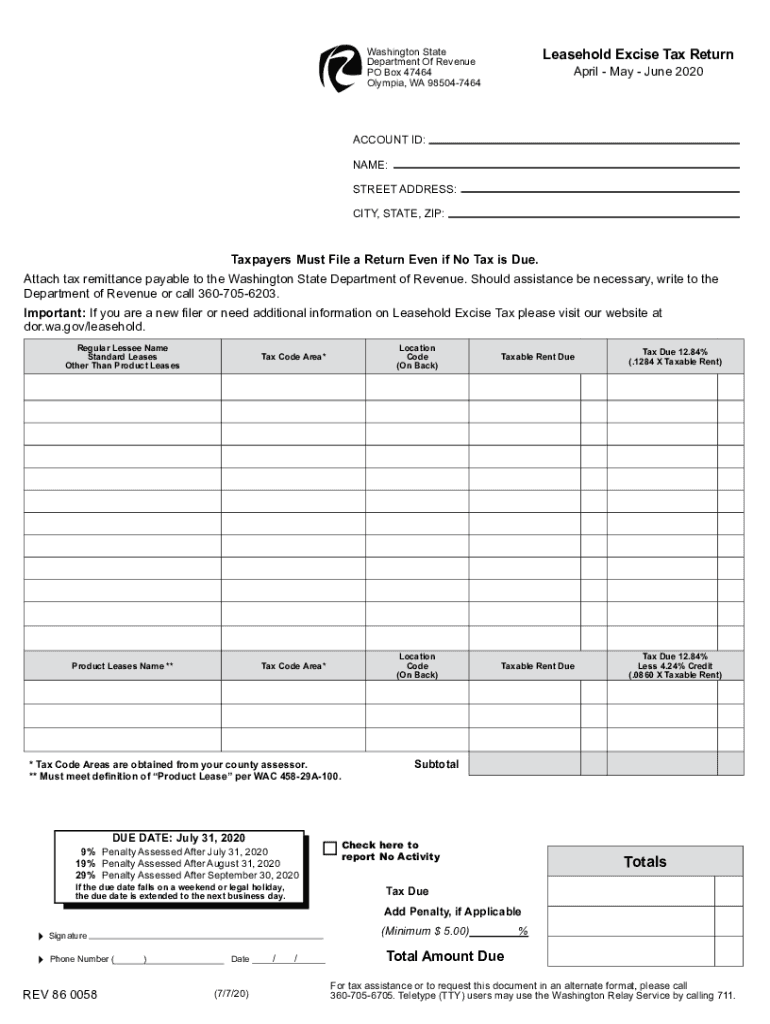

Leasehold Excise Tax Return Washington State Department Of Revenue PO Box 47464 Olympia, WA 985047464April May June 2020ACCOUNT ID: NAME: STREET ADDRESS: CITY, STATE, ZIP:Taxpayers Must File a Return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign department of revenue or

Edit your department of revenue or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your department of revenue or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit department of revenue or online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit department of revenue or. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out department of revenue or

How to fill out department of revenue or

01

To fill out the Department of Revenue form, follow these steps:

02

Start by reading the instructions provided with the form. These instructions will guide you on what information is required and how to properly fill out the form.

03

Gather all the necessary documentation and supporting materials. This may include income statements, receipts, tax documents, and any other relevant paperwork.

04

Carefully review each section of the form. Complete all the required fields accurately and legibly. Be sure to double-check your entries for any errors or omissions.

05

If you are unsure about how to address a particular section or question, consult the instruction manual or seek assistance from a tax professional.

06

Once you have filled out the form, review it one final time to ensure completeness and accuracy.

07

Sign and date the form as required.

08

Make a copy of the completed form for your records.

09

Submit the form to the Department of Revenue by mail or electronically, depending on the instructions provided.

10

If mailing the form, consider using certified mail or a similar method to ensure delivery and keep a record of the submission.

11

Follow up with the Department of Revenue if necessary to confirm receipt of your form and address any questions or concerns they may have.

Who needs department of revenue or?

01

The Department of Revenue is needed by individuals and businesses who have tax obligations or financial operations that fall under its jurisdiction.

02

Specifically, those who need the Department of Revenue may include:

03

- Individuals who need to file and pay their income taxes

04

- Businesses that need to report and remit sales tax

05

- Employers who need to withhold and deposit payroll taxes

06

- Property owners who need to pay property taxes

07

- Entities engaging in certain regulated activities that require specific tax reporting or licensing

08

- Individuals or businesses requesting tax refunds or applying for tax credits or incentives

09

- Tax professionals and advisors who assist clients with tax compliance and planning

10

It is important to note that the specific requirements and obligations may vary depending on the jurisdiction and the nature of the individual or business's activities. It is always recommended to consult the official guidelines and regulations provided by the Department of Revenue in your respective jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify department of revenue or without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including department of revenue or, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out department of revenue or using my mobile device?

Use the pdfFiller mobile app to fill out and sign department of revenue or. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit department of revenue or on an Android device?

With the pdfFiller Android app, you can edit, sign, and share department of revenue or on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is department of revenue or?

The department of revenue is a government agency responsible for collecting taxes and revenues.

Who is required to file department of revenue or?

Individuals, businesses, and organizations that earn income are required to file with the department of revenue.

How to fill out department of revenue or?

You can fill out the department of revenue forms online or by mail with the required information about your income and taxes.

What is the purpose of department of revenue or?

The purpose of the department of revenue is to ensure that taxes are collected and revenues are properly accounted for to fund government operations and services.

What information must be reported on department of revenue or?

You must report your income, deductions, credits, and any other relevant financial information on the department of revenue forms.

Fill out your department of revenue or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Department Of Revenue Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.