Get the free Mid-Year and Year-End Reporting forms 2019 - 2021

Show details

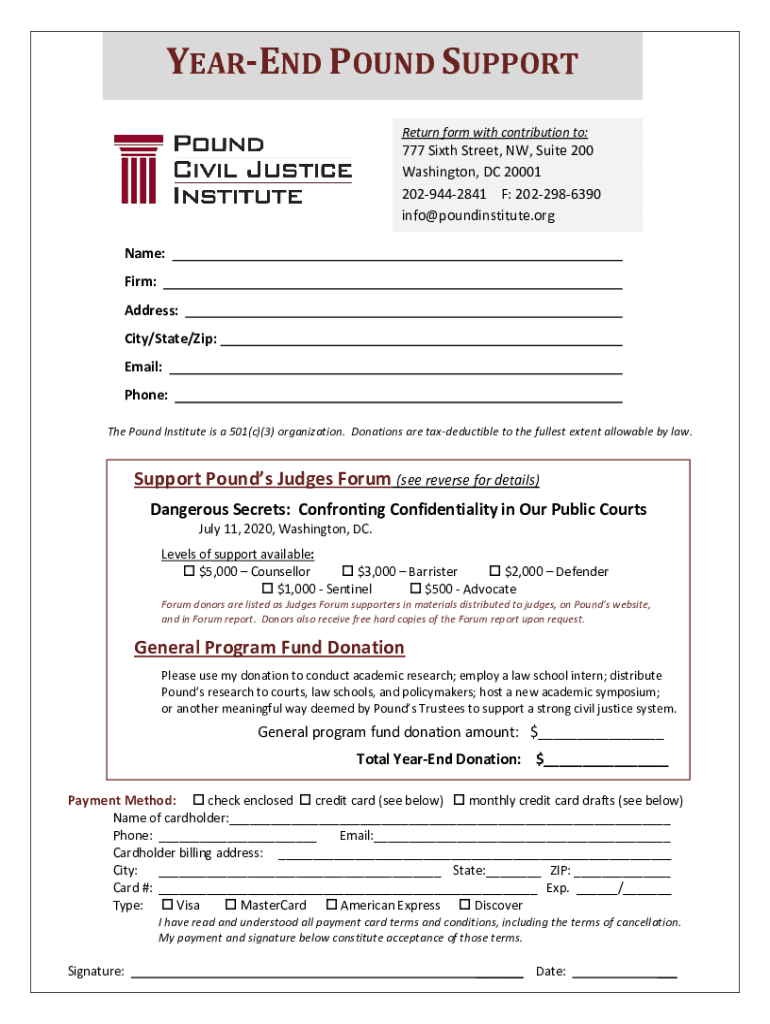

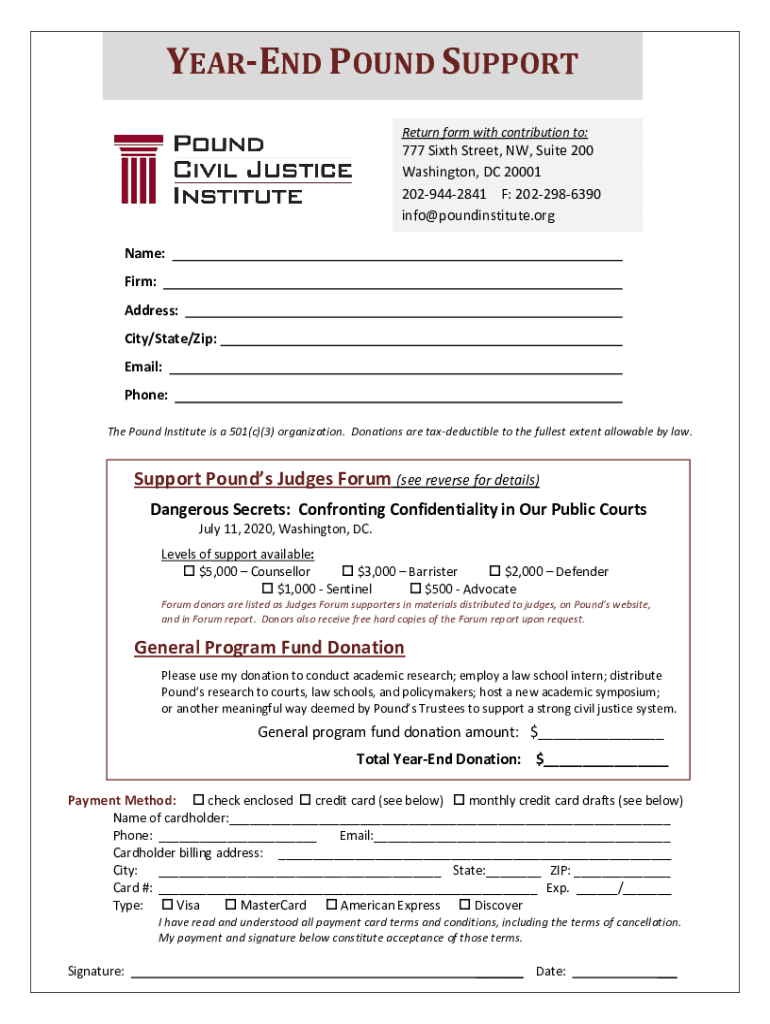

YEAREND POUND SUPPORT

Return form with contribution to:777 Sixth Street, NW, Suite 200

Washington, DC 20001

2029442841 F: 2022986390

info@poundinstitute.org

Name:

Firm:

Address:

City/State/Zip:

Email:

Phone:

The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mid-year and year-end reporting

Edit your mid-year and year-end reporting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mid-year and year-end reporting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mid-year and year-end reporting online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mid-year and year-end reporting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mid-year and year-end reporting

How to fill out mid-year and year-end reporting

01

To fill out mid-year and year-end reporting, follow these steps:

02

Gather all relevant financial documents, including income statements, balance sheets, and cash flow statements.

03

Review the financial data and ensure its accuracy.

04

Start with the income statement and fill in all the necessary details, such as revenue, expenses, and net income.

05

Move onto the balance sheet and record the company's assets, liabilities, and equity.

06

Complete the cash flow statement by documenting all cash inflows and outflows.

07

Double-check all calculations and reconcile any discrepancies.

08

Prepare supporting schedules, if required, such as depreciation schedules or inventory valuation.

09

Verify the completeness of the report and make sure it complies with relevant accounting standards and regulations.

10

Review the final report for any errors or inconsistencies.

11

Submit the mid-year or year-end reporting to the appropriate authorities or stakeholders.

12

Keep a copy of the report for future reference and auditing purposes.

Who needs mid-year and year-end reporting?

01

Mid-year and year-end reporting is needed by various entities, including:

02

- Publicly traded companies to comply with financial reporting regulations and to provide information to shareholders and investors.

03

- Private companies to assess their financial performance and make informed business decisions.

04

- Non-profit organizations to fulfill reporting requirements for funders, donors, and regulatory bodies.

05

- Government agencies to monitor and evaluate the financial health of businesses and to ensure compliance with tax laws.

06

- Financial institutions and lenders to assess the creditworthiness and financial stability of borrowers.

07

- Internal stakeholders, such as management and board members, to evaluate the company's financial position and make strategic decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mid-year and year-end reporting to be eSigned by others?

Once you are ready to share your mid-year and year-end reporting, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit mid-year and year-end reporting online?

The editing procedure is simple with pdfFiller. Open your mid-year and year-end reporting in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit mid-year and year-end reporting on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share mid-year and year-end reporting on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is mid-year and year-end reporting?

Mid-year and year-end reporting are financial reports that organizations use to provide updates on their financial performance and operations. They typically cover the first six months and the full year of a company's financial activities, respectively.

Who is required to file mid-year and year-end reporting?

Organizations, including corporations and nonprofits, are typically required to file mid-year and year-end reporting to regulators, investors, and other stakeholders to provide transparency and accountability.

How to fill out mid-year and year-end reporting?

To fill out mid-year and year-end reporting, organizations typically need to gather financial data, including income statements, balance sheets, and cash flow statements. They also need to ensure compliance with relevant accounting standards and regulations.

What is the purpose of mid-year and year-end reporting?

The purpose of mid-year and year-end reporting is to provide a snapshot of an organization's financial health, performance, and prospects. It helps stakeholders make informed decisions and evaluate the organization's progress towards its goals.

What information must be reported on mid-year and year-end reporting?

Mid-year and year-end reporting typically include financial statements, notes to the financial statements, management discussion and analysis, and other relevant disclosures required by accounting standards and regulations.

Fill out your mid-year and year-end reporting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mid-Year And Year-End Reporting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.